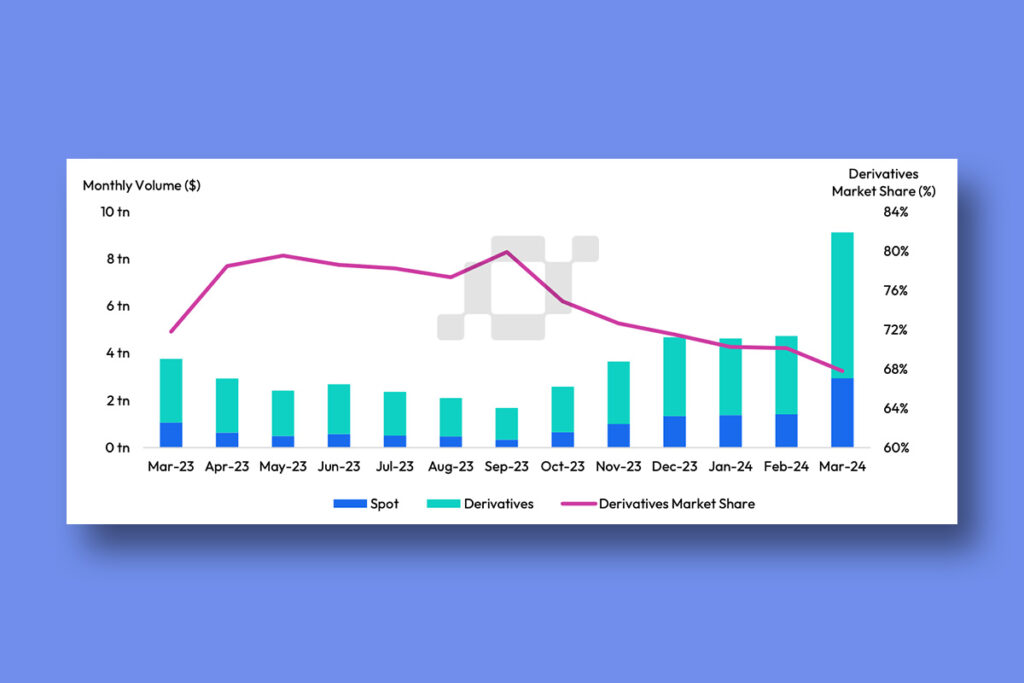

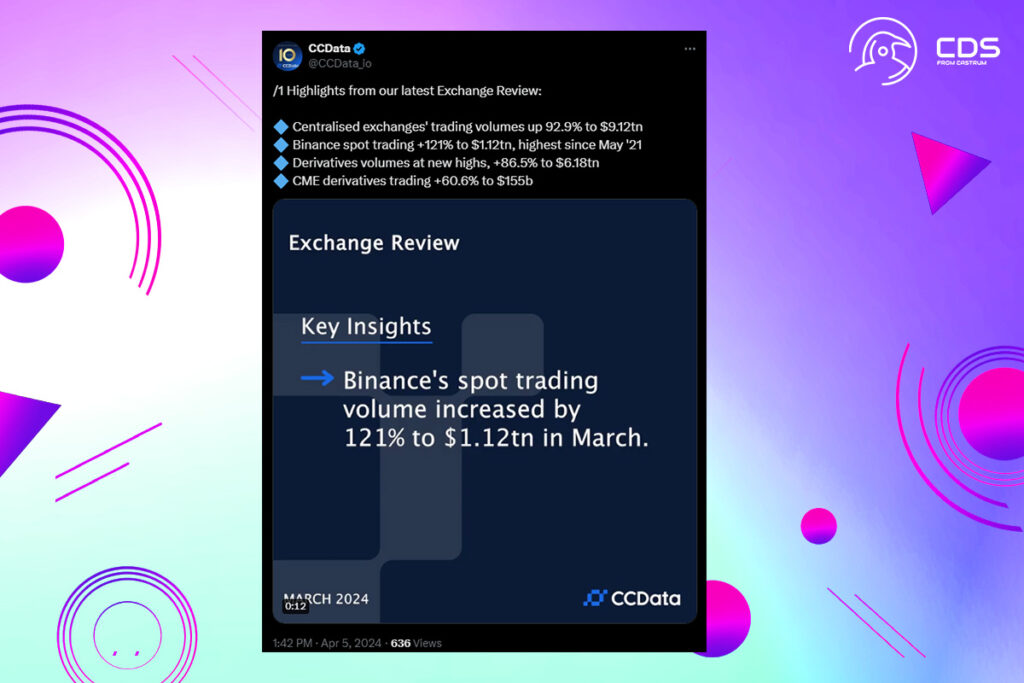

Crypto News – A new report from CCData states that after seven straight months of growth, the spot trading volume of the Binance exchange reached its highest level since May 2021.

Binance Trading Volume Hit $1.12 Trillion Last Month, According to CCData Report

The report claims that in March, Binance‘s spot trading volume climbed by 121% to $1.12 trillion. According to the data, the exchange’s total market share climbed to 44.1% in March, up 1.04%.

CCData showcases Binance’s comeback following the resolution of its legal dispute with the US Department of Justice and the payment of a $4.3 billion settlement penalty. This is demonstrated by the fact that its derivatives trading volumes have increased to $2.91 trillion, their highest levels since May 2021, or an 89.7% increase.

Customer Growth Attributed to Key Services

Binance increased its market dominance by 2.3% from February to March, with the most gain in spot markets, according to CCData researchers. With its current 38.0% share of spot trading volumes on CEXs, the exchange has also experienced the largest year-to-date growth.

The U.S. DOJ deal allowed Binance to boost its market share by 50% in just two months, according to a January analysis from analytics firm Kaiko, which also noted that more trade volume had occurred. As of 2023, the exchange reported over 40 million more customers than it did in 2022, despite regulatory obstacles. Compared to the prior year, Binance’s growth was almost thirty percent higher, and the company credited its “key services” for this.

Leave a comment