Bitcoin Reserves – Is Bitcoin’s Price Set to Surge? Low Supply and Institutional Demand Could Trigger a Rally

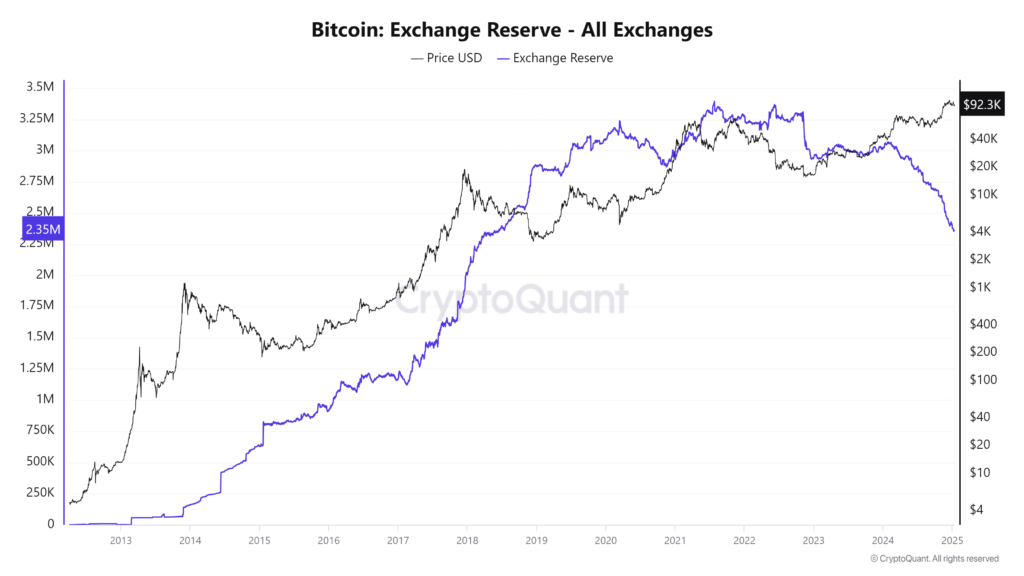

Bitcoin reserves across cryptocurrency exchanges have reached a near seven-year low, dropping to 2.35 million BTC as of January 13, 2025. This decline in Bitcoin supply, unseen since June 2018 when Bitcoin was priced around $7,000, has raised speculation about a potential supply shock that could drive prices higher. The continued institutional buying, particularly from crypto hedge funds, is likely contributing to this dramatic reduction in available Bitcoin on exchanges.

