What Are Crypto Debit Cards?

Crypto debit cards are financial tools that allow users to spend their cryptocurrency holdings seamlessly. These cards operate by converting crypto assets into fiat currency at the point of sale, enabling real-world use of digital assets.

Historically, one of the biggest challenges for cryptocurrency adoption has been the inability to use digital currencies for everyday transactions. Crypto debit cards address this issue, bridging the gap between the blockchain-driven world of cryptocurrencies and traditional financial systems. With these cards, users can make purchases at millions of merchants worldwide, even those that don’t directly accept cryptocurrency.

Crypto debit cards are as legitimate as traditional debit cards and provide a secure, user-friendly way to transact. Whether it’s online shopping or dining out, these cards make it simple to use cryptocurrency for daily expenses. They also offer additional benefits, such as rewards programs and enhanced security features, making them an attractive option for crypto enthusiasts and newcomers alike.

This guide explores how crypto debit cards work, their advantages, and tips for using them effectively.

What Is a Crypto Debit Card?

A crypto debit card is a payment card that allows you to spend cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) directly from your wallet. Issued by cryptocurrency platforms in partnership with major payment processors such as Visa and Mastercard, these cards enable seamless spending both online and in physical stores that accept standard debit or credit card payments.

Instead of manually converting your crypto to fiat currency before making a purchase, crypto debit cards handle the conversion in real-time. This streamlined process makes crypto more accessible for everyday use. Additionally, some crypto debit cards offer rewards programs, cashback, and other perks, further enhancing their appeal.

Crypto debit cards can also be used at ATMs to withdraw cash, providing even greater flexibility. However, as with traditional cards, they are susceptible to security threats, so users should prioritize safety and privacy when using them.

How Do Crypto Debit Cards Work?

Crypto debit cards function similarly to traditional debit cards but are linked to a cryptocurrency wallet instead of a bank account. Here’s how they work:

- Real-Time Conversion: When you use the card, the crypto in your wallet is automatically converted to fiat currency (such as USD, EUR, or GBP) at the time of purchase.

- Payment Processing: The payment network (Visa or Mastercard) processes the transaction, allowing you to pay merchants who accept standard card payments.

- Seamless Integration: This integration makes it possible to spend crypto even at establishments that don’t directly support digital currencies.

With crypto debit cards, users enjoy the benefits of cryptocurrency while accessing the global payment network of traditional cards.

