BTC Price Decline Risk: 5 Things Shaping BTC’s Future This Week

As the cryptocurrency fails to hold onto important support levels, traders and investors are becoming increasingly concerned about the negative swing in Bitcoin’s price behavior. Following weeks of increased volatility, Bitcoin is now at risk of a more severe fall. Some analysts have projected a possible decline to around $20,000. The fire is being fanned by broader market uncertainty brought on by macroeconomic headwinds and declining investor morale. As Bitcoin battles these obstacles, it’s important for all traders to know the market fundamentals this week. Here are five things you should know regarding the future of Bitcoin this week.

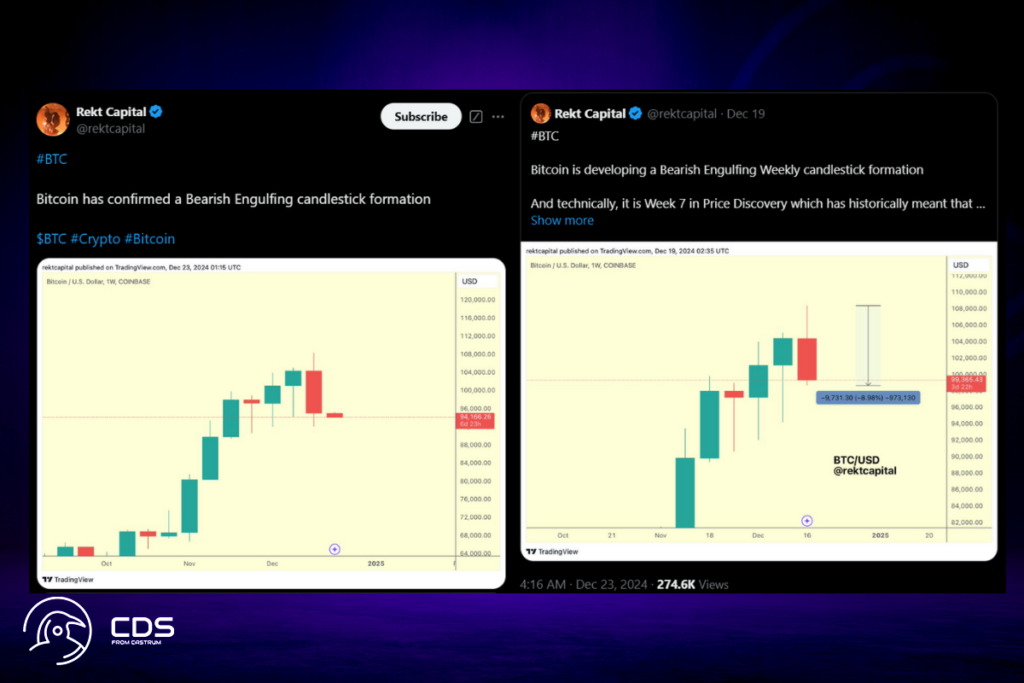

Bitcoin’s Bearish Engulfing Formation Signals Extended Correction

As the holiday season approaches, Bitcoin is finding it difficult to maintain support around the mid-$90,000 range following a weak weekly close. With BTC/USD still down $13,000 from last week’s all-time highs, data from Cointelegraph Markets Pro and TradingView presents an uncertain picture for BTC price activity.

Bitcoin has confirmed a Bearish Engulfing candlestick formation, popular trader and analyst Rekt Capital

Rekt Capital cautioned that a five-week rise was coming to an end as BTC/USD has lost weekly support. Moreover, the analyst cautioned that there are growing indications that Bitcoin is about to enter a multi-week correction.

Any relief rally, if at all needed, into these old supports could turn them into new resistance to confirm additional downside continuation.

