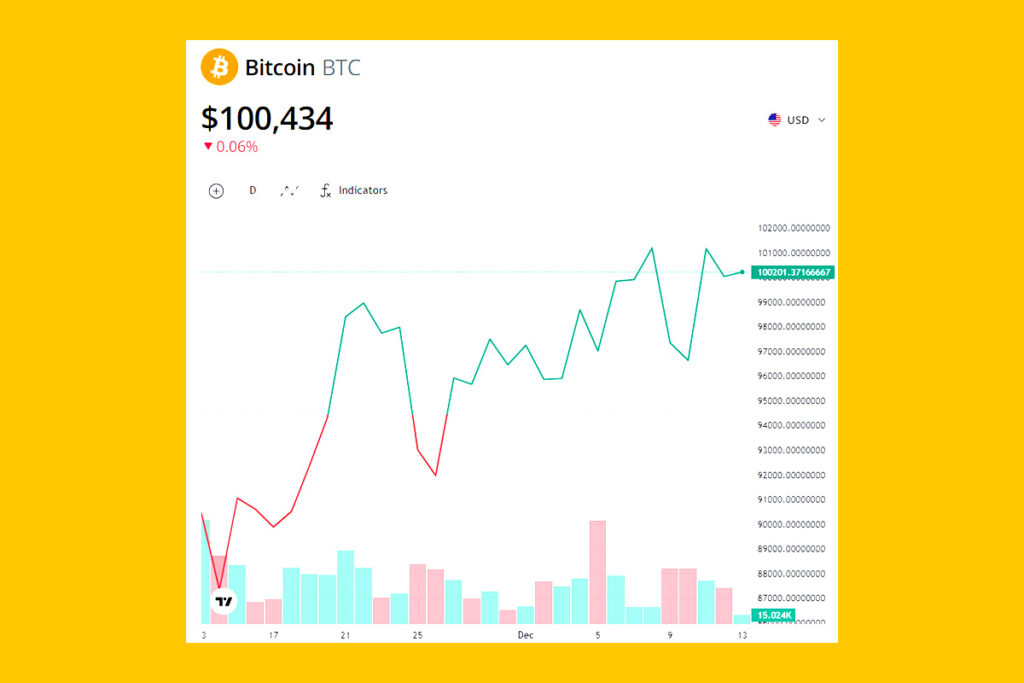

Bitcoin Price Target: Global Rate Cuts and December Optimism

A research report from crypto services firm Matrixport suggests that the price of bitcoin may reach $160,000 in 2025, supported by easing global monetary policy and better macroeconomic conditions. In an attempt to boost investment and economic activity in the area, the European Central Bank (ECB) decreased its benchmark interest rates by 25 basis points to 3% on December 12, which is a bullish indication for the price of Bitcoin. According to Jag Kooner, head of derivatives at Bitfinex, investors may be drawn to riskier assets like Bitcoin as a result of the worldwide trend toward reducing interest rates.

This dual easing could spur capital flows into risk-on markets, including crypto. Combined with the traditional optimism seen in December markets, this may fuel a potential “Santa rally,” driving Bitcoin and other cryptocurrencies higher as investors allocate more capital into the space.

