BlackRock Bitcoin ETF Surpasses 500,000 BTC Milestone

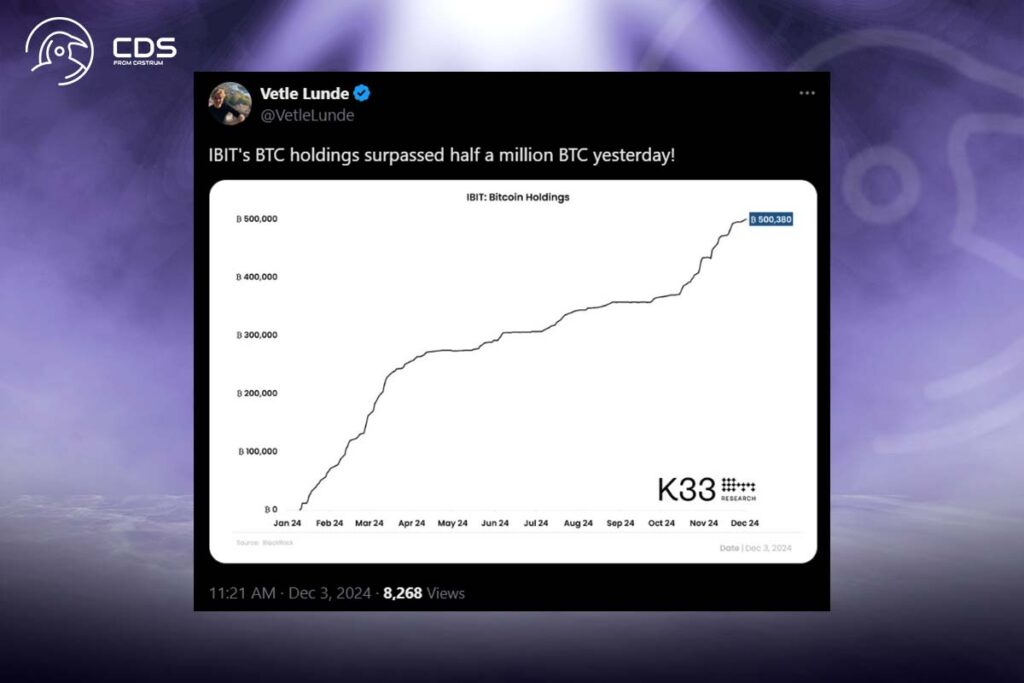

In its most recent fund disclosures, BlackRock stated that as of Nov. 29, its Bitcoin ETF had already amassed 496,854 BTC. K33 statistics indicate that IBIT’s $338.3 million (about 3,526 BTC) in net inflows yesterday were sufficient to push it over the threshold, reaching 500,380 BTC, or 2.38% of the 21 million bitcoins in circulation.

BlackRock surpassing 500,000 BTC is yet another huge milestone after a tremendous launch year. It remains the third strongest ETF instrument in the U.S. measured by YTD flow, ahead of Invesco’s $314 billion behemoth QQQ. Remarkably, the products are well positioned to continue to grow, with IBIT’s institutional ownership sitting at 24% as of the end of Q3 2024.

Eventually, we expect these vehicles to emerge into standard portfolio diversifiers with large funds, allocating 1-3% of their capital to these funds due to BTC’s tendency to improve risk-adjusted returns. While AUM surpassing 1 million BTC is well within reach, we expect more soft notional flows to these products in 2025 due to BTC’s meteoric rise in value, softening the impact on notional flows.

K33 Head of Research Vetle Lunde

Bitcoin ETFs Fuel Historic Growth: BlackRock Leads $31B Inflows in 2024

IBIT is the fastest-growing ETF in the history of ETFs, BlackRock CEO Larry Fink remarked in an interview with Fox Business after IBIT surpassed the 250,000 BTC mark in March. He also expressed his surprise at the amount of bitcoin’s increase. According to The Block’s Bitcoin Price Page, Bitcoin was trading for about $69,000 at the time and has since increased by another 38% to be trading for about $95,321.

After adding a record $6.6 billion in November, the U.S. spot Bitcoin ETFs had net inflows of $353.6 million on Monday, maintaining their upward trend. The Block’s data shows that since the funds’ introduction, they have received a total of $31.2 billion in net inflows.

The consistent and strong inflows to IBIT and its peers throughout the year have been a central source of BTC’s push to new all-time highs and highlight the extent to which ETFs improved access to BTC exposure for new pockets of capital,

Lunde

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment