Bitcoin and Ether: Weakened Correlation Amid Rising Prices

Bitcoin and Ether– Bitcoin (BTC), the largest cryptocurrency by market capitalization, is currently trading around $92,000, reflecting a remarkable 115% increase year-to-date. At the same time, the overall cryptocurrency market has reached an all-time high, surpassing $3.025 trillion, according to the TOTAL metric on TradingView. Bitcoin is increasingly seen as a “risk-on” asset, meaning its price tends to rise in tandem with high-risk assets like U.S. equities.

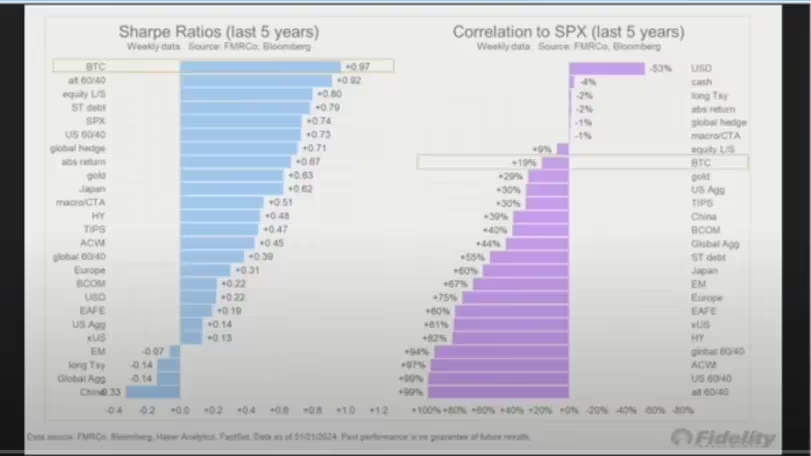

However, Bitcoin’s price volatility, as measured by its implied volatility, remains relatively high. According to Glassnode, Bitcoin’s 30-day implied volatility stands at approximately 60%, down from over 100% in 2021. While this shows a reduction in short-term price fluctuations, Bitcoin’s inherent properties—such as being self-custodial and free from counterparty risk—continue to appeal to long-term investors. Despite this, Bitcoin’s strong correlation with U.S. equities, particularly with risk-on assets like the Nasdaq, has been evident over the past few years.

Bitcoin and Nasdaq Correlation: A Changing Dynamic

Historically, Bitcoin has shown a high correlation with the Nasdaq Composite, often moving in tandem with the tech-heavy index. From 2021 to 2022, Bitcoin and the Nasdaq moved together, rising and falling in sync, almost joined at the hip. This trend extended into the first half of 2024, when Bitcoin broke its previous all-time high, surpassing $73,000 in March, while the Nasdaq also reached new record highs.

However, since March, a shift in this correlation has become apparent. While the Nasdaq continued to hit new highs, Bitcoin experienced a consolidation phase, trading within a range of $50,000 to $70,000. This trend became more pronounced after the U.S. presidential election in early November, when Donald Trump’s victory seemed to trigger a fresh surge in Bitcoin’s price, pushing it to new highs above $93,000. In contrast, the Nasdaq showed signs of stagnation, falling 4% below its all-time high, while Bitcoin remained just over 1.5% away from its peak.

The current 30-day correlation between Bitcoin and the Nasdaq is just 0.46, one of the lowest levels recorded in the past five years. In fact, during September, the correlation even turned negative, reaching nearly -0.50. This suggests that, while both assets may be correlated in times of risk-on sentiment, there are growing signs of a divergence in their price movements.

Bitcoin’s Shifting Correlation with Ether

This pattern is not exclusive to Bitcoin and the Nasdaq. The correlation between Bitcoin and Ether (ETH), the second-largest cryptocurrency by market capitalization, has also weakened. Historically, Bitcoin and Ether have had a strong 1:1 correlation, especially during periods of market growth. However, in recent months, the 30-day rolling correlation between the two assets has dropped to just 0.35, marking the second-lowest level on record.

The weakening correlation between Bitcoin and Ether highlights a broader trend in the market: as both cryptocurrencies become larger and more established, they may begin to trade more independently. While there may still be moments of strong correlation between the two, especially during significant market events, over the long term, their price movements may diverge more frequently.

Leave a comment