Bitcoin Price- Why 2020 Bitcoin Buyers Are Still Holding Their BTC

Bitcoin Price– Bitcoin (BTC) investors who purchased their holdings in 2020 or later are still holding onto their assets despite significant price movements, according to recent research from on-chain analytics firm Glassnode.

New data released on April 1 by Glassnode shows that many Bitcoin investors who entered the market between 2020 and 2022 have not sold, even as Bitcoin’s price surged. Despite the price reaching highs of $110,000 in 2024, these investors remain committed to holding their assets.

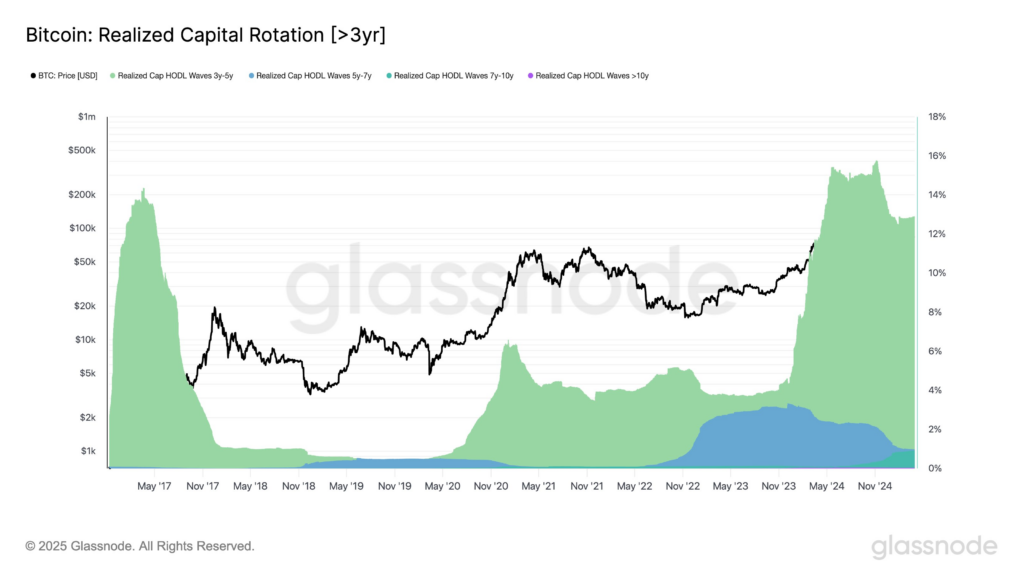

Glassnode’s analysis reveals that while the share of Bitcoin (BTC) wealth held by investors who bought BTC between three and five years ago has declined slightly since November 2024, it remains high compared to historical levels. “This suggests that the majority of investors who entered between 2020 and 2022 are still holding,” the report said.

HODLing Trends: 2020-2022 Buyers vs. 2015-2017 Buyers

Glassnode further breaks down the data by comparing 2020-2022 buyers with those who entered earlier. It notes that over two-thirds of Bitcoin buyers from 2015-2017 exited their positions during the December 2024 price peak, suggesting that their lower cost basis prompted them to sell.

While long-term holders remain strong, the behavior of short-term holders (STHs) has been more volatile. These more speculative investors, who tend to react to short-term price swings, have exhibited increased sensitivity during recent Bitcoin price fluctuations, including a 30% drop after hitting new record highs.

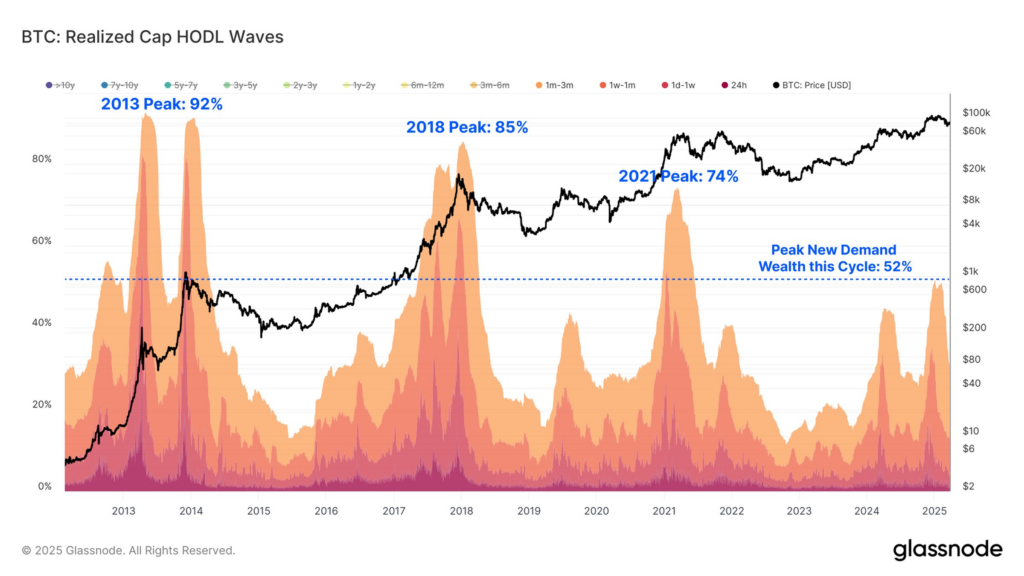

Glassnode emphasizes that the current level of participation by short-term holders does not indicate a speculative frenzy, which is commonly observed during the peaks of previous Bitcoin (BTC) cycles. As of March 31, short-term holders held about 40% of Bitcoin’s network wealth, a far cry from the 70-90% seen during past market tops.

Overall, Glassnode concludes that Bitcoin’s current market cycle shows signs of a more measured bull market, with less concentrated speculative activity compared to previous peaks. This trend suggests that while Bitcoin (BTC) is still attracting new investors, the current market is more distributed and stable than in previous cycles.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment