Can Shiba Inu Survive the Bear Market? Is SHIB Heading Toward $0.000010?

As the cryptocurrency market struggles with volatility, investors are keeping a careful eye on how altcoin performance is changing. Bearish sentiment is putting more and more pressure on various altcoins, including Shiba Inu (SHIB), as Bitcoin and Ethereum show indications of consolidation.

As wider market uncertainty looms, SHIB is finding it difficult to sustain its rising pace despite its vibrant community and distinctive market position. In this article, the current market conditions will be analyzed, and whether Shiba Inu can be pushed below the critical $0.000010 level by the bears. It will also analyze whether the token has enough strength to weather the storm and continue its uptrend.

Shiba Inu Faces Bearish Pressure: Will $0.00001078 Be the Next Major Support?

The entire coin market is down to $55.04 billion as Bitcoin falls below the $89,000 threshold. Over the last few hours, Shiba Inu has dropped by almost 6.67%, with a segment-wide decline of 12.89%. The meme coin continues its downward trend under the impact of the 20-day EMA, which serves as a dynamic resistance.

Shiba Inu is presently trading at $0.00001381, following an intraday decline. The closing price of Shiba Inu fell overnight to its lowest level since September 18, 2024. The 100-day and 200-day EMA lines have delivered a negative crossover due to the heightened bearish influence. Additionally, there has been a negative crossover between the MACD and signal lines.

The price of Shiba Inu is getting closer to a declining trendline that could serve as support as it continues to breach important support levels. Additionally, a possible slide into the $0.00001078 support level is suggested by Fibonacci forecasts.

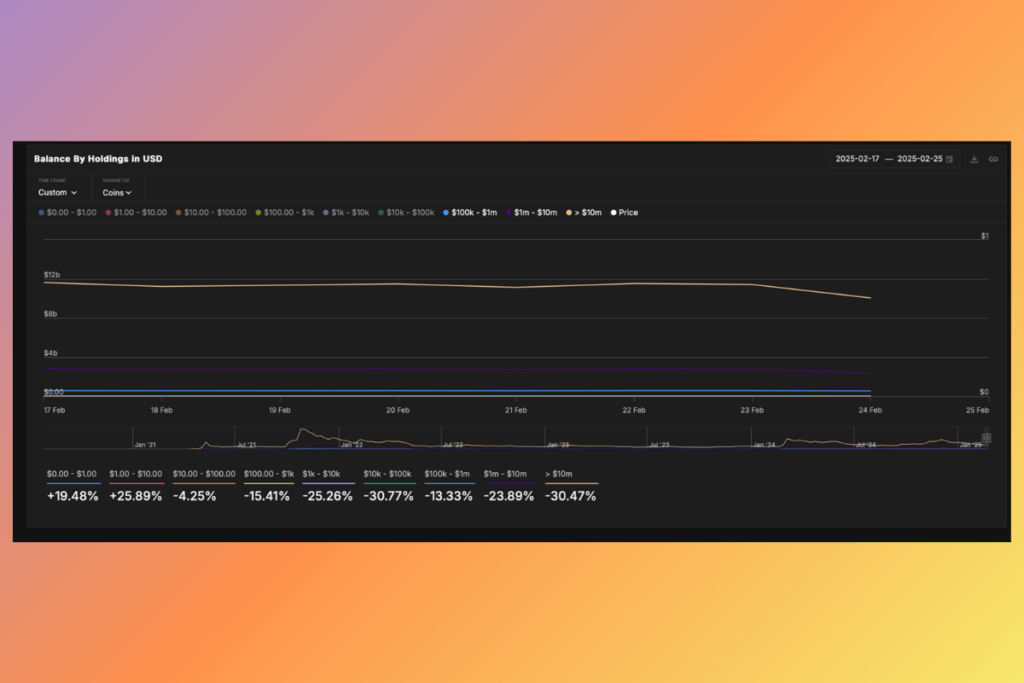

Shiba Inu Faces Increased Sell Pressure: Whale Holdings Loses $2 Billion

Whale holdings of Shiba Inu had a sharp decline during the most recent market meltdown. Over the previous week, the overall value of Shiba Inu whale holdings in USD has decreased dramatically, according to IntoTheBlock. Wallets holding more than $100,000 in Shiba Inu were valued at $15 billion on February 17. Their valuations, however, have plummeted to $12.98 billion due to the current decline. It is anticipated that the meme coin’s decline will continue as whales oversupply the market.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment