Bitcoin Slips for 4th Day Straight: Is a Relief Rally Off the Table?

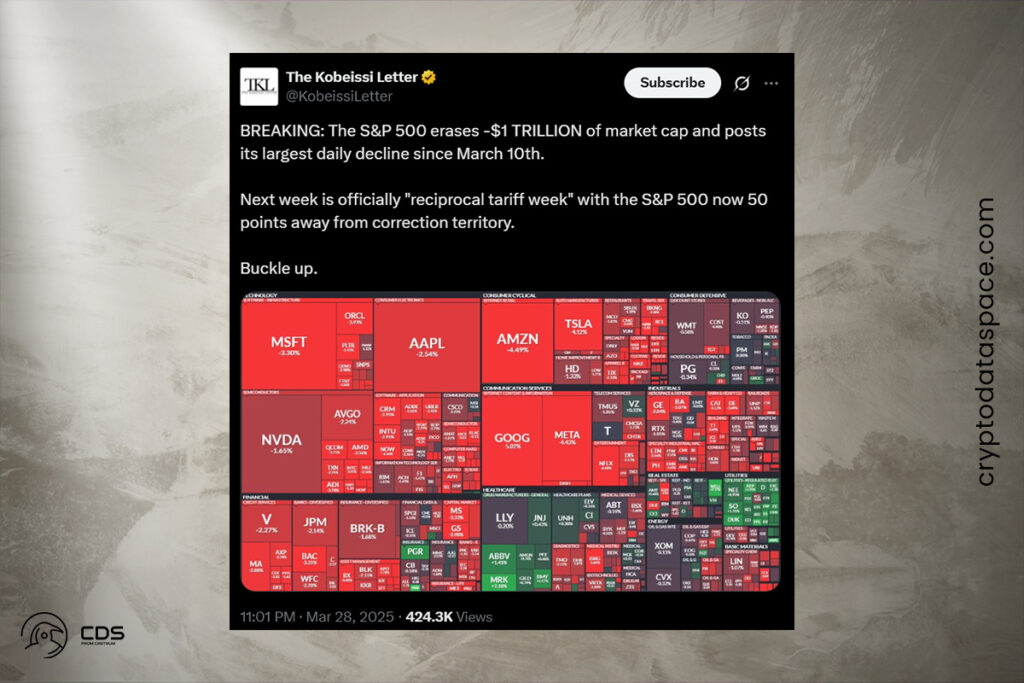

On March 28, the price of Bitcoin continued to drop, hitting an intraday low of $83,387 for the fourth day in a row. The decrease of Bitcoin was similar to that of the S&P 500 index, which fell 112 points, and the Wall Street sell-off, in which the DOW closed 700 points down. The mounting concerns of investors about inflation are a major factor in the sell-off in stocks. After February’s core Personal Consumption Expenditures (PCE) index increased to 2.8%, a higher-than-expected monthly increase of 0.4%, these worries became more intense.

The market’s reaction to US President Trump’s recently imposed reciprocal tariffs, which imposed a 25% penalty on any cars not built in the US, compounded the sell-off. As traders anxiously await the announcement of new duties, including pharmaceutical tariffs, on April 2, which Trump has dubbed “Liberation Day,” the likelihood of a Bitcoin relief rally or oversold bounce is probably waning.

