BTC Price Outlook: BTC Testing Key $98K Resistance Amid Market Volatility

BTC Price– Bitcoin (BTC) showed resilience on December 11, recovering to around $97,600 after a brief setback caused by Microsoft’s decision to reject a proposal for a corporate Bitcoin treasury. Despite facing fresh selling pressure earlier in the week, the top cryptocurrency regained its upward momentum and found new support near the $98,000 mark.

BTC Price Shrugs Off Microsoft’s Rejection

Data from Cointelegraph Markets Pro and TradingView highlighted Bitcoin’s intraday highs ahead of the Wall Street open, signaling a quick recovery from the news that Microsoft had declined to add Bitcoin to its balance sheet. The decision, widely criticized by crypto enthusiasts, added to the selling pressure, but Bitcoin’s price ultimately managed to bounce back, trading up around 1.5% at the time of writing.

Michael Saylor, CEO of MicroStrategy, a vocal Bitcoin proponent, expressed his thoughts on the matter, stating that Microsoft’s decision was short-sighted. He shared his belief in a post on X (formerly Twitter), commenting, “In 5 years, they’ll understand. Everyone buys Bitcoin at the price they deserve.”

Saylor’s statement echoed the sentiment that Bitcoin’s value proposition will become clearer over time. “BTC doesn’t wait. It simply transfers wealth to those who see,” he added.

Market Stabilizes Around $97K

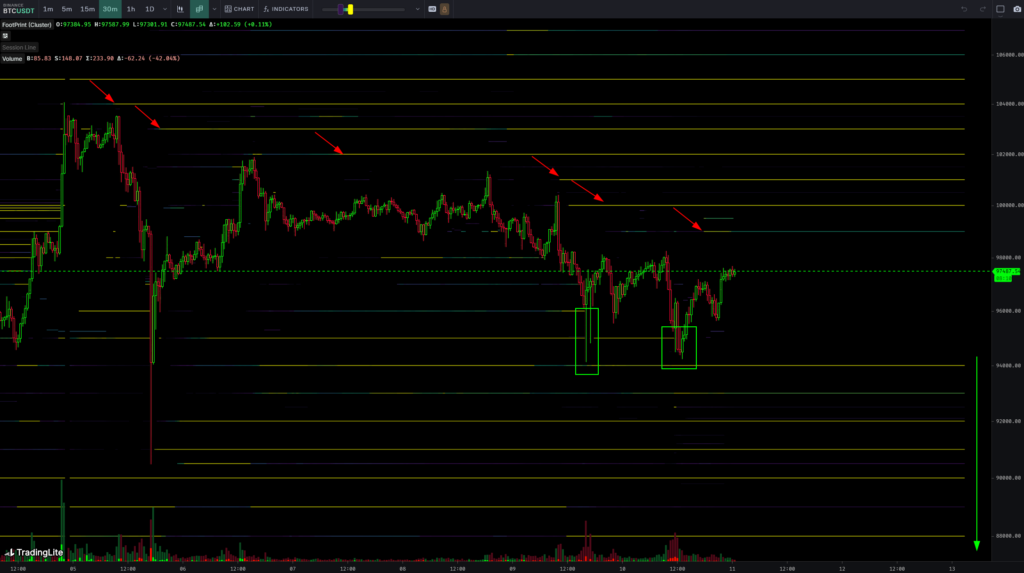

According to trader Skew’s latest market analysis, Bitcoin appears to have found a level of equilibrium around $97,000, with clear bid and ask liquidity lines defining the market. The EQ is around $97K, Skew said, noting that market participants are now looking for direction above and below key price levels.

He explained that buyers need to push the price above $98,000 to target $100,000, while sellers must exert control below $96,000 to potentially break the support and push the price lower. This tug-of-war between buyers and sellers is a critical factor in determining Bitcoin’s next move.

Bitcoin’s Price Action Mirrors December 2023

Noticing similarities between Bitcoin’s current price action and last year’s December patterns, Michaël van de Poppe, a trader and analyst, pointed out that the market might experience another dip before resuming its upward trajectory.

Bitcoin is literally mimicking the price action from last December, van de Poppe posted on X. “I’m not sure whether we’ll get such a deep correction, but I do know that it’s time for Altcoins to shine again.”

This observation suggests that Bitcoin could undergo a short-term dip before continuing its bull run into the new year. Van de Poppe’s forecast aligns with the general expectation of increased volatility in the market, particularly with macroeconomic data expected to influence investor sentiment.

Inflation Data Could Impact Bitcoin’s Trajectory

Later on December 11, the release of the U.S. Consumer Price Index (CPI) data for November was expected to bring further macroeconomic volatility. Skew anticipated that the CPI report would show “sticky” inflationary trends, which could have significant implications for the broader market, including Bitcoin.

At some point soon, there will be some spook around higher prices & costs, Skew predicted, referring to the potential market reaction to inflation concerns. If inflation continues to run hot, it could increase demand for alternative assets like Bitcoin, as investors look for a hedge against rising prices.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment