Crypto News – Bitcoin is reaching levels not seen since the bull market, barely a year after the demise of the cryptocurrency exchange FTX.

Behind the Scenes of the $63K BTC Rally

On Wednesday morning, it surpassed $63,000, a 40% increase this year. According to certain experts, this rise will be unique, and Bitcoin will shortly surpass the $69,000 mark it set in November 2021. This surge could be attributed in large part to the entry of major firms, such as $10 trillion fund manager BlackRock. According to research firm Bernstein, these institutional investors will fuel additional rallies.

Bitcoin is on an 18-month path to $150,000, led by unprecedented institutional adoption,

Bernstein analysts

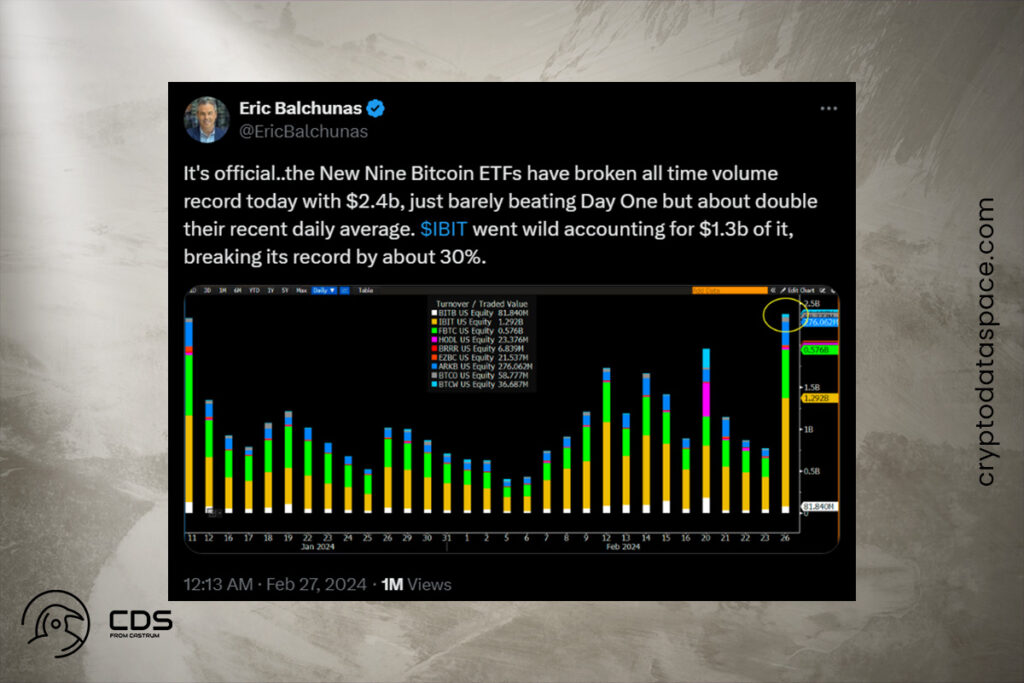

Eric Balchunas Emphasizes the Role of ETFs

BlackRock, Fidelity Investments, and other major players in finance approved spot Bitcoin ETFs in January, which helped bring billions of dollars into the cryptocurrency markets. The nine new ETFs are raking in as much as $2.6 billion a day in daily inflows, shattering previous records. A new fact in the cryptocurrency space that spot ETFs are driving Bitcoin activity was brought to light by Bloomberg Intelligence’s Eric Balchunas. According to Balchunas, the performance of spot ETFs indicates their importance to the largest and most reputable assets on Wall Street.

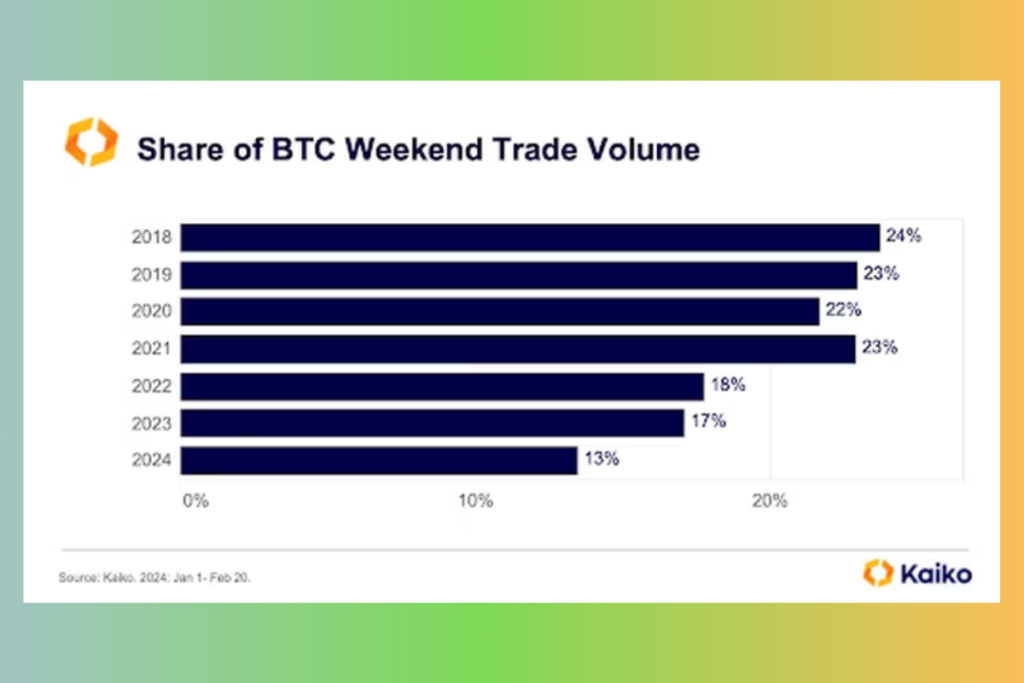

Kaiko Analyzes Bitcoin’s Weekday Volumes

According to a report released on Monday by the cryptocurrency data firm Kaiko, which looked at Bitcoin’s weekend volume trends since 2018, the percentage of trading that occurs on weekends has decreased, indicating that more trading occurs during the week. According to Kaiko, this indicates institutional engagement. According to the data, the percentage of Bitcoin traded on weekends has decreased dramatically over the previous six years, from 24% in 2018 to barely 17% last year.

Weekend and overnight liquidity management has always been a challenge for 24/7 crypto markets, creating a mismatch between the operating hours of traditional financial institutions and the needs of large crypto traders and market makers,

Kaiko report

Bitcoin Funding Rates Rise

According to CoinGlass data, the open interest-weighted funding rate for Bitcoin is surging to record highs on perpetual futures contracts, surpassing the levels observed prior to the introduction of the ETF in January. Increased demand for the underlying asset of the contract is reflected in the high open interest, which indicates that more traders are entering into contracts.

Funding rates are also increasing above levels observed prior to the spot Bitcoin ETF approvals in January, according to CoinGlass data. There may be a lot of market demand for long bets if the financing rate is high.

Leave a comment