Bitwise Plans Bitcoin Standard Company ETF Featuring Top BTC Holding Firms

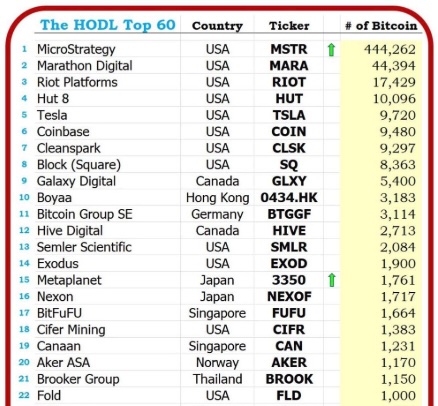

Bitwise, the world’s largest crypto asset manager, is set to launch a groundbreaking Bitcoin Standard Company ETF, a fund that will incorporate companies holding Bitcoin as part of their corporate financial reserves. This innovative ETF aims to track an index of publicly traded companies, including notable names such as MicroStrategy, Marathon Digital, Coinbase, Semler Scientific, and Metaplanet, among others.

Key Criteria for Inclusion

The ETF’s design prioritizes companies embracing the Bitcoin standard through substantial treasury allocations. According to Bitwise’s prospectus, the fund will allocate at least 80% of its assets to securities that make up the index. Companies eligible for inclusion must meet stringent requirements:

- Holdings: A minimum of 1,000 Bitcoins in their corporate treasury.

- Market Cap: A valuation exceeding $100 million.

- Liquidity: An average daily trading volume of at least $1 million.

- Public Float: A minimum public-free float of 10%.

Notable Companies in the Index

Industry leaders expressing interest in the ETF include Marathon Digital and Metaplanet. Marathon Digital CEO Fred Thiel confirmed the company’s eligibility, citing their holdings of over 44,000 BTC. Similarly, Metaplanet CEO Simon Gerovich noted his company’s adherence to the Bitcoin standard. Semler Scientific’s CEO, Eric Semler, highlighted the growing imperative for public companies to integrate Bitcoin into their financial strategies, stating, “In the near future, I predict it will be considered irresponsible for public companies not to own Bitcoin on their balance sheets.”

MicroStrategy’s Role in Bitcoin Bonds ETF

In a related development, Strive Asset Management, spearheaded by Vivek Ramaswamy, has filed for a Bitcoin Bond ETF with the US SEC. This ETF will focus on convertible bonds issued by companies like MicroStrategy, designed to channel proceeds toward Bitcoin acquisitions. Industry analysts, including Bloomberg’s Eric Balchunas, describe it as “essentially a MicroStrategy convertible bond ETF until other firms join the trend.”

MicroStrategy continues to dominate the intersection of corporate finance and cryptocurrency. The company has raised significant capital through equity and bond issuance over the past four years. CEO Michael Saylor recently proposed the “21/21 plan,” a bold strategy to secure $21 billion each from equity and bond financing over the next three years to bolster Bitcoin holdings further.

Optimism for Bitcoin’s Future

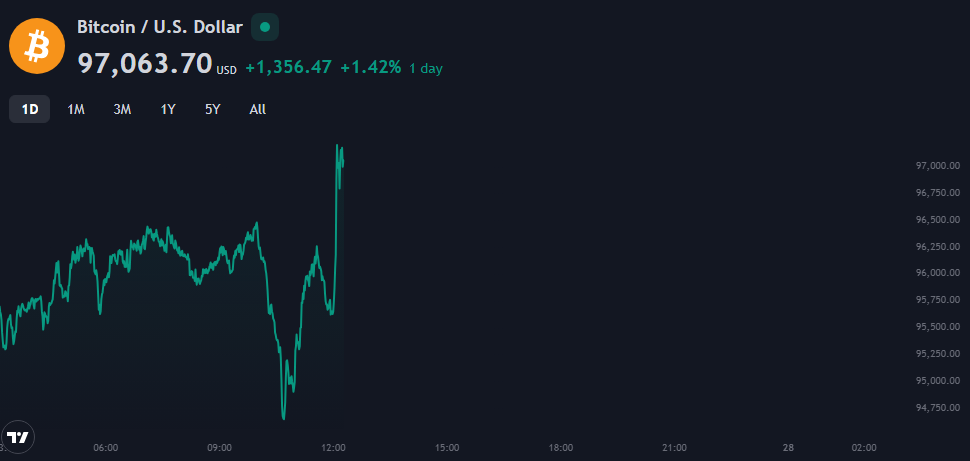

Both Bitwise and Strive Asset Management are optimistic about Bitcoin’s long-term potential. Bitwise predicts fresh all-time highs for Bitcoin and leading altcoins, such as Ethereum and Solana, by 2025, citing increasing market demand.

This dual wave of innovative ETFs underscores a growing institutional shift toward Bitcoin as a financial reserve and investment vehicle, setting the stage for broader adoption in corporate treasuries worldwide.

Frequently Asked Questions (FAQ) About Bitwise Bitcoin Standard Company ETF

What is the Bitwise Bitcoin Standard Company ETF?

The Bitwise Bitcoin Standard Company ETF is an investment fund designed to include publicly traded companies that hold Bitcoin as part of their corporate financial reserves. The ETF tracks an index based on companies adopting the Bitcoin standard.

What are the criteria for companies to be included in the ETF?

To qualify for inclusion in the ETF, companies must meet the following criteria:

Hold at least 1,000 Bitcoins in their corporate treasury.

Have a market capitalization exceeding $100 million.

Maintain a minimum average daily trading volume of $1 million.

Have at least 10% of their shares in public float.

Which companies are expected to be part of this ETF?

Notable companies expected to be included are MicroStrategy, Marathon Digital, Coinbase, Semler Scientific, and Metaplanet. Additional companies that meet the specified criteria may also be included.

What benefits does this ETF offer to investors?

The Bitwise Bitcoin Standard Company ETF provides investors with exposure to leading companies adopting Bitcoin as a corporate reserve asset. It allows indirect investment in Bitcoin’s potential growth while benefiting from the financial performance of these companies.

How does this ETF differ from the Bitcoin Bond ETF?

The Bitcoin Standard Company ETF focuses on companies holding Bitcoin as part of their treasury reserves, while the Bitcoin Bond ETF invests in convertible bonds issued by companies to fund Bitcoin purchases. Both ETFs provide access to Bitcoin-related opportunities but through different investment strategies.

Leave a comment