Crypto News – MicroStrategy Joins Nasdaq 100 as Bitcoin Holdings Surpass 439,000 BTC

Crypto News – In a major move that reinforces its position as a dominant corporate Bitcoin holder, MicroStrategy has purchased an additional 15,350 BTC for $1.5 billion between December 9 and December 15, 2024, at an average price of $100,386 per Bitcoin. The purchase brings the company’s total Bitcoin holdings to 439,000 BTC, worth over $45 billion at current market prices.

This latest acquisition follows a similar transaction in which MicroStrategy raised $1.5 billion by selling approximately 3,884,712 shares of its stock. This strategy forms part of the company’s broader $42 billion capital raise targeting more Bitcoin acquisitions, with the remaining $7.65 billion in shares still available for sale.

MicroStrategy’s Bitcoin Accumulation Strategy

Since its first Bitcoin purchase, MicroStrategy has actively acquired Bitcoin, steadily increasing its holdings over the past several months. Its average acquisition price for the total 439,000 BTC currently held is $61,725 per Bitcoin, representing a total investment of $27.1 billion. The company’s strategy, led by Michael Saylor, co-founder and executive chairman, reflects its unwavering commitment to Bitcoin as a long-term investment.

MicroStrategy now owns about 2.1% of Bitcoin’s total supply of 21 million BTC, signaling its significant influence in the market. This aggressive buying approach is part of the company’s Bitcoin Yield strategy, which aims to balance the growth of Bitcoin holdings with share dilution, benefiting shareholders as the company continues to acquire more Bitcoin.

MicroStrategy’s Market Performance and Valuation Premium

Despite some investor concerns regarding its reliance on equity and debt-funded Bitcoin acquisition programs, MicroStrategy’s market performance has been strong. The company’s market capitalization currently stands at $92 billion, significantly higher than its Bitcoin net asset value (NAV), reflecting a valuation premium.

Analysts at Bernstein believe that this premium could persist for a long time, stating that as long as Bitcoin’s price remains around the $100,000 mark, MicroStrategy will continue its acquisition strategy. The company also benefits from its leverage levels and its ability to issue more debt or tap into equity markets for further Bitcoin purchases.

MicroStrategy’s Inclusion in Nasdaq 100

In a milestone for the company, MicroStrategy is set to join the Nasdaq 100 Index on December 23, 2024. This inclusion brings increased visibility to the company, and large exchange-traded funds (ETFs), such as the popular QQQ, are expected to buy shares of MicroStrategy. According to Bloomberg analyst James Seyffart, the net buying by ETFs could total at least $2.1 billion in shares.

MicroStrategy’s entry into the Nasdaq 100 places it as the 40th largest company in the index, with an approximate 47 basis points (bps) weight. This will improve the company’s market liquidity and further propel its capital flywheel effect, enabling it to continue acquiring more Bitcoin at scale.

The Path to S&P 500 Inclusion

Looking ahead, MicroStrategy’s leadership is aiming for the company to be included in the S&P 500 by 2025. However, this goal faces challenges, particularly due to the lack of profit from its software business. A new accounting rule for Bitcoin valuations could improve MicroStrategy’s chances of inclusion by allowing it to recognize unrealized gains on its Bitcoin holdings. This would improve the company’s financials and make it eligible for inclusion in the prestigious index.

Bitcoin Yield Strategy and Stock Performance

MicroStrategy’s Bitcoin Yield, a key performance indicator that tracks the percentage change in its Bitcoin holdings relative to its diluted shares, is currently at an impressive 72.4% year-to-date as of December 15. This metric highlights the company’s ability to acquire Bitcoin efficiently while balancing shareholder dilution.

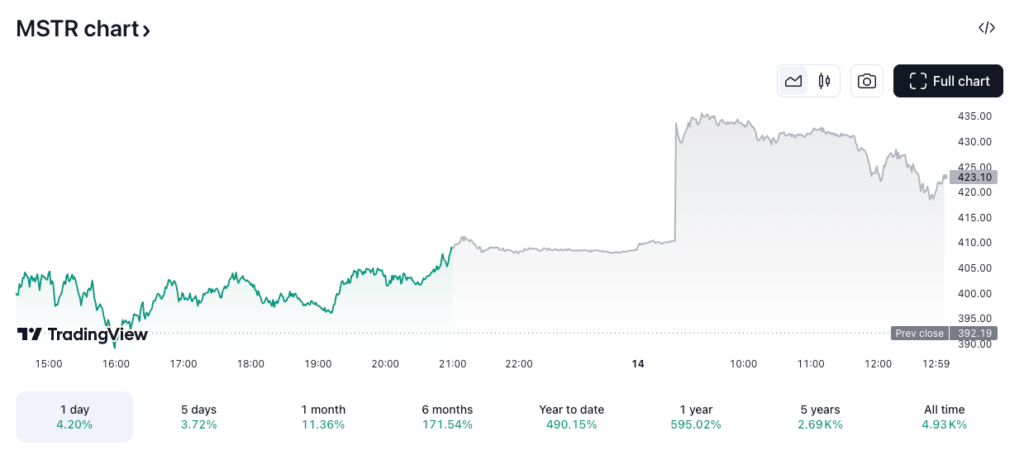

As for its stock performance, MicroStrategy’s shares have seen a remarkable rise, gaining over 490% year-to-date, and closed up 4.2% at $408.67 on Friday, December 13. The stock has continued to see positive movement, with a 3.5% increase in pre-market trading on Monday.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment