Future of Bitcoin Dominance: Predictions Amid Changing Economic Policies

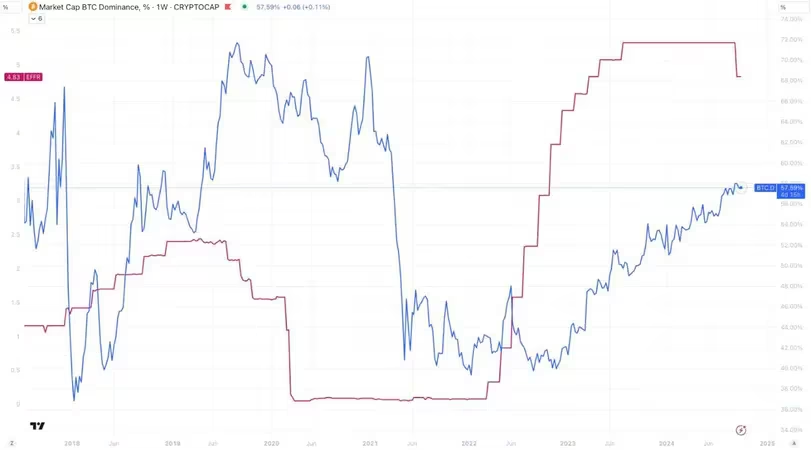

Bitcoin Dominance Rate – According to SwissOne Capital, there exists a positive correlation between the Bitcoin (BTC) dominance rate and U.S. interest rates. Recently, the initiation of the Federal Reserve’s (Fed) rate-cutting cycle could jeopardize the uptrend in BTC’s dominance, potentially leading to wider gains across the crypto market. Over the past two years, BTC’s dominance rate has surged from 38% to 58%, contributing to a doubling of the total digital asset market value, now exceeding $2 trillion, as reported by TradingView.

Limited Upside for Bitcoin Dominance

SwissOne Capital notes that the recent 50 basis point rate cut signals limited further upside for BTC’s dominance. Historically, Bitcoin’s dominance tends to decline during rate-cutting cycles, a trend evidenced when the dominance peaked above 70% before tapering off with the easing cycle’s commencement in late 2019. The metric saw a drop to approximately 40% by late 2021 as central banks worldwide injected trillions to mitigate the pandemic’s impact, prompting unprecedented risk-taking in the market, particularly among alternative cryptocurrencies (altcoins).

Historical Trends and Future Projections

The correlation between BTC’s dominance and interest rates has been apparent through previous cycles, including the 2022-23 and 2018 rate hikes. SwissOne Capital asserts that the recent onset of the U.S. rate-cutting cycle may curtail further growth if historical trends hold true. Current expectations from the CME FedWatch tool indicate traders anticipate another 25 basis point reduction by year-end.

Declining Peaks and the Rise of Stablecoins

Since 2015, the BTC dominance rate has consistently produced lower peaks, signaling broader market growth. Despite the impressive surge over the last two years, the current dominance remains significantly below the former peak of 73%. This decline is likely attributed to the explosive growth of stablecoins, which have achieved a market capitalization of $172 billion, now accounting for nearly 10% of the total market cap. SwissOne Capital suggests that BTC’s dominance may top out between current levels and 60% before facing a significant reversal.

FAQ

What is Bitcoin dominance?

Bitcoin dominance refers to the percentage of Bitcoin’s market capitalization relative to the total market capitalization of all cryptocurrencies. It indicates Bitcoin’s market share and influence within the broader crypto market.

How does the Federal Reserve’s interest rate affect Bitcoin dominance?

Historically, Bitcoin’s dominance rate has shown a positive correlation with the Fed’s interest rates. When the Fed cuts rates, it can lead to a decline in Bitcoin’s dominance as more investors may turn to alternative cryptocurrencies and other assets.

Why has Bitcoin’s dominance increased recently?

Over the past two years, Bitcoin’s dominance has risen from 38% to 58%, largely due to its stronger performance compared to other cryptocurrencies, which has also contributed to the overall growth of the digital asset market.

Leave a comment