Bitcoin Supply Hits 8-Year Low: Will This Trigger a Historic Breakout?

The supply of Bitcoin has decreased to its lowest level in eight years, raising expectations that the price could rise to a new all-time high. Blockchain analytics company Santiment said on X on March 27 that the supply of Bitcoin on exchanges had fallen to 7.53%, the lowest level since 2018. This suggests that more Bitcoin investors are transferring their holdings into self-custody, reducing the quantity that may be sold immediately. A diminishing exchange supply is often seen as a bullish indicator since it indicates more confidence among holders and less short-term sell pressure.

Bitcoin’s New Reality: Are 30% Drops the New Bear Market Signal?

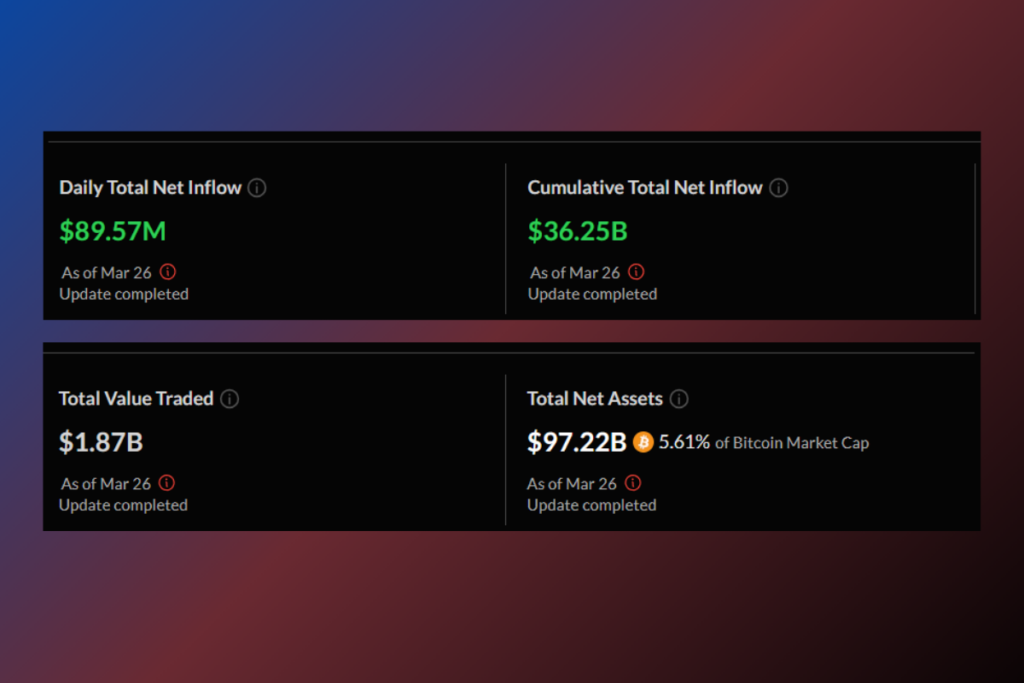

Institutional demand has been one of the primary drivers of Bitcoin’s price fluctuation. Since March 14, there have been consistent inflows into Bitcoin ETFs, causing the price of BTC to increase by over 10%. On the other hand, Bitcoin fell 17%, and ETF inflows were negative to almost stationary between February 10 and March 13. With big investors having a bigger market impact than individual speculators, this pattern demonstrates the close relationship between institutional buying and Bitcoin price patterns.

According to a Mar. 25 article on OKX’s research page, the market behavior of Bitcoin is also shifting in tandem with the increasing institutional demand. A 50% decline was considered a bear market in the past. However, severe crashes caused by panic selling have decreased in frequency as Bitcoin has developed. These days, a 30% drop is frequently sufficient to set off bear market fears.

According to the article’s views, on-chain data indicates that Bitcoin may be experiencing a temporary mini bear market rather than the longer drops of previous cycles. The short-term holder market value to realized value ratio, which contrasts the current price of Bitcoin with the average price at which short-term holders bought their coins, was one early indicator of this shift. Even prior to the significant price declines on February 25, the metric showed a bearish sentiment.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment