Bitcoin Act: Trump’s Victory Sparks Optimism for Crypto-Friendly Policies

Bitcoin Act Gains Momentum in the US – A new Bitcoin-related bill in the United States is gaining substantial support, potentially positioning Bitcoin to reach unprecedented heights, including a $1 million valuation. This bill, known as the Bitcoin Act, has gained momentum following the 2024 presidential election, where former President Donald Trump emerged victorious, sparking optimism for crypto-friendly policies.

Bitcoin Act: A Groundbreaking Proposal for a National Bitcoin Reserve

The Bitcoin Act, championed by Wyoming Republican Senator Cynthia Lummis, proposes the creation of a strategic Bitcoin reserve for the United States. If passed, this reserve would make the US the first country to treat Bitcoin as a “savings technology”. The proposal has garnered significant support due to Trump’s victory and the anticipated Republican majority in the US Senate. According to Anastasija Plotnikova, co-founder and CEO of Fideum, the bipartisan backing suggests that the bill could gain approval within the next four years.

Bitcoin Reserve Proposal: A Game Changer for Bitcoin’s Value

The creation of a strategic Bitcoin reserve in the world’s largest economy could be a game changer for Bitcoin’s price, potentially pushing it well above the $1 million mark. Adam Back, co-founder and CEO of Blockstream and a renowned cryptographer, believes that such a move could trigger a rapid price surge for Bitcoin. He further noted that the markets have yet to fully price in the possibility of the reserve act being passed, making the potential impact even greater.

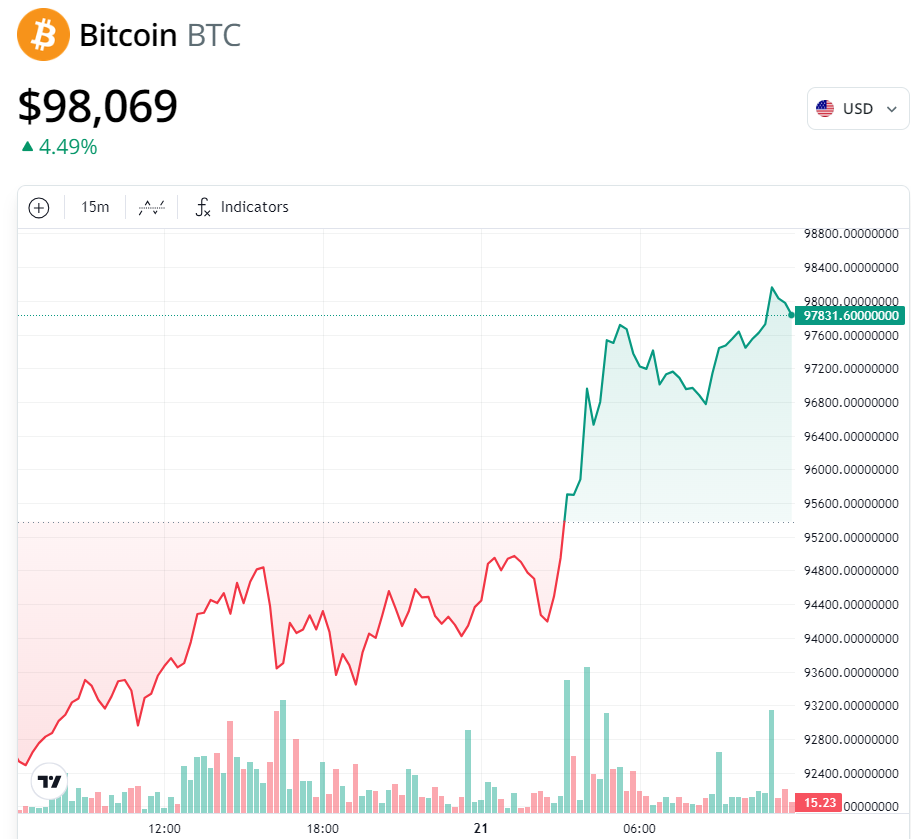

At the time of writing, Bitcoin (BTC) is hovering just below the $100,000 mark, trading around $98,000, according to data from Cointelegraph. This suggests that Bitcoin is already on the cusp of a major milestone, with the possibility of a significant price surge if the Bitcoin Act comes to fruition.

Economic Implications: Bitcoin’s Institutional Adoption and Legitimacy

The Bitcoin Act’s potential impact goes beyond the immediate price surge. As Plotnikova points out, the bill could attract institutional investors, such as pension funds and sovereign wealth funds, making Bitcoin an increasingly legitimate asset class. Analysts predict that Bitcoin’s price could surge towards $500,000 as a result of this influx of institutional capital, further reinforcing Bitcoin’s status as a global store of value.

Trump’s Presidency and the “War on Crypto”

The Bitcoin Act is not the only positive development for the cryptocurrency space following Trump’s victory. According to Michael Saylor, CEO of MicroStrategy, Trump’s presidency and a Republican-controlled Senate could signal the end of the so-called “war on crypto”. Saylor believes that under Trump’s leadership, the crypto industry could see accelerated institutional adoption, the creation of Bitcoin ETFs, and the approval of Bitcoin as a collateral asset by traditional banks.

Saylor also expects other major milestones for Bitcoin during this period, including the creation of options on Bitcoin ETFs, which would increase Bitcoin’s appeal among institutional investors. Additionally, the prospect of Bitcoin being accepted as collateral by major financial institutions would further legitimize the cryptocurrency in the eyes of traditional markets.

The Future of Bitcoin: A $1 Million Price Target?

The support for the Bitcoin Act and the potential creation of a US Bitcoin reserve have sparked a surge of optimism in the cryptocurrency community. Many industry leaders, including Adam Back and Michael Saylor, believe that Bitcoin could reach $1 million as a result of these developments. The potential for the US to adopt Bitcoin as part of its national economic strategy could propel the cryptocurrency to new heights, setting a new precedent for how digital assets are treated in the global economy.

Leave a comment