Ark Invest’s Major Move: Sells Over $100 Million in Coinbase and Grayscale Shares Amidst Bitcoin Rally

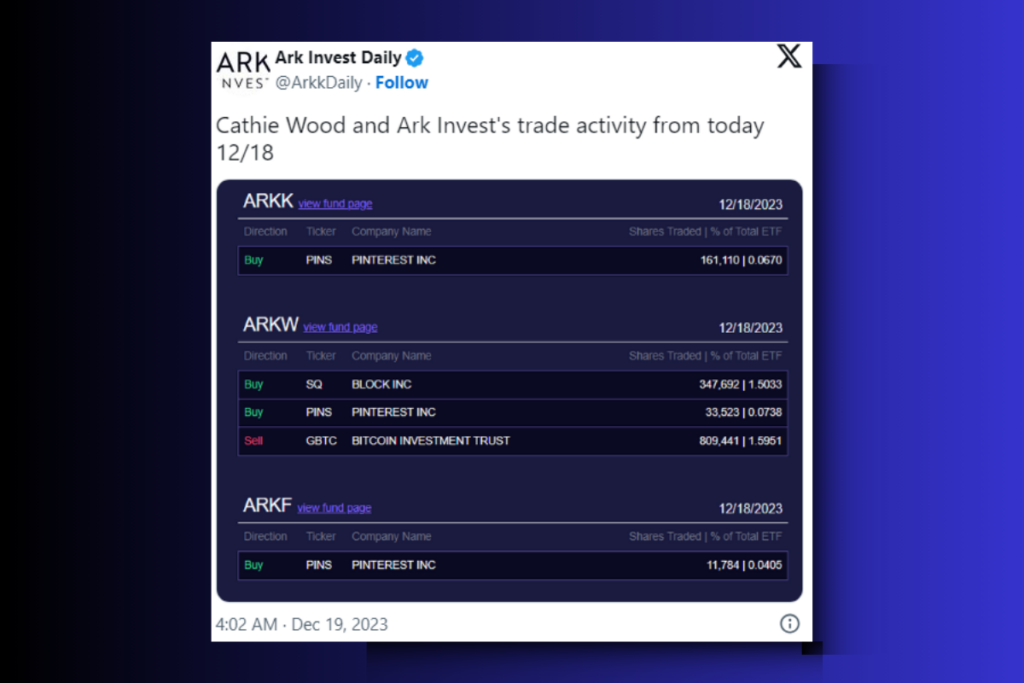

Crypto News – ARK Invest, led by Cathie Wood, executed a significant transaction this Monday, offloading approximately 809,441 shares of Grayscale Bitcoin Trust (GBTC), valued at $27.6 million. This sale, part of the ARKW Next Generation Internet ETF, marks the largest in over a year, as reported by Ark Invest Daily.

In parallel, Bitcoin’s value surged past $43,000 in early Tuesday trading in Asia, reflecting a near 5% increase within the last 24 hours. This rise coincides with recent updates on Exchange-Traded Funds (ETFs) from the U.S. Securities and Exchange Commission (SEC).

Under the headline “Ark Invest Offloads $42.5 Million in GBTC Shares,” the report details Ark’s divestment strategy. The firm sold 12,000 GBTC shares on Friday for $409,000, followed by sales of $1.6 million on Wednesday and a substantial $12.9 million on Monday. This series of transactions culminated in a total divestment of $14.9 million in GBTC shares in just the previous week.

At Monday’s market close, GBTC shares were trading at $34.54. This sale allows Ark to capitalize on the recent uptick in value, though GBTC shares are still approximately 39% lower than their February 2021 peak of $56.70.

GBTC’s discount to its net asset value has notably narrowed in recent months. As of December 19, the GBTC negative premium rate is at -8.04%, with a significant monthly change of -1087.02, according to Coinglass data.

In a separate but equally impactful move, Ark Invest divested around $59 million in Coinbase (COIN) shares last week. The firm disclosed the sale of 18,962 COIN shares, worth $2.8 million, on Friday. Capitalizing on the cryptocurrency rally, Ark sold 12,142 Coinbase shares from its Innovation ETF ($1.8 million), 2,278 shares from its Next Generation Internet ETF ($337,000), and 4,542 shares from its Fintech Innovation ETF ($672,000).

This selling pattern aligns with earlier transactions in the week, including $42.6 million of COIN on Wednesday, $11.5 million on Tuesday, and $1.9 million on Monday. The cumulative divestment for the week amounted to $58.8 million in Coinbase shares.

Moreover, Ark Invest had previously liquidated $100 million worth of Coinbase shares in the preceding week, underscoring a continued strategy of significant divestment in the cryptocurrency sector.

Leave a comment