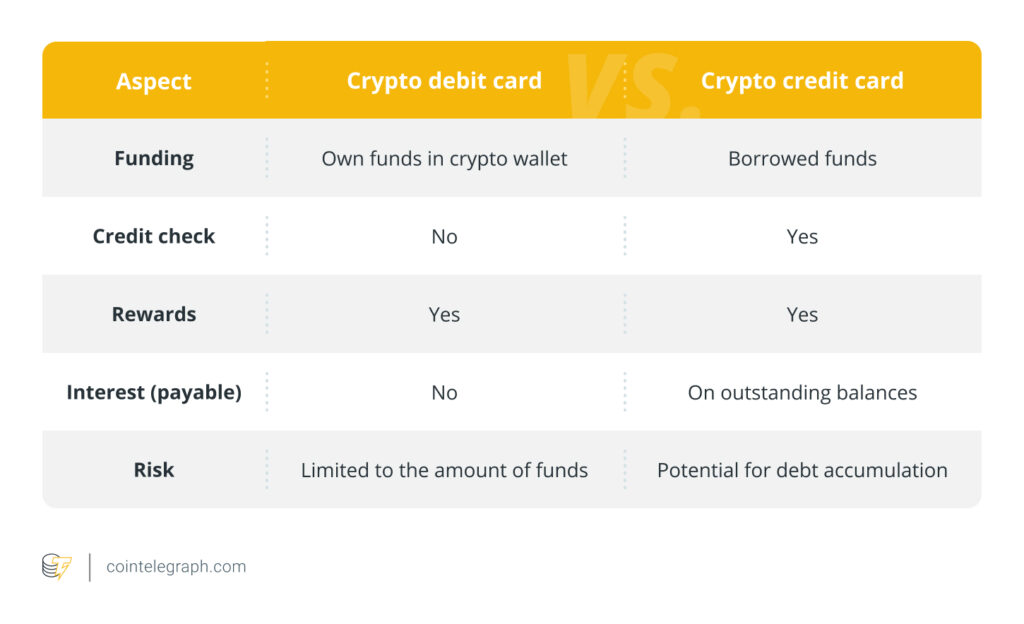

Crypto Debit Cards vs Crypto Credit Cards

Crypto cards come in two main types: debit and credit. While they may seem similar, they cater to different financial needs:

Crypto Debit Cards

- How They Work: Operate like prepaid cards; users link their crypto wallets to the card to fund transactions.

- Fees: Typically charge maintenance, withdrawal, and crypto-to-fiat conversion fees.

- Rewards: May offer perks like cashback, travel rebates, or access to exclusive services.

- Spending Limit: Restricted to the balance in your wallet.

Crypto Credit Cards

- How They Work: Function like traditional credit cards, allowing you to borrow funds for purchases.

- Fees: May include interest, annual fees, and late payment penalties.

- Rewards: Often provide crypto-based incentives, such as earning Bitcoin or native tokens.

- Credit Impact: Affects your credit score, similar to regular credit cards.

How to Get a Crypto Debit Card

Follow these steps to obtain a crypto debit card:

- Choose a Provider: Research cryptocurrency platforms that offer debit cards, such as Binance, Coinbase, or Crypto.com. Compare fees, rewards, and supported cryptocurrencies to find the best fit.

- Sign Up: Create an account on the platform and complete the Know Your Customer (KYC) verification process, which typically involves submitting identification and proof of address.

- Fund Your Wallet: Deposit cryptocurrency into your wallet. Some providers may require you to stake specific tokens to unlock rewards or benefits.

- Request the Card: Apply for the card through the platform. You may receive a virtual or physical card, depending on the provider.

- Activate and Use: Once you receive your card, activate it via the platform’s app or website and start making purchases or withdrawals.

What to Consider When Choosing a Crypto Debit Card

Before selecting a crypto debit card, consider the following factors:

- Fees and Limits: Review transaction fees, withdrawal charges, and spending limits.

- Supported Cryptocurrencies: Ensure the card supports the digital currencies you plan to use.

- Global Acceptance: Choose cards linked to major networks like Visa or Mastercard for broader usability.

- Rewards: Look for cards offering cashback, cryptocurrency incentives, or discounts.

- Security Features: Opt for cards with advanced security measures, such as two-factor authentication (2FA) and transaction alerts.

Benefits of Crypto Debit Cards

Crypto debit cards combine the convenience of traditional payment methods with the advantages of blockchain technology. Key benefits include:

- Ease of Spending: No need for manual crypto-to-fiat conversions.

- Real-Time Conversion: Automated currency exchange during transactions.

- Global Usability: Accepted at millions of merchants worldwide.

- Enhanced Security: Features like 2FA and virtual cards reduce fraud risks.

- Incentives: Earn rewards, including cashback and cryptocurrencies, for card usage.

Challenges of Crypto Debit Cards

Despite their advantages, crypto debit cards have some challenges:

- Hacking Risks: Wallets linked to cards are potential targets for hackers.

- Regulatory Uncertainty: Crypto regulations vary by region and can impact card functionality.

- Merchant Acceptance: Some vendors may not accept crypto debit cards.

- Tax Implications: Using these cards triggers taxable events, requiring careful record-keeping.

The Future of Crypto Debit Cards

As cryptocurrencies continue to integrate into mainstream finance, the utility of crypto debit cards is expected to grow. Enhanced security features, broader merchant adoption, and innovative rewards programs will likely become standard. Additionally, advancements in blockchain technology and clearer regulatory frameworks will pave the way for widespread adoption.

Future crypto debit cards may also support greater interoperability, enabling seamless integration with multiple wallets and blockchain networks. As the ecosystem evolves, these cards will play a crucial role in bringing crypto into everyday life.

Leave a comment