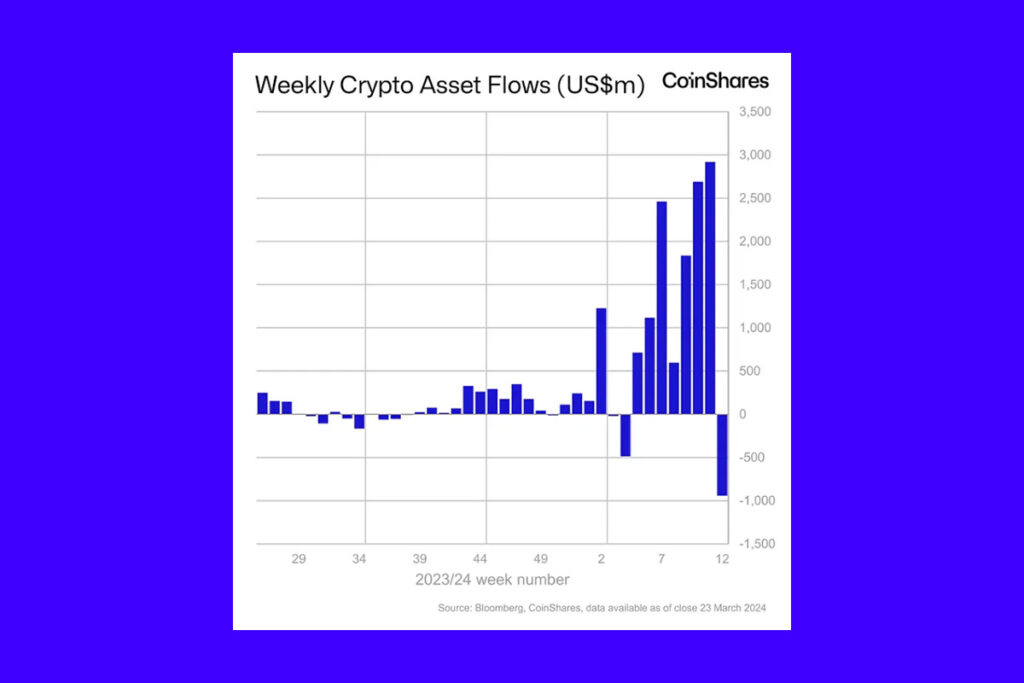

Crypto News – First out of a record seven-week run of inflows of $12.3 billion, crypto investment products had record weekly withdrawals of $942 million.

7-Week Net Outflow: Crypto Market Experiences First Major Outflow of $942 Million

According to a recent CoinShares analysis, even though Exchange-Traded Products (ETPs) saw strong trade volumes this week—$28 billion—they were barely two-thirds of what they had been the week before. Despite a $10 billion decline due to the current price adjustment, total assets under management (AUM) were still higher than previous cycle highs at $88 billion.

Little inflows were coming into US ETFs as a result of investors’ hesitancy after the recent market correction, according to James Butterfill, a researcher at CoinShares. The significant $2 billion withdrawal from Grayscale Investments last week was largely mitigated by these inflows of $1.1 billion.

Altcoins on the Rise Despite the Market

The largest cryptocurrency in the world, Bitcoin (BTC), saw the most withdrawals, totaling $904 million. For short-Bitcoin products, smaller outflows totaling $3.7 million were also noted. This happened just a short while after Bitcoin’s all-time high saw a more than 10% decline. Additionally severely impacted were Cardano (ADA), Solana (SOL), and Ethereum (ETH), with withdrawals of $3.7 million, $5.6 million, and $34 million, in that order.

Altcoins attracted investor interest despite the mood of the market, generating a net inflow of $16 million. With $5 million in inflows, DOT was the top performer, ahead of AVAX ($2.9 million) and LTC ($2 million).

Leave a comment