Institutional Buyers Fuel Bitcoin Supply Drop

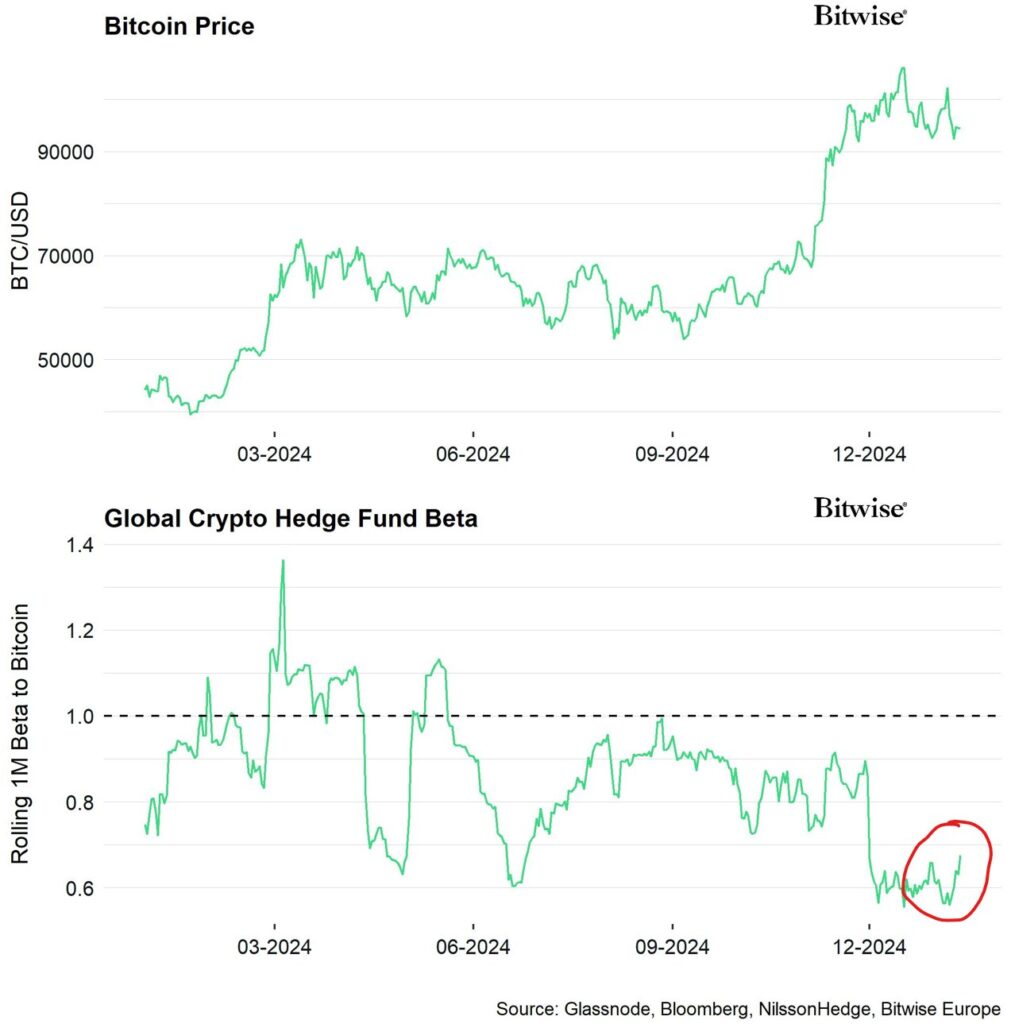

According to André Dragosch, head of research at Bitwise, the diminishing Bitcoin supply on exchanges can be attributed to sustained buying activity from institutional participants. He pointed out that global hedge funds’ exposure to Bitcoin has increased, with a notable rise in the correlation between their performance and Bitcoin’s price. This increasing market exposure may be a sign that institutional investors are strategically positioning themselves as Bitcoin’s supply tightens.

Bitcoin’s Supply Shock: A Precursor to Potential Price Rally

The current reduction in Bitcoin reserves on exchanges has raised expectations of an impending price rally, as the classic economic principle of supply shock suggests that limited supply combined with strong demand will result in price appreciation. This could be the case for Bitcoin, especially as recent data highlights significant institutional purchasing. For instance, US spot Bitcoin exchange-traded funds (ETFs) purchased nearly three times the number of coins produced by miners in December 2024, aligning with Bitcoin’s surge to an all-time high of $108,300 on December 17.

Challenges in Bitcoin’s Path to $100,000

While the outlook for Bitcoin in 2025 remains optimistic, there are significant resistance levels that need to be surpassed. Analysts are closely watching Bitcoin’s movement around the $100,000 psychological mark, a key level that could determine whether the cryptocurrency can push further into uncharted territory.

However, there are signs of a lack of trading activity in the market, particularly in the broader cryptocurrency sector, which may limit Bitcoin’s immediate upside potential. Ryan Lee, Chief Analyst at Bitget Research, explained that although market sentiment appears to be stabilizing with reduced selling pressure, Bitcoin still faces challenges in overcoming the resistance due to low trading volume. This lack of momentum suggests that any breakthrough may take time.

Crypto Market Faces Trading Paralysis

Beyond Bitcoin, the broader crypto market is also struggling with low trading volumes. Santiment, a market intelligence platform, reported on January 13, 2025, that trading volume across top cryptocurrencies, including Layer 1 and Layer 2 solutions, meme coins, and AI tokens, has dropped to the lowest levels seen since early November 2024. The subdued market activity is seen by some as a sign of fear, uncertainty, and doubt (FUD), which could increase the likelihood of a rebound if investor sentiment improves.

Looking Ahead: Optimism for Bitcoin’s Future

Despite the current challenges, analysts remain optimistic about Bitcoin’s long-term prospects. With a potential global $20 trillion increase in the money supply by the end of 2025, Bitcoin could experience significant inflows of investment, possibly pushing its price beyond $150,000. For now, all eyes are on the supply-demand dynamics, with the expectation that Bitcoin’s market may be gearing up for a major breakout.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment