Chainlink Price – How Chainlink’s SVR Integration Is Impacting AAVE’s Price and Market Sentiment

Chainlink Price – AAVE, the native token of the decentralized finance (DeFi) lending protocol Aave, has surged by 12% in price over the past 24 hours. This impressive rally follows the announcement of a Chainlink proposal aimed at integrating a new Smart Value Recapture (SVR) system. As of now, AAVE is trading at $369.10, with the potential to reclaim its three-year high of $399.85.

AAVE’s Integration with Chainlink’s SVR

On December 23, Chainlink unveiled its new oracle service, Smart Value Recapture (SVR). The SVR system is designed to capture profits from Maximum Extractable Value (MEV) and redistribute them back into DeFi protocols. This service is intended to make the liquidation process in DeFi more equitable, addressing concerns that liquidators and searchers often profit disproportionately, leaving less value for other participants.

Following the announcement, a proposal was submitted to the Aave governance forum suggesting the integration of the SVR into Aave’s lending protocol. The proposal aims to ensure that the MEV generated from Aave’s liquidations is recaptured and fairly distributed to all participants, including searchers, builders, and the protocol itself. The proposal has sparked significant interest, resulting in an uptick in AAVE’s trading activity.

AAVE’s Price Performance and Market Confidence

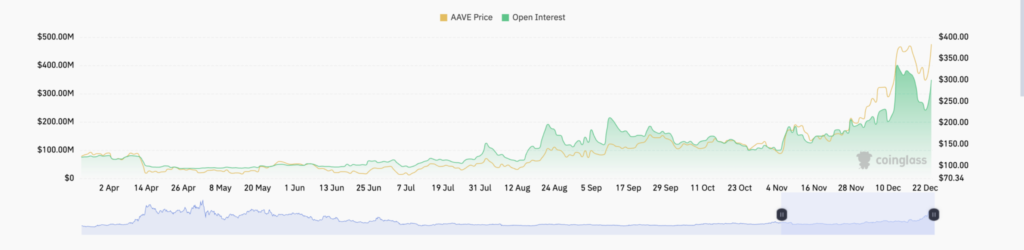

Over the last 24 hours, AAVE has experienced a double-digit price increase. This surge has been accompanied by rising open interest, which currently stands at $376 million, marking a 32% increase. Open interest refers to the total number of outstanding contracts in a derivatives market that have not been settled. The rise in open interest indicates that traders are opening new positions in response to the price rally, suggesting strong market confidence in the AAVE token.

In addition, the Relative Strength Index (RSI) for AAVE is showing an uptrend, currently at 62.88. The RSI is an indicator used to measure an asset’s market conditions, indicating whether it is oversold or overbought. At 62.88, and in an uptrend, it suggests that buying activity is strong, with more AAVE being bought than sold.

AAVE’s Potential to Break Through $400

Currently, AAVE is trading below the $399.85 resistance level, its highest price in the last three years. If the buying momentum continues, AAVE could break through this resistance and establish a new support level above $400. This would mark its first time surpassing the $400 mark since 2021. However, should a wave of sell-offs occur, the bullish outlook could be invalidated, causing AAVE’s price to dip back down to $323.46.

Conclusion: What’s Next for AAVE?

As AAVE continues to gain momentum following the Chainlink SVR integration proposal, the price could continue to rise, with potential to break through key resistance levels. The integration of Chainlink’s SVR could significantly enhance the Aave protocol’s value proposition and contribute to AAVE’s future growth. The rising open interest and RSI confirm strong market confidence, which supports the likelihood of further price appreciation. However, as always, market conditions can change rapidly, and AAVE’s future price will depend on both the continued adoption of the SVR system and broader market trends.

As the AAVE price continues to rise, fueled by the Chainlink SVR integration, investors are keeping a close eye on how this development might shape the protocol’s future. The SVR system aims to bring more fairness to the liquidation process by redistributing MEV profits, which could improve the overall user experience within the Aave ecosystem. This integration not only has the potential to enhance liquidity but also strengthens AAVE’s position in the competitive DeFi market. While the bullish sentiment is palpable, it is important for traders to remain cautious, as any shifts in market dynamics, regulatory changes, or unforeseen events could impact AAVE’s upward trajectory.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment