Crypto IPO Plans Crushed After Trump’s Trade War Announcement

US President Donald Trump’s massive tariff launch this week put a strain on cryptocurrency companies as market volatility sent share values plummeting and thwarted preparations for initial public offerings (IPOs). Despite the industry’s cordial ties with the US president, cryptocurrency equities plummeted just as much, if not more, than shares of other businesses. This included exchanges and Bitcoin miners.

Trump declared on April 2 that he would impose reciprocal tariffs on about 57 countries and impose duties of at least 10% on almost all imports into the US. Since then, as traders prepared for an impending trade war, key US stock indices, such as the S&P 500 and Nasdaq, have fallen by almost 10%.

Stablecoin Shake-Up: U.S. Lawmakers Push for Tighter Oversight on Tether

Digital assets known as stablecoins are usually based on the U.S. dollar, are intended to maintain a constant value, and enable cryptocurrency traders to initiate and exit positions without having direct access to dollars. With a daily turnover of tens of billions of dollars, they are by far the most traded digital assets on the market.

As parallel stablecoin bills race through the House and Senate to floor votes, questions have abounded over the fate of Tether, by far the market’s largest player. The GENIUS Act in the Senate and the STABLE Act in the House would mandate that foreign stablecoin issuers, such as El Salvador-based Tether, adhere to strict anti-money laundering regulations under the Bank Secrecy Act. They would also require thorough audits of the reserves held by these issuers.

Top Stocks Tumble After Trump’s Trade War Talk: Recession Risk Now 60%

According to statistics from Google Finance, Coinbase, a well-known Trump friend during the US elections in November, saw a similarly significant sell-off, with its stock price falling by almost 12% during that time. Miners of Bitcoin are also suffering. According to Morningstar statistics, the CoinShares Crypto Miners ETF (WGMI), which tracks a wide basket of Bitcoin mining equities, has lost over 13% of its value since just before Trump’s pronouncement on April 2.

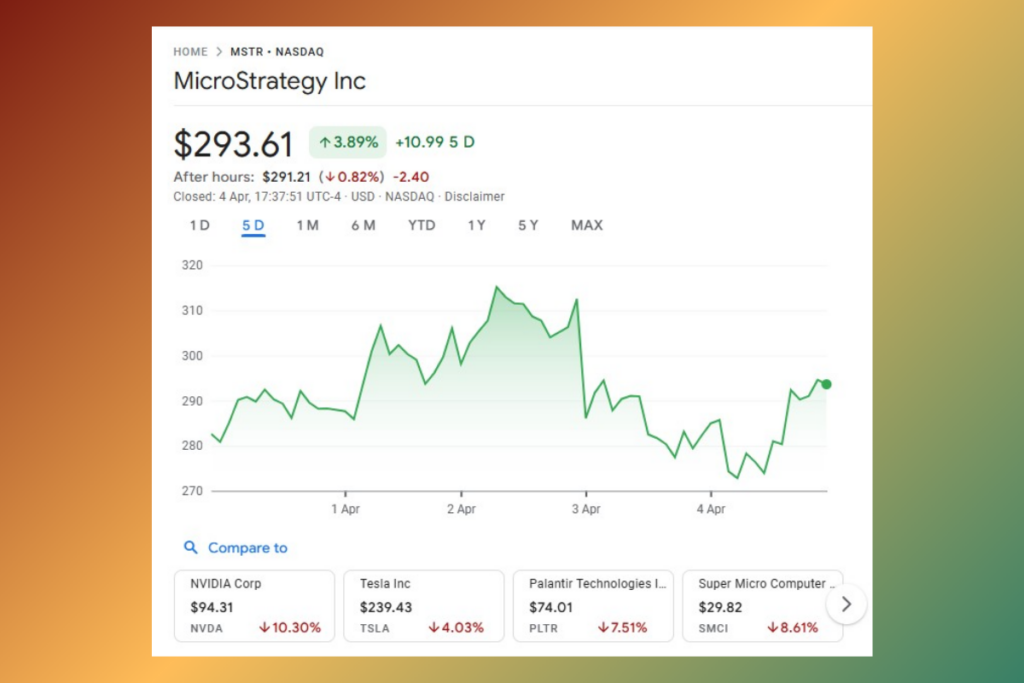

Not even Strategy, one of 2024’s top-performing equities, was exempt. According to Google Finance data, its share price has dropped by almost 6% as a result of the news. Investment bank JPMorgan has increased its projected odds of a global economic recession in 2025 from 40% to 60%, according to Reuters.

Disruptive U.S. policies have been recognized as the biggest risk to the global outlook all year. The effect … is likely to be magnified through (tariff) retaliation, a slide in U.S. business sentiment and supply-chain disruptions.

JP Morgan

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment