Coinbase Wants XRP Futures: What Does It Mean for Traders?

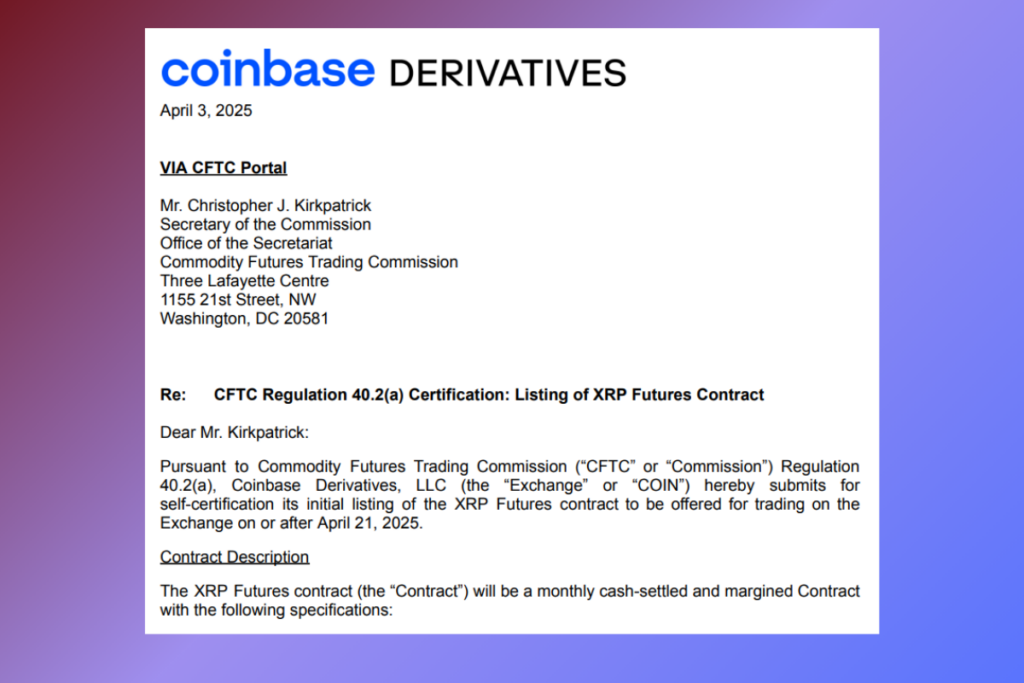

A request to introduce futures contracts for Ripple’s XRP coin has been made by US cryptocurrency exchange Coinbase to the US Commodity Futures Trading Commission (CFTC). The company also stated that April 21 is when it expects the contract to take effect.

We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures — bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets,

Everything You Need to Know About XRP Futures Before Trading Begins!

The certification filing states that the XRP futures contract will trade under the symbol XRL and be a monthly cash-settled and margined product. Other highlights about the content of the application are as follows:

- The contract is settled in US dollars and tracks the price of XRP.

- 10,000 XRP is represented by each contract. At $2 per coin, this is now worth almost $20,000.

- Contracts can be exchanged for the current month and the next two months. If spot XRP prices fluctuate by more than 10% in a single hour, trading will be halted as a precaution.

XRP Futures Traders Brace for More Downside Amid Bearish Sentiment

As market sentiment turned bearish, Cointelegraph reported in late March that funding rates for XRP derivatives had switched negative. In perpetual futures markets, funding rates are regular payments made between traders that maintain the futures price’s alignment with the spot price. Long traders (buyers) pay short traders when funding rates are positive, and short traders (sellers) pay long traders when funding rates are negative. When funding rates are negative, it indicates that bearish derivatives traders have a strong conviction and are prepared to pay more to hold onto their holdings.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment