Crypto News– The competition is intensifying among major banks in the U.S. as they vie to become the first to incorporate a Bitcoin ETF.

04 April Crypto News- What Happened Crypto Markets Today

Bitcoin Cash, a derivative of Bitcoin introduced in 2017, has recently experienced its halving event. Additionally, Meta, previously known as Facebook, has incurred a $40 billion loss in its metaverse division since the year 2021.

Morgan Stanley aims to outpace UBS in becoming the first bank to launch a Bitcoin ETF

The launch of spot Bitcoin exchange-traded funds (ETFs) in the United States has ignited competition among investment banks to be the first to incorporate these products.

According to crypto enthusiast Andrew (AP_Abacus), Morgan Stanley is striving to surpass UBS and become the inaugural wirehouse to fully endorse the Bitcoin ETF. Andrew reported on X platform on April 3, citing internal notes from Morgan Stanley, suggesting that the bank might disclose its move into Bitcoin ETFs shortly before the actual implementation.

UPDATE: several sources confirming that @MorganStanley is set to approve #Bitcoin ETF's on their platform in the next two weeks.

— Andrew (@AP_Abacus) March 26, 2024

– sources are from inside $MS, inside $BTC ETF firms, and legal insiders adjacent to both.

– @MorganStanley holds more than $1.5T in client assets.

Andrew also highlighted that global banks are actively discussing the addition of Bitcoin ETFs as a competitive race.

Bloomberg ETF expert Eric Balchunas chimed in on Andrew’s discussion thread, stating that neither Morgan Stanley nor UBS has yet added Bitcoin ETFs, based on a reliable source.

This speculation about Morgan Stanley’s potential move against UBS emerges a few weeks after Andrew’s previous report indicating that the bank is poised to greenlight Bitcoin ETFs.

Bitcoin Cash experiences price fluctuations during its second-ever halving event

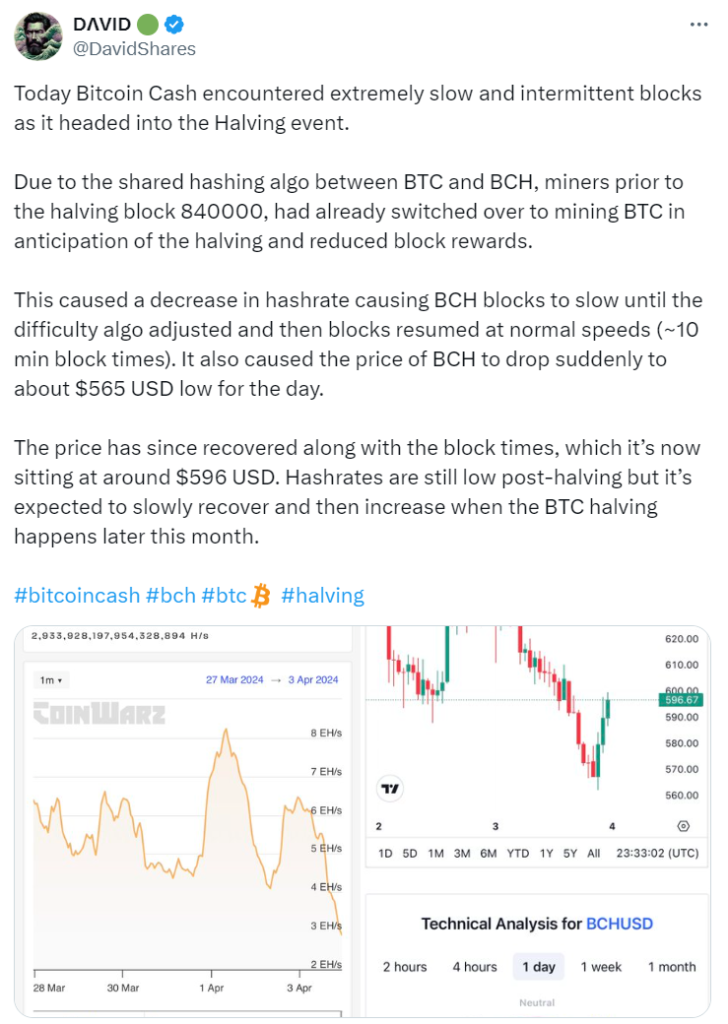

On Wednesday, Bitcoin Cash (BCH) experienced a dip in price, falling to $641, following a three-month-long rally. However, it quickly rebounded as the blockchain concluded its second-ever halving event. During halving events, mining rewards are halved. Bitcoin Cash operates on a proof-of-work blockchain network and was created to offer faster and more cost-effective transactions compared to Bitcoin. The first Bitcoin Cash halving occurred on April 8, 2020, reducing miner rewards from 12.5 BCH to 6.25 BCH.

Leading up to the halving, there was optimistic speculation, reflected in Bitcoin Cash’s price surge by 147.85% over the past three months and 24% over the last 30 days.

However, on the day before the halving, Bitcoin Cash experienced a 9.94% decline, dropping to $572.21, according to CoinMarketCap data. Nevertheless, following the halving, it swiftly recovered, reaching $604, marking a spike of approximately 5.5%.

Zuckerberg’s metaverse division has incurred losses amounting to 40 billion Dollars

Following its rebranding from Facebook to Meta in 2021, the company led by Mark Zuckerberg has accumulated losses totaling $40 billion attributed to its metaverse division.

Despite Meta’s impressive revenue of $134.9 billion in 2023, a deeper analysis of its financials reveals concerning trends for Reality Labs, the division overseeing products like the Quest VR headset. Financial data indicates consecutive year-over-year declines since 2021.

According to data from UploadVR, Meta had sold approximately 20 million Quest headsets since 2019 as of March 2023.

Leave a comment