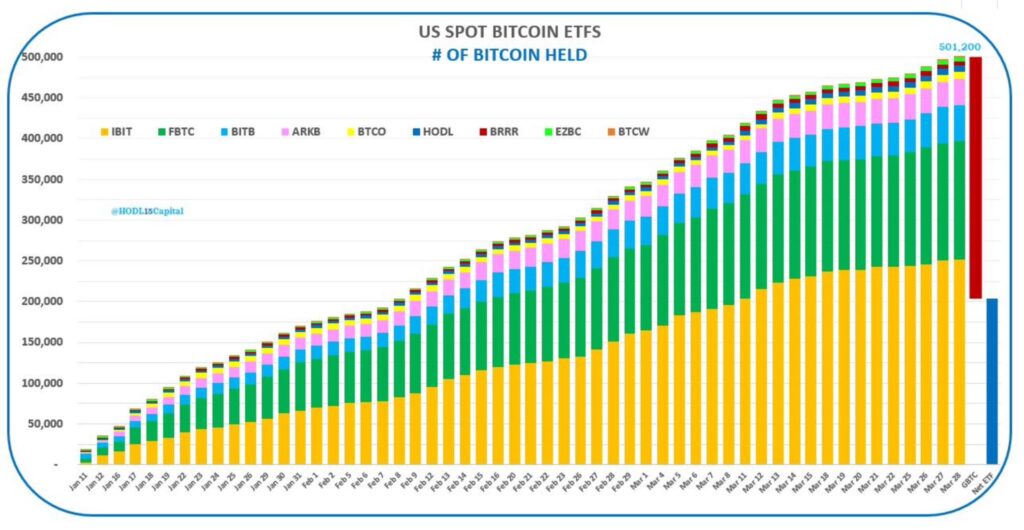

Crypto News– Since their launch in January, nine out of the 10 newly introduced spot Bitcoin exchange-traded funds (ETFs) have collectively acquired over 500,000 BTC, representing 2.54% of the current circulating supply.

Fresh Bitcoin ETFs Amass 500,000 BTC as GBTC Outflows Ease

These nine ETFs, which debuted on Jan. 11, reached this milestone after another day of inflows on Thursday, accumulating $287.7 million worth of Bitcoin, as reported by Farside Investors.

In just 54 trading days, the total BTC holdings of these nine ETFs have surged to a value of $35 billion. When considering all United States spot Bitcoin funds, including Grayscale, the cumulative BTC holdings amount to 835,000 BTC, nearly 4% of the entire supply.

Getting tagged in tweets about this filing, the Eth corr study, and other eth etf hopium. I respect it all but our odds for Eth ETF approval in May remain a pessimistic 25% (I’d go lower if I could tbh). There’s 7 wks till deadline and radio silence from SEC = bleak. (Again,… https://t.co/fc8elrYm64

— Eric Balchunas (@EricBalchunas) March 28, 2024

This week, ETF inflows have returned to positive territory, totaling $845 million so far, reversing the outflow trend that began on March 18.

On March 28, there was a total inflow of $183 million, with BlackRock leading the way as its IBIT fund attracted $95 million in investments.

Fidelity and Bitwise witnessed similar inflows of around $67 million each, while Ark 21Shares garnered $27.6 million following a substantial $200 million inflow on Wednesday.

Grayscale’s GBTC outflow amounted to $105 million, marking its lowest figure since March 12.

Since converting to a spot ETF in mid-January, the crypto asset manager has divested approximately 284,846 BTC from its GBTC fund.

1 Comment