Kooner

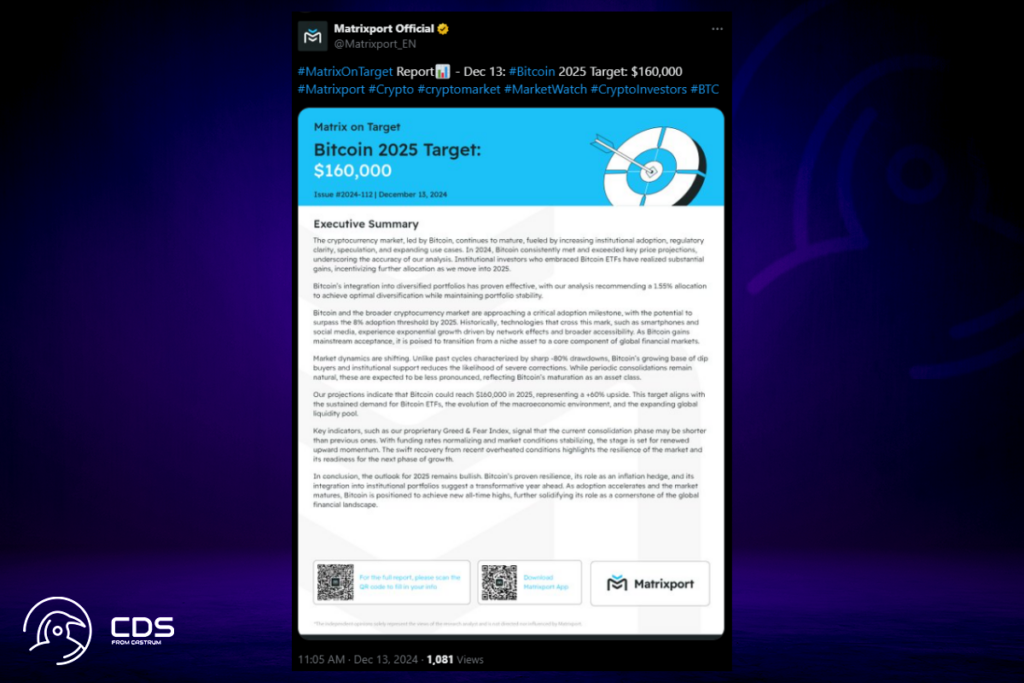

Matrixport Predicts Bitcoin to Hit $160K by 2025 Amid Easing Global Liquidity

The price of Bitcoin may be significantly boosted by improving macroeconomic conditions, especially because this is the first interest rate drop by the People’s Bank of China (PBOC) in 14 years. However, the direction of Bitcoin’s price until the end of 2024 may be greatly impacted by the Federal Reserve’s upcoming monetary decision on December 18. According to a report published by Matrixport in an X post on December 13, this trend might support the price of Bitcoin to above $160,000 in 2025.

Our projections indicate that Bitcoin could reach $160,000 in 2025, representing a +60% upside. This target aligns with the sustained demand for Bitcoin ETFs, the evolution of the macroeconomic environment and the expanding global liquidity pool.

Matrixport

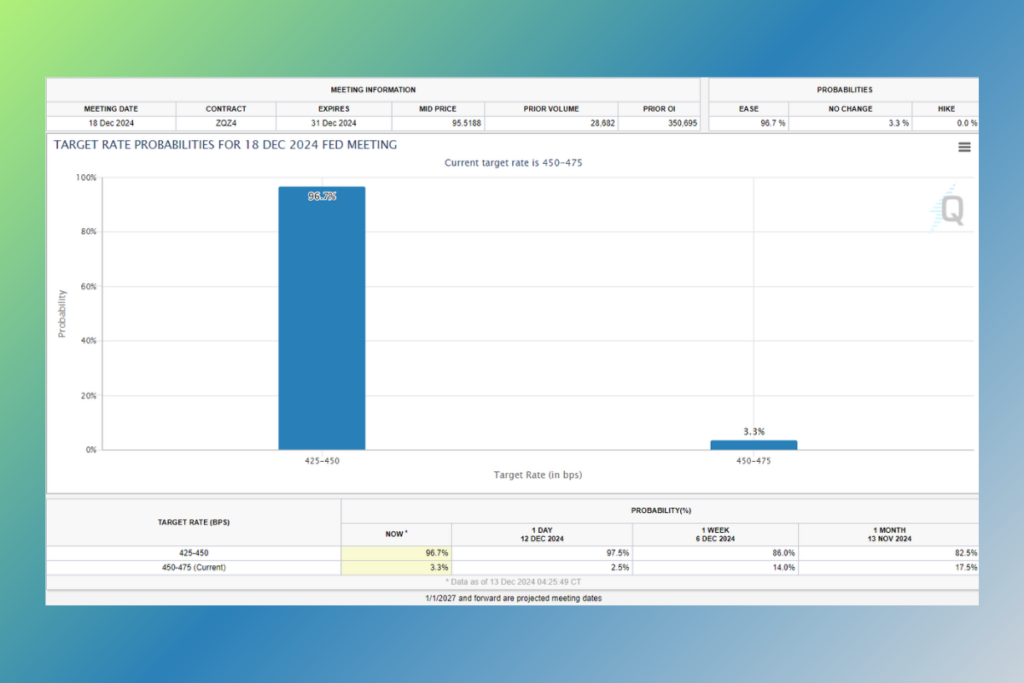

Federal Reserve’s December Policy: A Game Changer for Bitcoin Prices?

On December 18, investors in Bitcoin eagerly await the US Federal Reserve‘s final monetary policy announcement for 2024. According to the most recent statistics from the CME FedWatch tool, the probability of a 25 basis-point rate drop is now 96.7%, up from 82.5% one month ago. According to Kooner, a Fed interest rate drop would enable Bitcoin to close out the year at all-time highs.

Lower interest rates typically reduce borrowing costs, encouraging greater risk-taking among investors. Cryptocurrencies, as high-risk assets, often see inflows during such periods of increased liquidity. Additionally, the psychological boost from a dovish monetary stance can improve investor sentiment,

Kooner

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment