Bitcoin Price Rallies as Stablecoin Inflows Surge

Bitcoin Price – Bitcoin (BTC) is experiencing a slight pullback, trading at $89,077, down 0.5% over the past 24 hours, and 4.5% below its all-time high of $93,434. Despite this decline, several indicators suggest that the ongoing bull market may not be over. Optimism remains strong, fueled by expectations of a crypto-friendly Trump administration, rising stablecoin inflows to exchanges, and robust demand for Bitcoin via exchange-traded funds (ETFs).

Stablecoin Inflows Signal Continued Bitcoin Rally

Bitcoin’s recent price increase of 17% over the past week has been accompanied by a surge in stablecoin inflows to cryptocurrency exchanges. According to data from market intelligence firm CryptoQuant, these stablecoins act as market fuel, helping to drive Bitcoin’s price higher.

CryptoQuant analyst “theKriptolik” highlighted that large-scale stablecoin inflows typically precede price rallies. In a report published on November 15, the analyst confirmed that the current influx of stablecoins entering spot exchanges is higher than usual. Historically, similar stablecoin surges have preceded significant price increases, including during the 2021 bull run, when inflows between September 2020 and February 2021 triggered a rally that broke previous all-time highs.

Most recently, a similar surge in stablecoin inflows occurred between January and March of 2024, leading to a price rally that saw Bitcoin breaking its all-time high again, just ahead of the Bitcoin halving event. If this trend continues, it would further signal a demand-driven push for Bitcoin, suggesting that the current bull market is still intact.

Growing U.S. Demand and Bitcoin ETFs Driving Market Strength

The anticipation of a second term for former President Donald Trump is fueling optimism in the crypto market. QCP Capital, a leading crypto investment firm, has expressed confidence that Bitcoin’s strength signals a “systematic shift” in the market, spurred by expectations of Trump’s return to office.

Meanwhile, the Coinbase premium index, which tracks the price difference between Bitcoin on Coinbase and Binance, has surged to its highest level since April 2024, signaling increasing demand from U.S. investors. When Bitcoin surpassed $90,000 and reached its all-time high of $93,434, U.S. demand spiked, pushing the Coinbase premium index to 0.13, levels last seen in April.

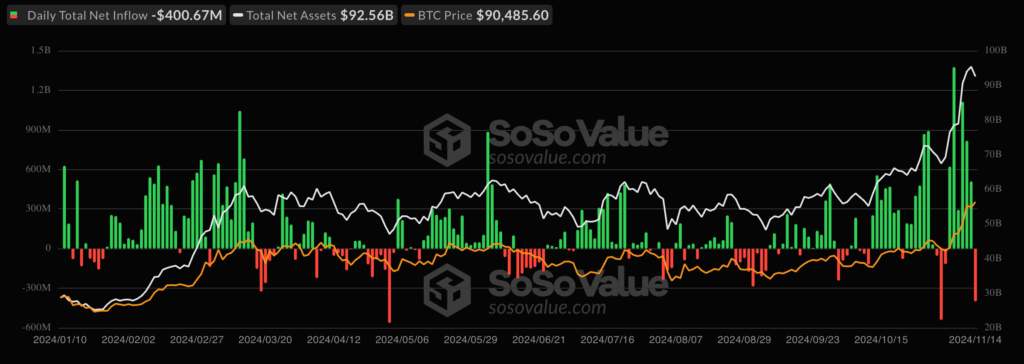

Significant inflows into U.S.-based Bitcoin ETFs further highlight the growing demand. Between November 6 and November 13, more than $4.7 billion was invested in spot Bitcoin ETFs, following the U.S. election. BlackRock’s spot Bitcoin ETF (IBIT) led the charge, accounting for 65.7% of these inflows, totaling over $3.09 billion during the same period. Despite some withdrawals on November 14, BlackRock’s IBIT ETF still saw a net inflow of $126.5 million, indicating strong ongoing demand for Bitcoin investment products.

Bitcoin Still Underpriced, Bullish Momentum Likely to Continue

Despite Bitcoin’s recent rally, key valuation metrics suggest that BTC remains reasonably priced and may have room for further growth. The Market Value to Realized Value (MVRV) ratio, a metric used to assess whether an asset is overvalued or undervalued, currently sits at 2.5. This is well below the overvaluation threshold of 3.5, which would indicate that Bitcoin is approaching a price peak.

As long as the MVRV ratio remains below this critical level, Bitcoin is not considered overvalued, suggesting that the current rally could continue. With strong demand, especially from U.S. investors and Bitcoin ETFs, Bitcoin appears poised for further growth, potentially reaching new price levels before hitting overbought territory.

Leave a comment