Rekt Capital

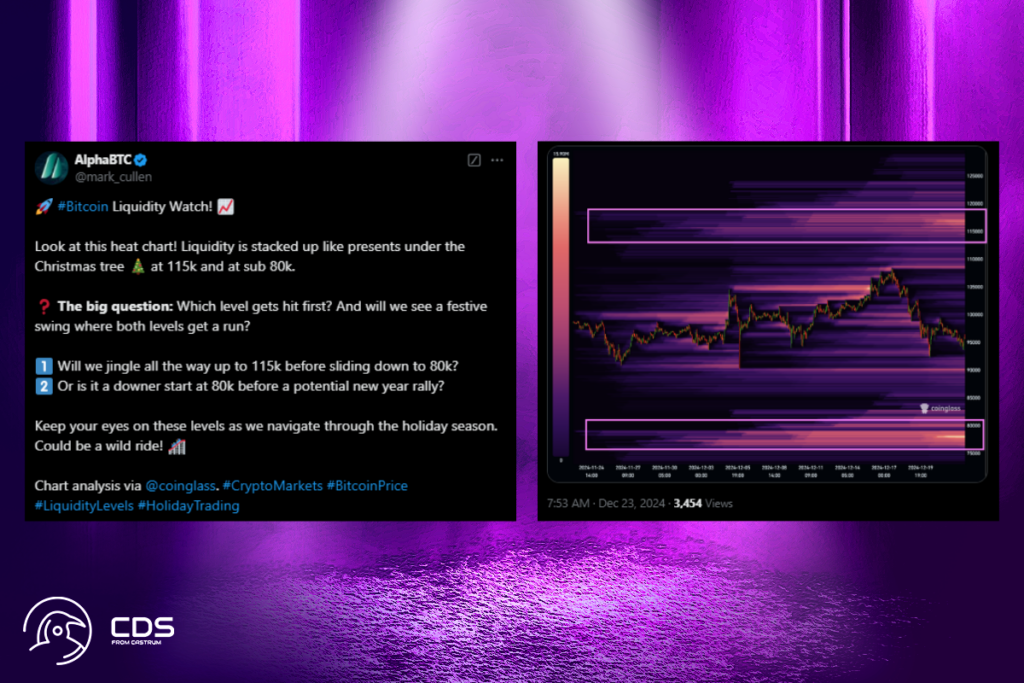

Holiday Liquidity Crunch: Bitcoin Faces $115K or $80K Scenarios

Due to prolonged periods of out-of-hours trading, holiday seasons present additional difficulties for participants in the cryptocurrency market. Moves up or down may be made worse by the lack of the liquidity profile that is typically available during the working day. According to well-known trader and analyst Mark Cullen, who takes a comprehensive view of the liquidity situation on exchanges, there are currently two crucial levels to keep an eye on through 2025. Bulls will suffer from one.

Liquidity is stacked up like presents under the Christmas tree at 115k and at sub 80k. The big question: Which level gets hit first? And will we see a festive swing where both levels get a run?

Cullen

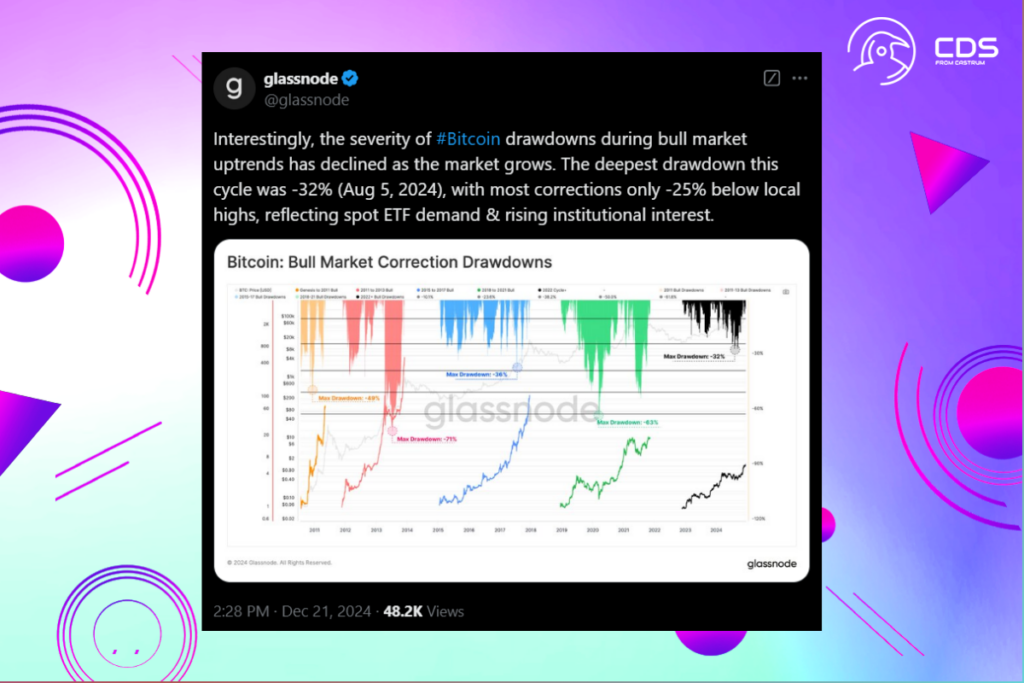

Two regions are depicted in the accompanying chart where should spot prices hit them, large liquidations are anticipated to take place. In contrast, a decline to $80,000 would represent a typical bull market correction in relation to earlier Bitcoin price cycles. Bitcoin’s rise to prior all-time highs has been marked by falls of 20% or more, as Cointelegraph reported. Onchain analytics company Glassnode found that the current cycle has been generally less volatile than previous ones.

The deepest drawdown this cycle was -32% (Aug 5, 2024), with most corrections only -25% below local highs, reflecting spot ETF demand & rising institutional interest,

Glassnode

Macroeconomic Uncertainty Weighs on Bitcoin Amid Fed’s Hawkish Stance

Because macroeconomic data prints are expected to be quiet this week, traders are less vulnerable to sudden volatility in risk assets due to inflation surprises. Nevertheless, the US will still announce its first jobless claims on December 26. This year, the cryptocurrency markets have shown a particular sensitivity to this event.