Whales Accumulate Bitcoin Despite Weak Spot Demand

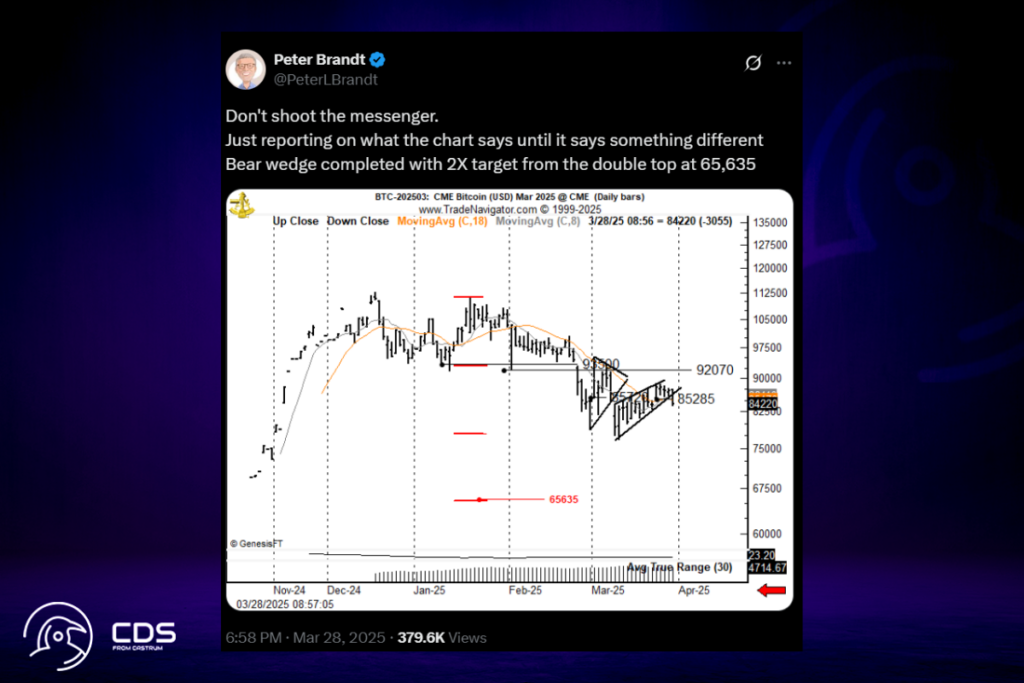

Peter Brandt, a seasoned trader, believes that Bitcoin may reach $65,635. Brandt verified the completion of a bear wedge pattern in an X social media post.

Don’t shoot the messenger. Just reporting on what the chart says until it says something different. Bear wedge completed with 2X target from the double top at $65,635.

Brandt

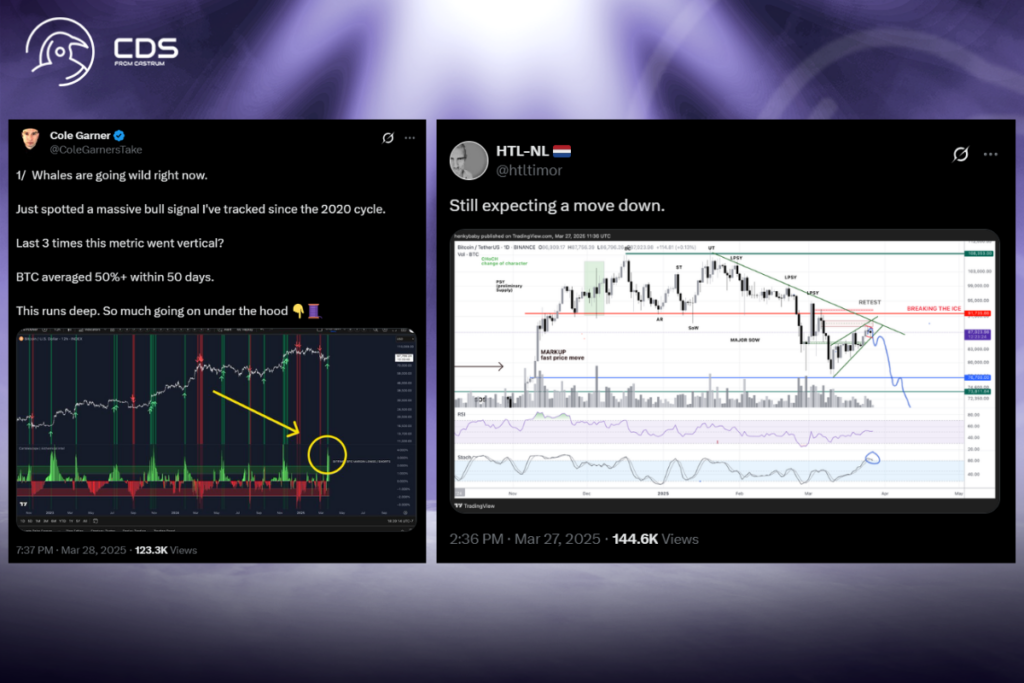

Coin trader HTL-NL concurred with Brandt, stating that Bitcoin’s inability to break through a long-term declining trendline and the bear wedge’s confirmation are evidence that the cryptocurrency would eventually return to its range lows. Given that several of the daily period criteria for Bitcoin are not oversold, it is challenging to predict a quick turnaround in the price action from a strictly technical perspective.

According to cryptocurrency trader Cole Garner, whales are going crazy at the moment, even though there isn’t much spot market demand in the current price range. Garner claims that a strong signal indicating historical returns of 50%+ returns in less than 50 days was just sent out by the Bitfinex spot BTC margin longs versus margin shorts measure.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment