APE Options Surge on PowerTrade: 800% Rise in Open Interest Sparks Bullish Sentiment

The recent strong positive trend is anticipated to continue shortly, according to options activity on PowerTrade, a cryptocurrency exchange that specializes in derivatives linked to altcoins. PowerTrade reported on Monday that open interest, or the quantity of active APE options contracts, increased by more than 800% to 263,000 ($394.5K) in a single day. The company also stated that call options or derivatives, which provide asymmetric upside potential, make up more than 80% of the total.

APE Options Surge: October Expiry Contracts See Record Activity on PowerTrade

The October 22 and October 25 expiry contracts see the most activity, with traders purchasing higher strike out-of-the-money (OTM) calls at strikes as high as $2.2, or about 50% above APE‘s prevailing market price. Given that the token has a market valuation of under $1 billion and reflects increasing complexity in the altcoin arena, the activity in APE options is significant. Nevertheless, compared to the billions of dollars trapped in BTC and ETH options contracts posted on the top exchange Deribit, open interest and volume are significantly smaller.

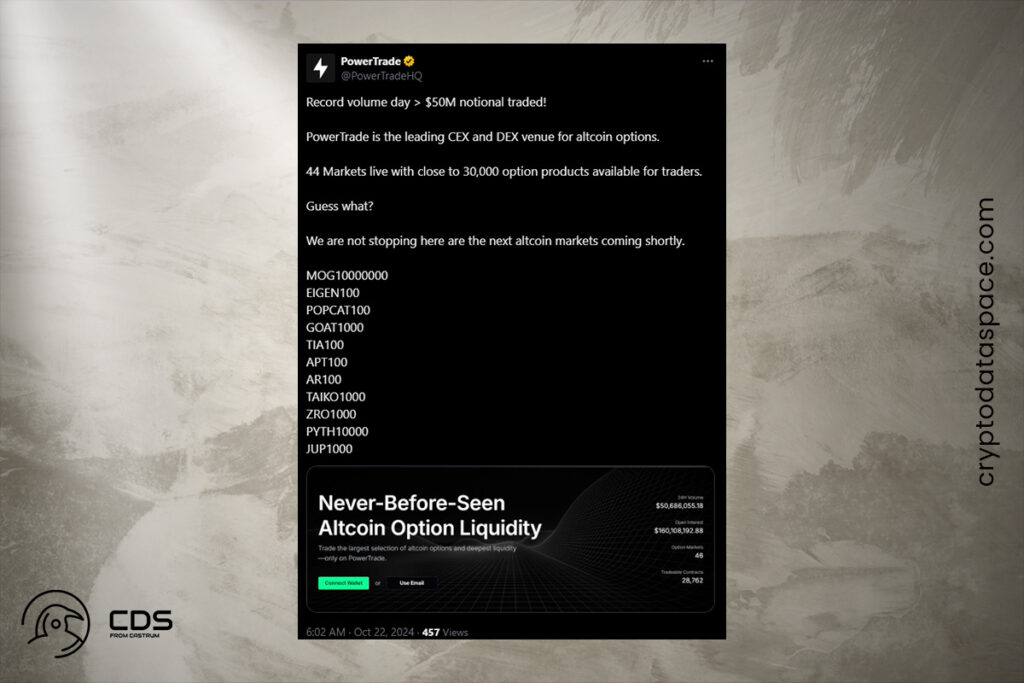

One contract represents one APE as the underlying in PowerTrade’s European-style USD-settled options. The platform hopes to offer options linked to several other cryptocurrencies, including EIGEN, APT, ARK, and PYTH. On Monday, it saw a record trading volume of $50 million in options attached to 44 altcoins.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment