Crypto Market Analysis -Will October Bring a Bitcoin Rebound? Insights and Trends

Crypto Market Analysis– Bitcoin’s (BTC) historically bullish month of October has not started as many had hoped, with the asset briefly dipping below $60,000 late Thursday before recovering. This fluctuation led to the liquidation of over $144 million in bullish crypto bets. Currently trading just above $61,300, Bitcoin has remained flat over the past 24 hours, amid a volatile U.S. trading session.

Market Overview: Altcoins and Investor Sentiment

In addition to Bitcoin’s challenges, major altcoins like Ether (ETH), BNB (BNB), and XRP (XRP) experienced losses of up to 2%. Meanwhile, the memecoin Dogecoin (DOGE) saw a 2% increase despite lacking any immediate catalyst. The CoinDesk 20 (CD20) index, which tracks the largest tokens by market capitalization, declined by 1%. Since the beginning of October, Bitcoin has fallen over 6%, which has significantly affected social sentiment on platforms like X, where some users are expressing bearish views on the asset’s recovery.

Betting Insights: Mixed Predictions for Bitcoin

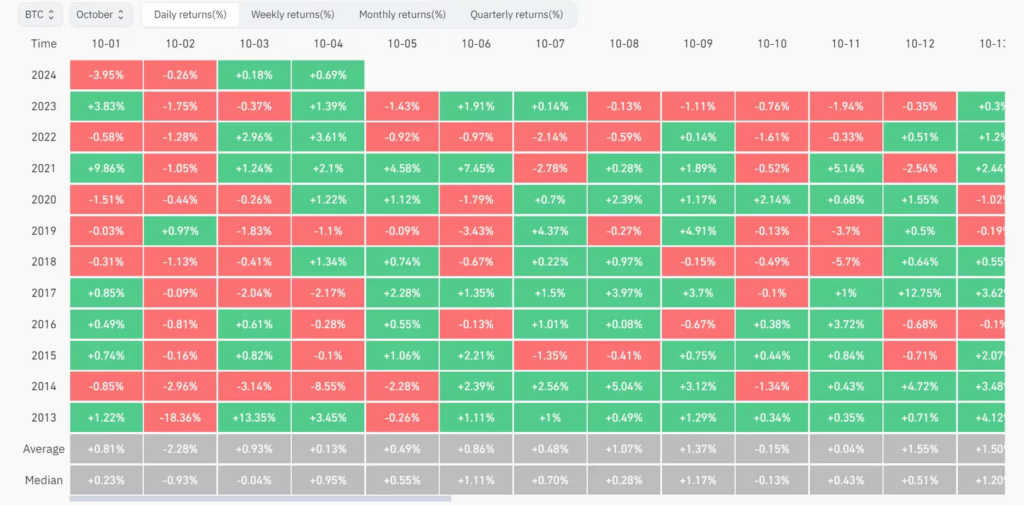

Opinions among Polymarket bettors are divided regarding Bitcoin’s price trajectory for October. While an attempt to reach $70,000 seems unlikely, there is a consensus that BTC will likely trade within a range between $57,500 and $65,000. Historical data from CoinGlass indicates that gains typically materialize in the latter part of the month, as the first week tends to be bearish. Notably, the second and third days of October have recorded green closes only six times since 2013, suggesting that the current price action aligns with historical trends.

Geopolitical Factors and Market Dynamics

Macroeconomic and fundamental factors have also influenced trading sentiment in recent weeks. Geopolitical tensions in the Middle East have shifted investor focus towards oil and gold, leading to significant price movements in these commodities. For instance, Brent crude oil experienced its largest single-day increase in nearly a year and is on track for an 8% weekly gain since early 2023.

Polymarket bettors currently assign a 63% probability that Israel will target Iranian oil facilities this month, while only a 35% chance exists for strikes on Iran’s nuclear sites. Additionally, the upcoming U.S. presidential election appears to be very close, with candidates either briefly tying or competing over a narrow margin. Notably, Donald Trump-themed Solana meme coin TREMP has gained 14%, while the original MAGA Trump token remains flat. In contrast, the Kamala Harris-themed KAMA token has seen a decline of 7.5%.

Leave a comment