Crypto News- Microsoft’s Bitcoin Plans: Insights from SEC Filing

Crypto News– On October 24, Microsoft Corp. (MSFT) filed a significant document with the United States Securities and Exchange Commission (SEC), revealing an intriguing agenda item for its upcoming annual shareholder meeting on December 10. Among the routine matters, such as the election of directors and the ratification of the independent auditor, one proposal drew attention: an Assessment of Investment in Bitcoin. Interestingly, Microsoft’s board has recommended that shareholders vote against this proposal.

Microsoft’s Financial Position and Potential Bitcoin Investment

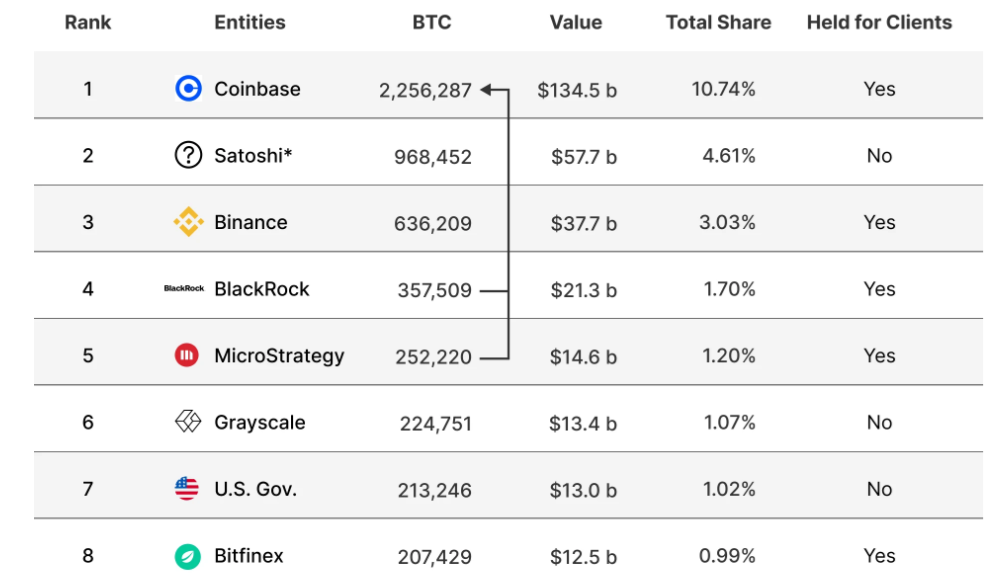

According to Microsoft’s second-quarter 2024 financial report, the company currently holds a substantial cash position of $76 billion in cash and equivalents. Should shareholders advocate for the allocation of even 10% of this amount to Bitcoin, it would represent a staggering $7.6 billion investment. At an average Bitcoin price of $73,000, this investment would equate to approximately 104,109 BTC—nearly eleven times the 9,720 BTC held by Tesla. However, this would still fall short of MicroStrategy’s aggressive strategy, which has resulted in a holding of 252,220 BTC.

Given the current dynamics of Bitcoin supply, this potential acquisition by Microsoft could lead to a significant supply shock. Notably, over 80% of all Bitcoin has not moved in more than six months, and the amount of BTC available on exchanges is at its lowest in over four years.

The Shareholder Voting Process in the U.S.

In publicly traded companies like Microsoft, shareholders have the power to vote on significant decisions during annual meetings. While votes on special proposals—such as this Bitcoin investment—are typically non-binding, they provide insight into shareholder sentiment. If enough support is garnered, it could pressure the company to consider the proposal seriously.

According to SEC regulations, a large shareholder can compel a company to engage all shareholders on specific issues. However, Microsoft’s board’s recommendation against the Bitcoin investment proposal reflects caution, likely due to concerns over market volatility and regulatory uncertainty. Yet, the increasing interest in Bitcoin from institutional investors cannot be overlooked. Notably, Reid Hoffman, the founder of LinkedIn and a member of Microsoft’s board, has expressed positive views on Bitcoin, describing it as a digital store of value in a Yahoo Finance interview.

Potential Methods for Microsoft’s Bitcoin Acquisition

Should Microsoft decide to pursue a Bitcoin investment, several options are available. The company could opt for direct purchases of Bitcoin on standard exchanges, similar to Tesla’s acquisition strategy.

Alternatively, Microsoft might consider investing in a Bitcoin spot ETF. This approach would provide indirect exposure to Bitcoin while offering additional liquidity and regulatory clarity, thereby mitigating the direct custody risks associated with holding physical assets. Such a structure would also facilitate easier buying and selling, enhancing capital efficiency.

Another strategy could involve using leverage, including derivatives like call options, to increase market exposure without the need for significant upfront capital. This would allow Microsoft to speculate on price movements, potentially magnifying returns; however, it also introduces additional risks associated with leveraged positions.

While it seems unlikely that Microsoft will make a Bitcoin investment in the immediate future, the shareholder pressure underscores Bitcoin’s growing appeal. This sentiment may prompt other companies to explore similar opportunities, reflecting a broader trend in corporate interest toward cryptocurrencies.

In conclusion, the upcoming shareholder vote on the potential investment in Bitcoin highlights the complexities of corporate governance and the evolving landscape of digital assets. As Microsoft navigates these discussions, the implications of their decisions could resonate throughout the corporate and cryptocurrency sectors alike.

FAQs

Why did Microsoft’s board recommend against the Bitcoin investment proposal?

Microsoft’s board recommended against the Bitcoin investment proposal due to concerns over the volatility and regulatory uncertainty associated with cryptocurrencies. The board aims to maintain a cautious approach regarding investments that could impact the company’s financial stability. They likely believe that the risks outweigh the potential benefits at this time.

How could a significant investment in Bitcoin impact Microsoft’s financials?

If Microsoft were to invest a substantial amount in Bitcoin, it could lead to a supply shock in the market, given the current dwindling supply of available BTC. For example, investing 10% of its cash reserves, approximately $7.6 billion, could significantly affect Bitcoin’s price due to increased demand. However, such an investment would also expose Microsoft to the inherent volatility of cryptocurrency markets, which could impact its financial performance depending on market fluctuations.

Leave a comment