AVAX Price Outlook Amid ETF Approval Speculations

Avalanche (AVAX) has been making headlines this week as speculation around a potential AVAX-focused ETF continues to grow. This excitement is driven by the rapid expansion of the Avalanche ecosystem, which has caught the attention of both investors and institutions. Recent developments, such as the asset’s inclusion in the Grayscale Digital Large Cap Fund, have added fuel to these ETF rumors. While not a direct indicator, this move suggests growing institutional interest, which could lead to a significant boost in visibility and price for the cryptocurrency.

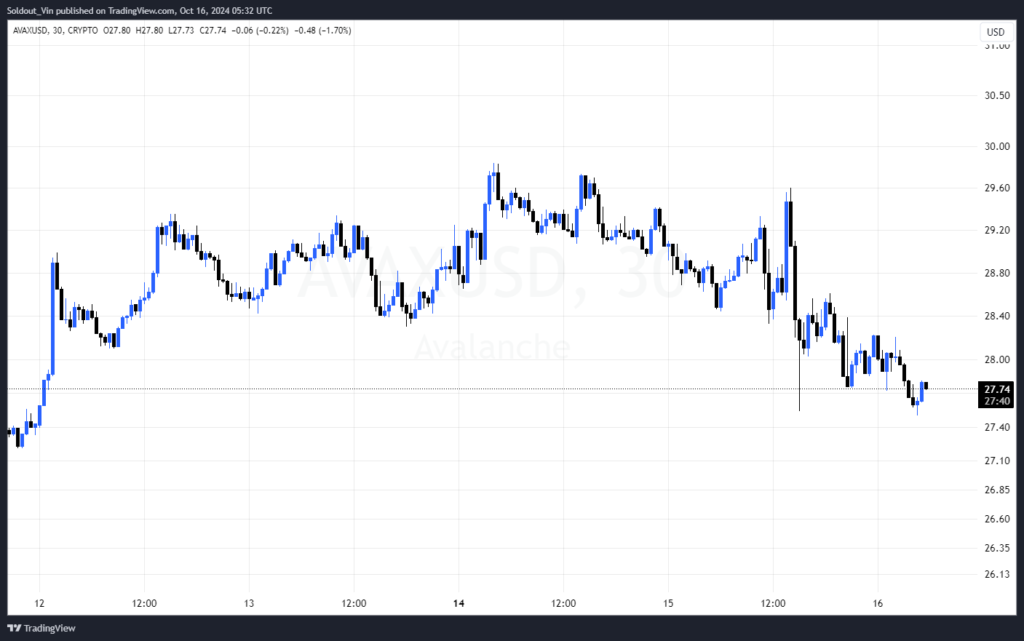

Currently, Avalanche is trading at $27.75, down 2.6% in the past 24 hours. Unlike Litecoin, which saw a noticeable price reaction following news of its ETF application, AVAX has yet to experience a similar uptick.

AVAX Price Projections with an Approved ETF

Grayscale’s decision to include AVAX in its fund could pave the way for institutional demand, potentially driving up its price. The Grayscale Digital Large Cap Fund, which also holds Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP, is expected to influence AVAX’s price movements, as net inflows into the fund would likely benefit all the included assets.

To gauge the potential price movement of AVAX post-ETF approval, we can look at the price reactions of Bitcoin and Ethereum after their respective ETF launches.

When the U.S. SEC approved a spot Bitcoin ETF on January 10, BTC initially surged 5%, though it briefly retraced as investors sold off to capitalize on the news. However, over time, Bitcoin rose by 57%, eventually reaching a peak of $73,000. As of October 16, BTC is trading at $66,000, a 33% increase since the ETF’s approval.

Ethereum’s reaction was more subdued. After the approval of its spot ETF, ETH surged 21% within 48 hours, almost hitting $4,000. However, its performance afterward was less impressive, with limited follow-through in price gains.

Using these performances as a benchmark, and considering the fact that Bitcoin’s market cap is 109 times larger than AVAX and Ethereum’s is 28 times bigger, we can make some speculative projections. If AVAX were to see similar percentage gains, it could theoretically reach as high as $2,943 (comparable to BTC’s rise) or $756 (matching ETH’s growth). However, more conservative estimates, accounting for differences in trading volume, suggest AVAX could realistically target between $440 and $231.

Avalanche Price Analysis: Can $160 Be a Reality?

Currently, AVAX is consolidating after a prolonged downtrend and is trading near the 0.786 Fibonacci retracement level (~$23). This area has provided support in recent weeks, hinting at a possible trend reversal.

The first significant resistance level for AVAX is around the 0.27 Fibonacci extension (~$74), with additional targets at $110 and $165 if the bullish momentum continues. In the short term, a breakout above $34 would confirm a reversal, with immediate upside targets of $62 to $74.

On the downside, the 0.786 Fibonacci retracement level (~$23) is a critical support zone. Should AVAX fall below this level, it could indicate weakness, with lower support levels around $16, $11, and $8.

Will an AVAX ETF Drive Significant Price Gains?

The approval of an AVAX-focused ETF could certainly be a catalyst for significant price gains. However, the actual impact will depend on a range of factors, including overall market conditions, trading volume, and investor appetite. Historical trends from Bitcoin and Ethereum suggest that AVAX could see substantial price increases, with potential targets ranging between $160 and $440 in an optimistic scenario.

Leave a comment