Bitcoin Sell-Off Not Over? Expert Predicts $69K Target as ETF Outflows Surge!

Geoffrey Kendrick, global head of digital assets research at Standard Chartered, believes that Bitcoin is headed for more declines. He told The Block that he anticipates Bitcoin dropping further lower over the weekend or by Monday to the $69,000 to $76,500 range.

Now that is a dip I would like to buy,

Kendrick

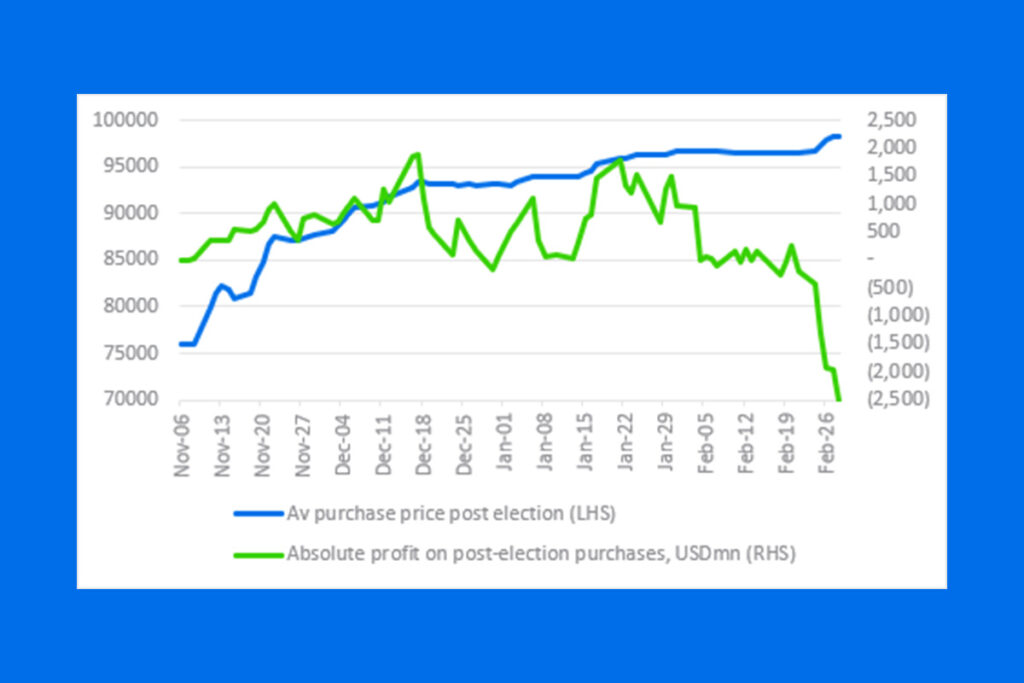

Bitcoin is currently trading at about $83,786 after briefly falling below $79,000 overnight. According to Kendrick, the decline below $80,000 begs the issue of whether the sell-off is coming to an end. After the more than $1 billion redemption from ETFs on Tuesday, he noted that he anticipates another significant outflow today. According to Kendrick, net ETF purchases have decreased by $2.5 billion at the $80,000 level since the U.S. election last November.

Bitcoin Bears Take Control: Hedge Fund Shorts Jump 43% Since U.S. Election!

The significance of ETF outflows has been disputed. Some contend that redemptions, which represent the closing of carry transactions, are market-neutral. These transactions, which frequently include hedges, entail borrowing Bitcoin at lower prices, holding it in ETFs, and then selling it later at a premium. However, according to Kendrick, the ETF outflows cannot be explained by these carry trades since they are too small.

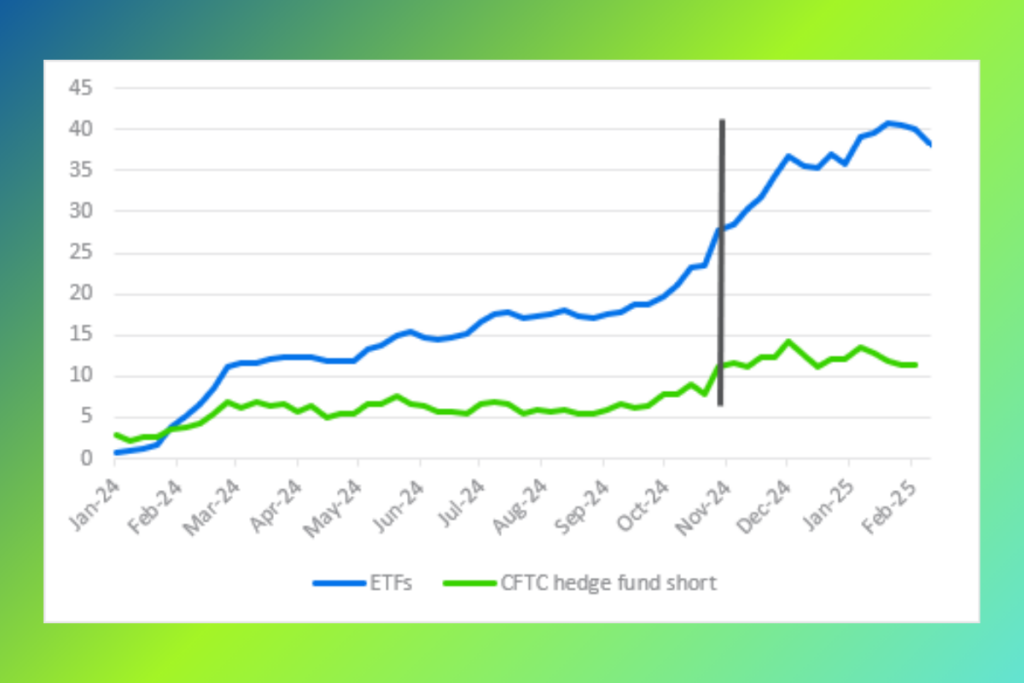

Rather, he cites the growing short holdings of hedge funds as evidence that investors are actively betting against Bitcoin. ETFs’ posture grew from $23.5 billion to $40.2 billion before dropping to $37 billion, according to CFTC statistics, while hedge funds’ short positions have grown from $7.9 billion to $11.3 billion since the U.S. election (as of February 18).

Of course, CFTC data may just represent other short futures (on exchanges), so viewing these in percentage increase is probably fairer. ETF positions up 71% since Nov. 5, CFTC hedge fund shorts up 43%. To the degree these stem from underlying retail flow, I think they remain at risk of panic selling. Again, look for large outflows today,

Kendrick

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment