Susquehanna International Group Acquires Over $1 Billion in Bitcoin ETFs into Portfolio

Crypto News– In a recent 13F-HR filing dated May 7, Susquehanna International Group, a prominent quantitative trading firm, revealed a significant investment strategy in the first quarter of 2024. The firm, known for its sophisticated trading techniques, made a substantial move by purchasing more than $1 billion worth of shares in Bitcoin exchange-traded funds (ETFs).

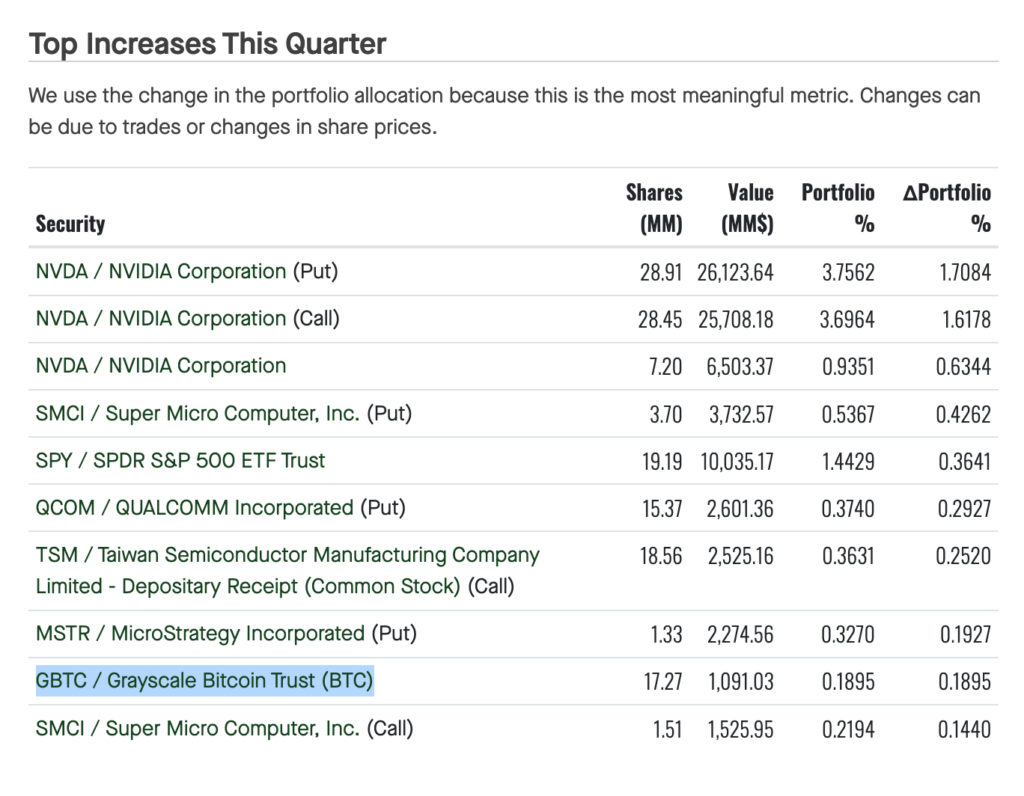

According to the filing submitted to the Securities and Exchange Commission, Susquehanna disclosed ownership of 17,271,326 shares in the Grayscale Bitcoin Trust (GBTC), amounting to a market value of approximately $1.09 billion as of March 31, 2024. Additionally, the firm reported holding 1,349,414 shares of the Fidelity Wise Origin Bitcoin Fund (FBTC), valued at around $83.74 million on the same date.

Expanding its portfolio further, Susquehanna bolstered its position in the ProShares Bitcoin Strategy ETF (BITO), which provides investors exposure to Bitcoin futures contracts. According to data from investment research firm Fintel, the firm owned 7,907,827 shares of BITO as of March 31, valued at approximately $255.42 million. This marked a notable increase of 57.59% from a February filing that listed 5,021,149 shares.

Furthermore, Susquehanna’s investment strategy included indirect exposure to Bitcoin’s spot price through its holdings in MicroStrategy stock (MSTR), a company that holds 214,400 BTC on its balance sheet. However, during the portfolio rebalancing, Susquehanna opted to reduce its stake in MicroStrategy by nearly 15%, trimming its holdings from 287,180 shares in February to 244,863 shares as of March 31.

Susquehanna’s strategic move into the realm of Bitcoin ETFs underscores the growing institutional interest in cryptocurrency as an asset class, positioning the firm at the forefront of the evolving digital asset landscape.

Susquehanna’s Cryptocurrency Investment a Fraction of Its Portfolio, Valued at Over $575.8 Billion

In the first quarter of 2024, Susquehanna International Group, despite its significant investments in Bitcoin funds, maintained a diversified portfolio valued at more than $575.8 billion. While the firm made headlines with its foray into digital assets, its cryptocurrency allocation remains a small portion of its overall holdings.

Among Susquehanna’s top investments are stalwarts like NVIDIA Corporation and the index-tied SPDR S&P 500 ETF Trust. In addition to Bitcoin funds, the trading firm added new assets to its portfolio during the past quarter. These include shares of Convertible Zero, a convertible bonds firm, bonds from NRG Energy Inc., and preferred stocks in Albemarle Corporation.

The adoption of Bitcoin funds by trading firms and financial advisers continues to rise, reflecting a broader trend of institutional interest in digital assets. In April, Fidelity’s Bitcoin ETF attracted significant investments from traditional financial advisers, Legacy Wealth Management, and United Capital Management of Kansas. Each adviser injected $20 million into FBTC, becoming top shareholders in the fund.

These advisers cater to a substantial portion of the population, particularly baby boomers, who hold a significant share of the country’s wealth. Legacy Wealth Management manages assets exceeding $359 million, while United Capital Management of Kansas oversees more than $436 million in assets. Their endorsement of Bitcoin ETFs signals a shift in investment strategies, highlighting the increasing acceptance of digital assets within traditional financial circles.

FAQs

What is Susquehanna International Group and what does it do?

Susquehanna International Group is a quantitative trading firm that engages in trading in financial markets using sophisticated algorithms.

What are Bitcoin ETFs and how do they work?

Bitcoin Exchange-Traded Funds (ETFs) allow investors to invest in Bitcoin through a fund that tracks the performance of Bitcoin or is based on financial instruments related to Bitcoin, such as Bitcoin futures contracts.

Why did Susquehanna International Group make such a large investment in Bitcoin ETFs?

Susquehanna increased its investment in Bitcoin ETFs because it observed a growing institutional interest in cryptocurrencies and digital assets. This investment aligns with the company’s strategy of diversifying its portfolio.

What is the total weight of this investment in Susquehanna’s portfolio?

Susquehanna’s $1 billion investment in Bitcoin ETFs represents a small portion of its total portfolio. The company’s total assets consist of a diverse range of financial instruments in addition to this investment.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment