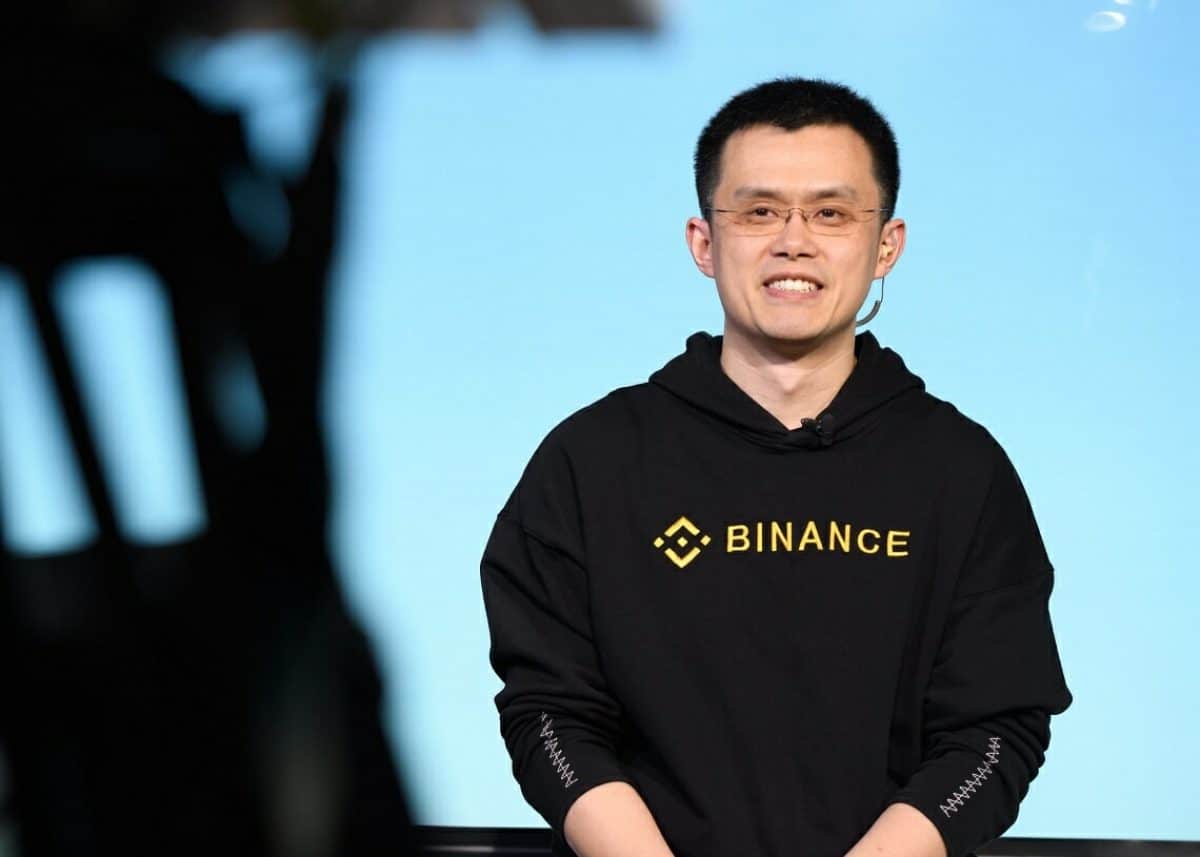

Binance CEO Changpeng “CZ” Zhao issued a response on Thursday regarding the launch of First Digital USD (FDUSD), a stablecoin introduced by First Digital, a custodian and trust company based in Hong Kong. This development coincides with Hong Kong’s implementation of a new crypto regulatory framework on June 1, aiming to establish itself as a prominent cryptocurrency hub in the region.

Binance CEO CZ On First Digital USD (FDUSD) Stablecoin Support On Exchange

Binance CEO Changpeng “CZ” Zhao issued a response on Thursday regarding the launch of First Digital USD (FDUSD), a stablecoin introduced by First Digital, a custodian and trust company based in Hong Kong. This development coincides with Hong Kong’s implementation of a new crypto regulatory framework on June 1, aiming to establish itself as a prominent cryptocurrency hub in the region.

In light of the regulatory actions taken by US authorities against Paxos-issued Binance USD (BUSD) in February, Binance is actively seeking a stablecoin alternative, and the First Digital USD (FDUSD) holds the potential to become a significant stablecoin option on the platform.

First Digital, a Hong Kong licensed trust company, launches a new USD pegged stablecoin (FDUSD), on #BNB Smart Chain.

CZ

As the First Digital USD (FDUSD) stablecoin launched on BNB, Crypto Twitter went on to ask Binance CEO whether the exchange will support and list the new stablecoin.

We don’t talk about “will/will not”. Just follow our official announcements.

CZ

First Digital Trust has introduced the First Digital USD (FDUSD), a stablecoin that is supported by cash or highly liquid assets, maintaining a 1:1 ratio with the US dollar. These assets are securely held in accounts within regulated financial institutions in Asia. Additionally, the company is actively engaging in discussions with leading exchanges for the possibility of listing the FDUSD.

The launch of this stablecoin represents a major stride forward in our mission to provide a secure and efficient digital currency that can be seamlessly integrated into everyday transactions. Going forward, investors, retail and institutional will be looking for predictability, which is why FDUSD was conceptualised.

Vincent Chok, CEO of First Digital

Today, the Hong Kong Securities & Futures Commission (SFC) initiated its licensing system, granting registered crypto exchanges and companies the ability to provide digital asset trading and related services to both institutional and retail investors. However, until the Hong Kong Monetary Authority (HKMA) establishes regulations regarding stablecoins, retail investors will not be permitted to engage in stablecoin trading.

Of particular interest, First Digital Trust has introduced the First Digital USD (FDUSD), which has the potential to address concerns regarding stablecoins backed by robust reserves and ensuring their safety.

To access more crypto news: cryptodataspace.com

1 Comment