In general, the macroclimate is also unknown. Invoking a hawkish outlook for 2025, the Federal Reserve cut interest rates by a projected 0.25% last week. As a result, markets saw a decreased likelihood of further rate cuts, which could hurt liquidity and lead to a risk-asset drop that included Bitcoin and other cryptocurrencies. The Kobeissi Letter, a trading resource, commented on the issue and said that Bitcoin in particular was facing further liquidity challenges.

In the past, Bitcoin prices have followed global money supply with ~10 week lag. As global money supply hit a new record of $108.5 trillion in October, Bitcoin prices reached an all-time high of $108,000. Over the last 2 months, however, money supply has dropped by $4.1 trillion, to $104.4 trillion, the lowest since August.

The Kobeissi Letter

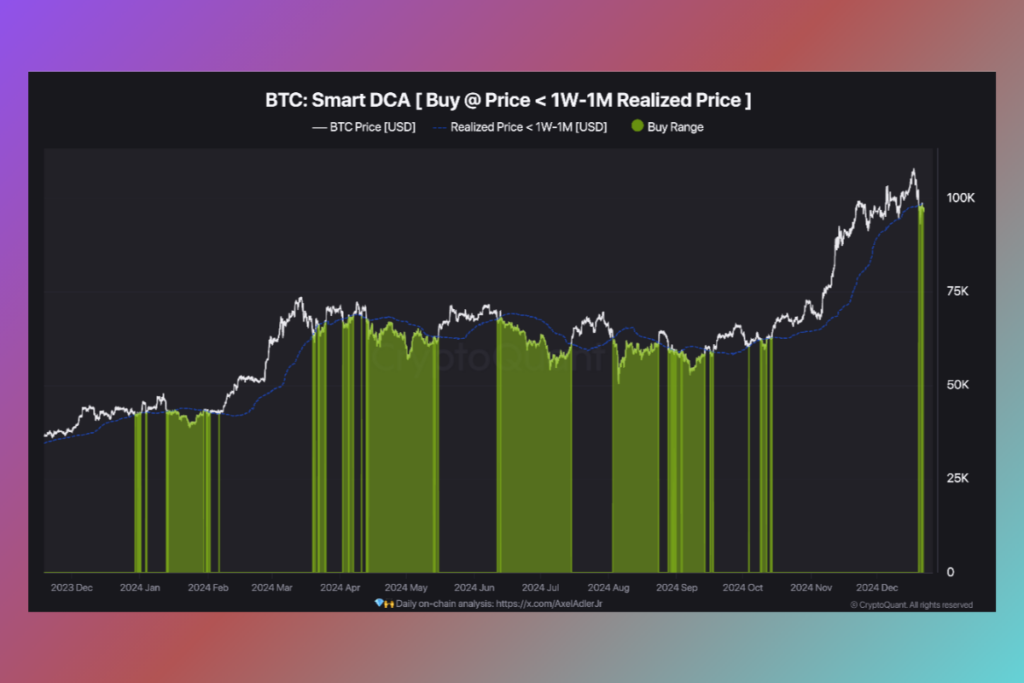

Bitcoin Reaches Favorable Zone for DCA Strategy at $95K

Following a two-month hiatus, the price action of Bitcoin has returned to levels that are predicted to be beneficial by a specialized buying indication. When the price of Bitcoin/USD falls below its short-term realized price, the on-chain analytics platform CryptoQuant’s so-called Smart DCA tool alerts users.

A realized price is the total price at which the supply was last moved. A week to a month before the date of observation, Smart DCA uses transactions to identify relatively lower price levels and, hence, potentially profitable buying opportunities. The process of purchasing Bitcoin with a fixed sum of money at regular periods is known as dollar-cost averaging, or DCA. In one of its Quicktake blog entries this weekend, CryptoQuant contributor Darkfost stated that the price of BTC/USD is currently in a favorable zone for implementing a DCA strategy of around $95,000.

Employing a DCA strategy helps mitigate the impact of volatility and reduce associated risks, making it a prudent approach depending on market conditions. This tool, when used alongside an understanding of broader market trends and sentiment, can deliver valuable insights for making informed investment decisions.

Darkfost

Bitcoin Faces FUD Surge as Sentiment Hits Rock Bottom—Is This a Bullish Sign?

Research suggests that this week’s liquidity flood may have helped bulls in the long run, even though the price of bitcoin may have suffered more than its sentiment. On December 22, the research firm Santiment reported in an X post that social media users were experiencing the highest FUD spiral of the year. Santiment determined that for every four favorable market remarks, there were five negative ones by analyzing comments on X, Reddit, Telegram, and 4Chan.

Crypto’s further flush has sent Bitcoin’s crowd sentiment down to its most negative statistical point of the year. Vocal traders are now showing severe FUD, and that’s good news for contrarians who know markets move the opposite direction of retail’s expectations.

Santiment

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment