US Bitcoin Reserve: A Solution to Reducing $119 Trillion National Debt by 2049

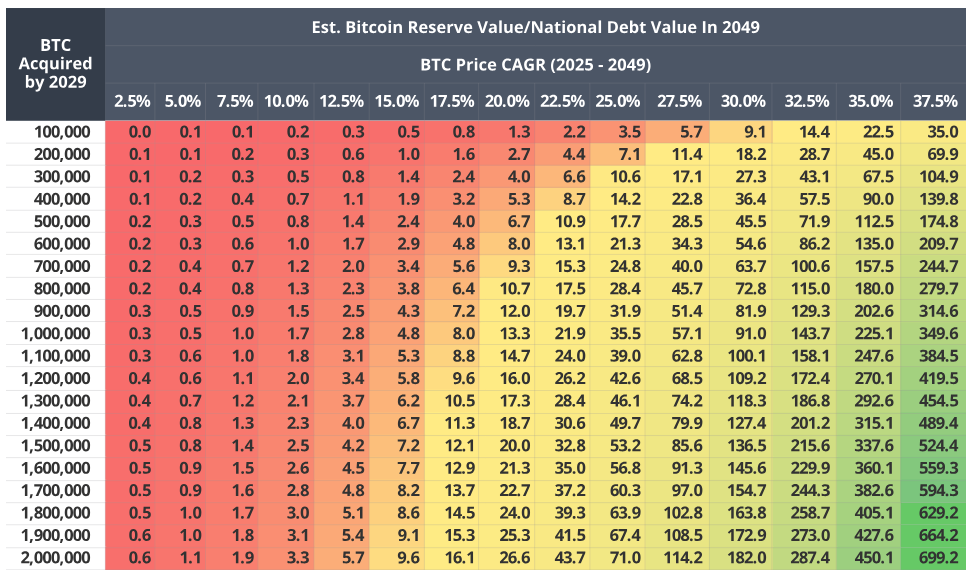

Bitcoin Reserve – The United States could reduce its national debt by 35% over the next 24 years if it establishes a 1 million Bitcoin reserve, according to an analysis by asset management firm VanEck. This projection is based on a bill introduced by Senator Cynthia Lummis, which seeks to incorporate Bitcoin as a reserve asset. VanEck’s analysis assumes a compound annual growth rate (CAGR) of 25% for Bitcoin, projecting a price of $42.3 million by 2049. Meanwhile, the national debt is expected to grow at a 5% CAGR, climbing from $37 trillion in 2025 to $119.3 trillion by the same year.

Bitcoin Reserve to Offset $42 Trillion in Liabilities

VanEck’s digital asset research team, led by Matthew Sigel and Nathan Frankovitz, believes the Bitcoin reserve could represent roughly 35% of the national debt by 2049, potentially offsetting around $42 trillion in liabilities. This estimate assumes that Bitcoin will start at a $200,000 price in 2025 and grow by 25% annually until it reaches $42.3 million. Currently, Bitcoin is trading at $95,360, meaning its price would need to more than double to align with VanEck’s starting point.

Bitcoin Could Represent 18% of Global Financial Assets by 2049

If Bitcoin reaches the projected value of $42.3 million, it would make up approximately 18% of the world’s financial assets, a significant increase from its current 0.22% share in today’s $900 trillion market. This dramatic rise underscores the potential of Bitcoin not just as a digital asset but as a foundational pillar in global financial systems.

Potential for Bitcoin Reserve Under Lummis Bill

Under the Lummis bill, the U.S. could utilize the 198,100 Bitcoin it currently holds from asset seizures. The remaining 801,900 Bitcoin could be obtained through various means, including Emergency Support Functions or selling a portion of the U.S.’s $455 billion gold reserves. Notably, these moves would not require money printing or taxpayer funding, making it a potentially viable strategy without inflationary risks.

Impact of BRICS Nations on Bitcoin Adoption

The adoption of Bitcoin as a global settlement currency could gain momentum, especially among BRICS nations (Brazil, Russia, India, China, and South Africa). Sigel noted that these countries might use Bitcoin to avoid the effects of increasing USD sanctions, positioning Bitcoin as a viable alternative for international trade.

As Bitcoin continues to gain traction as a store of value, its growing role in the global financial landscape could further bolster VanEck’s projections. The potential for a Bitcoin reserve could mark a turning point in U.S. economic policy, aligning with broader trends in cryptocurrency adoption at state, institutional, and corporate levels.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment