Bitcoin Price- Bitcoin Faces Volatility Ahead of US Inauguration: Key Levels to Watch

Bitcoin Price– Bitcoin (BTC) is entering a period of heightened uncertainty as it braces for potential volatility surrounding the US Presidential inauguration on January 20. The cryptocurrency, which has been trading within a defined range, is expected to experience some significant price movements, particularly as traders react to key macroeconomic events in the coming week.

Bitcoin’s Rangebound Movement and Key Levels to Watch

Bitcoin has been trading between $90,000 and $96,000, with the current price around $91,417. As noted by popular trader CrypNuevo, key liquidation levels are forming at $91k (sweep of range lows) and $96k-$97k (nearby liquidations). These levels could act as trigger points for a breakout or breakdown in the short term. If Bitcoin’s price moves lower, a retest of sub-$90,000 levels is possible, something that many analysts have been predicting for January.

Inflation Data and Fed’s Role in Bitcoin’s Short-Term Outlook

This week is crucial for both the cryptocurrency and broader financial markets, as inflation data including the Consumer Price Index (CPI) and Producer Price Index (PPI) for December will be released. These prints are expected to influence the Federal Reserve’s stance on interest rates, with the possibility of the central bank tightening further rather than cutting rates. According to The Kobeissi Letter, the current trend of “higher for longer” interest rates could dampen investor sentiment and capital inflows into risk assets, including Bitcoin.

The US Dollar Strength: A Headwind for Bitcoin

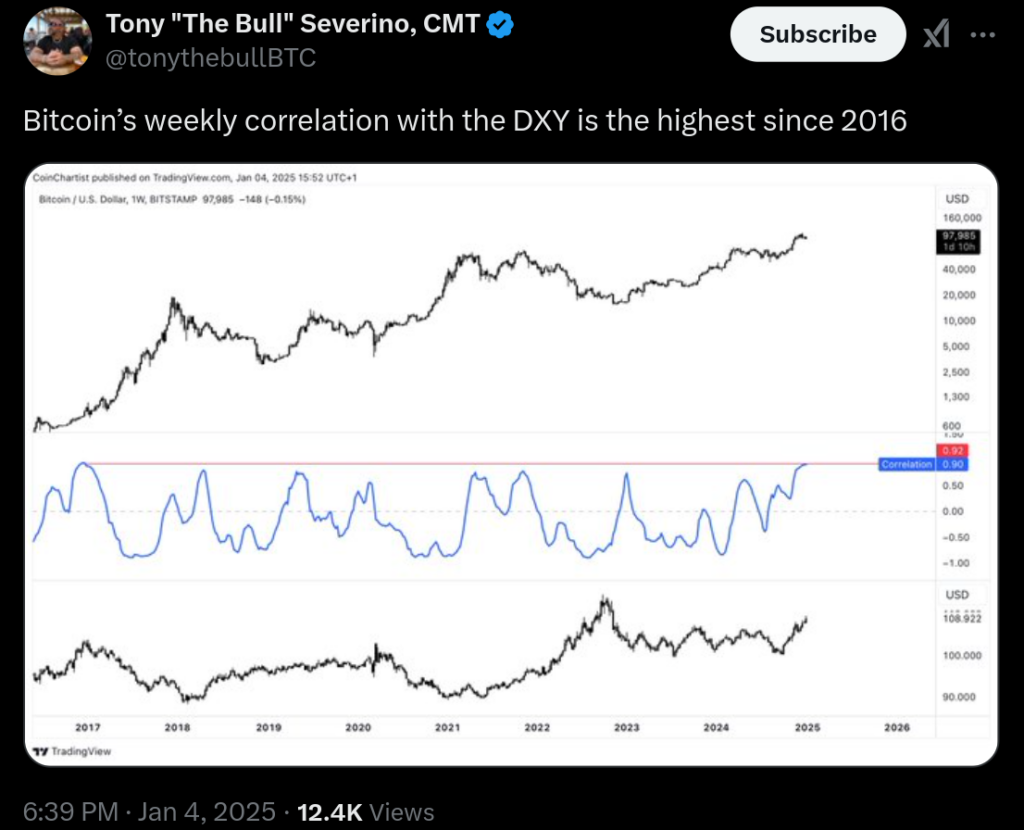

The US dollar is showing strength ahead of the presidential inauguration, which could pose a significant headwind for Bitcoin. The US Dollar Index (DXY) is at its highest level since late 2022, creating downward pressure on crypto assets. As noted by trader Tony Severino, the correlation between the US dollar and Bitcoin is at its highest level since 2016, making Bitcoin vulnerable to further weakness if the dollar continues to rise.

As Bitcoin navigates these potential challenges, traders will need to stay alert for signs of increased volatility and adjust their strategies accordingly.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment