Bitcoin vs Altcoins: Why Their Correlation May Be Breaking

Bitcoin vs Altcoins– Recently, altcoins have been moving almost in perfect sync with Bitcoin (BTC), as if they are caught in its gravitational pull. This pattern is largely driven by high-frequency trading (HFT) bots and institutional funds that keep the market tightly synchronized. However, there are signs that this may be changing, with some altcoins beginning to break away from Bitcoin’s movements.

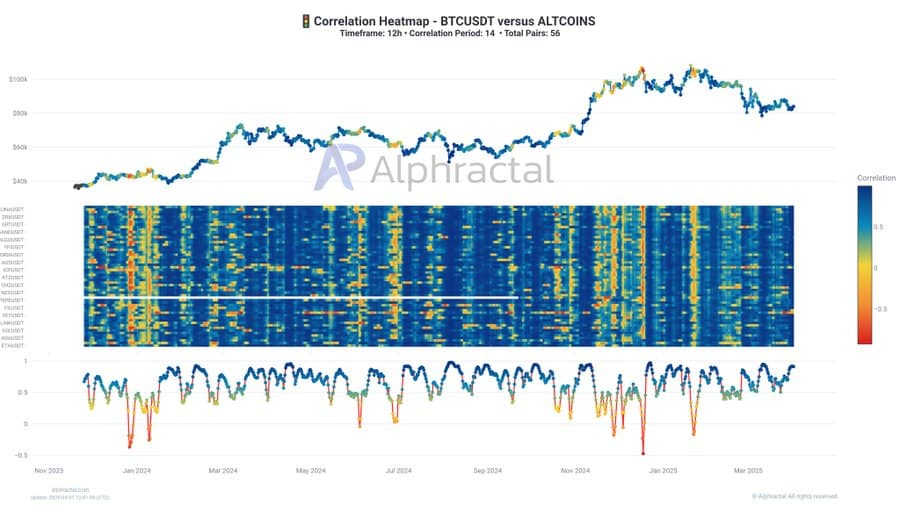

A look at the latest correlation heatmap between Bitcoin and various altcoins reveals that most altcoins are closely following Bitcoin’s price movements. The chart shows strong correlations, with many altcoins in shades of blue, nearing a 1.0 correlation. This is not a coincidence but the result of HFT bots and institutional strategies designed to tie altcoin prices to Bitcoin’s fluctuations, aiming to manage liquidity and risk.

However, there are some altcoins, particularly smaller ones, that are starting to break away from Bitcoin’s influence. While major tokens like Ethereum (ETH) and Binance Coin (BNB) continue to closely track Bitcoin, some lesser-known altcoins are showing signs of independence.

Could This Be a Bullish Signal for Altcoins?

The decoupling of certain altcoins from Bitcoin’s price could signal a bullish phase, especially if the correlations continue to weaken. This shift may indicate that investors are starting to spot undervalued altcoins, focusing more on individual fundamentals than on Bitcoin’s every move. If this trend gains momentum, we could see altcoins carving out their own paths, driven by their unique growth prospects rather than the broader market movements.

Bitcoin’s dominance, currently at 62.70%, still heavily influences the market. Economic uncertainties and regulatory developments have caused many investors to favor Bitcoin for its relative stability. Additionally, institutional investors and HFT bots continue to keep altcoins closely aligned with Bitcoin’s performance, managing risks and liquidity in the process.

As the market evolves, any significant decoupling between Bitcoin and altcoins could signal a shift in investor sentiment and open the door to new opportunities in the altcoin space. However, for now, Bitcoin’s dominance remains strong.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment