Crypto News- ATO’s Cryptocurrency Probe: The Australian Taxation Office (ATO) is reportedly on the hunt for personal data and transaction details from approximately 1.2 million cryptocurrency exchange users, as part of a potential crackdown on crypto tax obligations.

According to Reuters, the ATO aims to identify traders who may have skirted tax payments on their crypto trades, as outlined in a notice issued last month.

ATO’s Cryptocurrency Probe: 1.2 Million Users Face Investigation

In its pursuit, the ATO seeks a trove of personal information, including users’ dates of birth, social media profiles, and contact numbers, along with transaction specifics like wallet addresses, types of coins traded, and bank account particulars.

Under Australian regulations, cryptocurrencies are treated as taxable assets, unlike conventional foreign currencies. This necessitates traders to fork over capital gains tax on profits realized from crypto asset sales.

Crypto Market Boom Amid Investigation: Profits Soar as ATO Acts

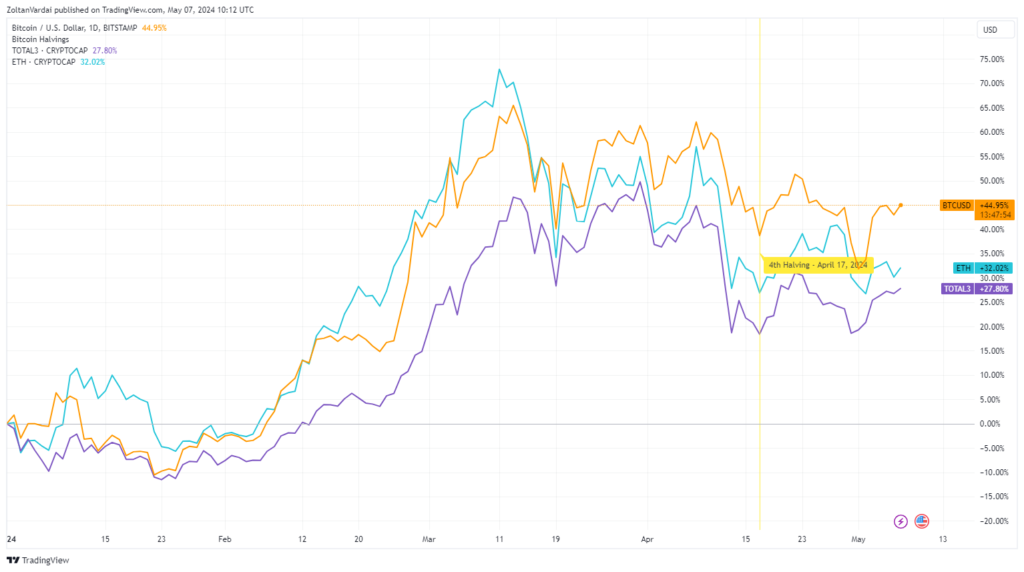

This initiative surfaces at a time of considerable profitability for crypto investors. Bitcoin (BTC) has surged over 44% since the year’s onset, while Ether (ETH) has climbed 32% year-to-date (YTD). The combined market capitalization of top altcoins, excluding Bitcoin and Ether, has also swelled over 27% YTD, per TradingView data.

Crypto Complexity: ATO Warns of Tax Obligation Ignorance

Navigating the labyrinthine landscape of cryptocurrencies often leads to a dearth of awareness regarding tax obligations, as noted in the ATO’s statement:

“The allure of purchasing crypto assets under false pretenses may appeal to those seeking to evade their tax responsibilities.”

Global Push for Tax Recovery: Canada’s Crypto Audits Intensify

Australia isn’t alone in its pursuit of recouping unpaid taxes from digital asset gains. In Canada, the Canada Revenue Agency (CRA) is reportedly conducting over 400 audits related to crypto and probing hundreds of crypto investors to reclaim unpaid taxes, according to the National Post. These audits compound the CRA’s pursuit of an estimated $39.5 million in unpaid taxes from the fiscal year 2023-2024.

Meanwhile, Turkey is poised to introduce legislation later this year pertaining to crypto taxes, aiming to establish a legal framework for crypto taxation in one of the world’s leading crypto economies.

US Tax Policy Shift: Proposed Hikes Target High-Earning Investors

In the United States, regulators are eyeing an increase in the long-term capital gains tax rate to 44.6%, albeit solely for investors earning over $1 million annually. The Biden administration’s Federal Budget proposal also includes a 25% tax on unrealized gains for ultra-high-net-worth individuals.

Matthew Walrath, founder of Crypto Tax Made Easy, downplayed the impact of these proposals, stating, “For 99.9% of people, it’s a big, fat nothing burger because it’s essentially just a proposal,” to Cointelegraph.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment