Anticipation Builds as Ethereum ETF Decision Looms: Could ETH Price Soar Further?

Crypto News – After the United States Securities and Exchange Commission (SEC) greenlit several spot Bitcoin ETFs earlier this year, the cryptocurrency community has been abuzz with speculation, foreseeing a similar fate for Ethereum ETFs in the near future.

The anticipation surrounding this decision has ignited considerable conjecture, particularly concerning its potential impact on Ethereum’s market value.

What’s the Fuss About Ethereum ETFs?

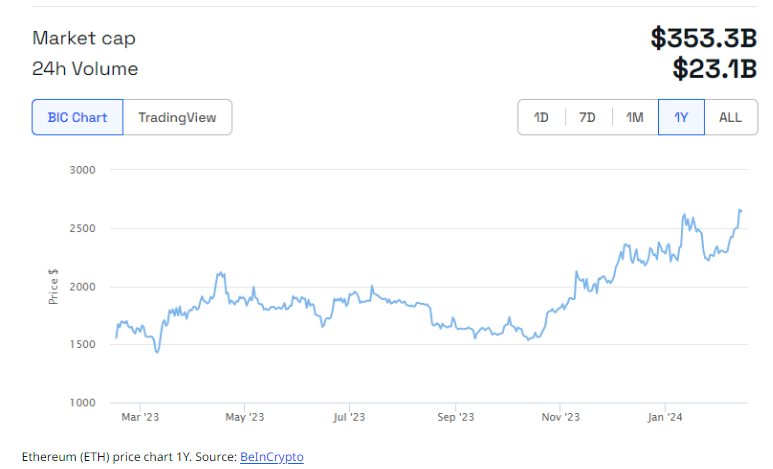

Ethereum, the second-largest cryptocurrency by market capitalization, has recently experienced a notable surge in its value. On February 20, the price of ETH surpassed $3,000 for the first time since April 2022.

This upward trajectory is in part attributed to the increasing optimism surrounding the possible approval of a spot Ethereum ETF. Financial experts suggest that such an ETF approval could lead to greater integration of Ethereum within the traditional financial system, potentially bolstering its value and appeal to investors. With the next deadline for the SEC’s decision looming in early March, the speculation continues to mount.

Dave LaValle, Grayscale’s Head of ETFs, recently assessed the likelihood of SEC approval for Ethereum ETFs at 50%, a figure slightly lower than Bloomberg Analyst Eric Balchunas’ projection in November 2023.

During an interview with The Defiant, Balchunas expressed a 70% chance of an Ethereum ETF approval, a sentiment voiced nearly two months before the approval of Bitcoin ETFs.

“I see no valid grounds for the SEC to deny spot Ethereum ETFs, especially considering their approval of futures Ethereum ETFs. Denial would be illogical and could potentially open the door to further legal challenges,” remarked Balchunas.

The lawsuit Balchunas refers to involves Grayscale’s legal action against the SEC following the commission’s repeated objections to the firm’s attempt to convert its GBTC fund into a spot Bitcoin ETF. The judge presiding over the case sided with Grayscale, criticizing the SEC’s rejection reasons as ‘arbitrary and capricious.’

While the SEC has not explicitly classified ETH as a security, its stance on cryptocurrencies remains cautious. Gary Gensler, the SEC Chair, has been vocal about the need for regulatory compliance to mitigate fraud and market manipulation risks.

Potential Impact on ETH Price

Many analysts are optimistic about the approval of an ETH ETF, viewing it as a potential catalyst for driving Ethereum’s price to new highs. The prospect of a broader investor base and increased market legitimacy could propel ETH’s value upwards.

Ryan Sean Adams of Bankless echoed this optimism in a tweet, contrasting current positive indicators like L2 acceleration and restaking yields with past market upheavals.

“ETH just crossed $3k! The last time we hit this milestone, we were grappling with various crises: Terra collapse, 3 arrows downfall, CeFi mishaps, Genesis fiasco, and the $10 billion FTX fraud. This time, we’re backed by L2 hyper acceleration, restaking yields, and the prospect of an ETH ETF. What a solid foundation. $3k is the new floor,” tweeted Adams.

Leave a comment