Bitcoin Price: When Should You Start Selling? Insights from CryptoQuant

Bitcoin Price – As Bitcoin (BTC) continues its upward trajectory, onchain analytics platform CryptoQuant has issued an advisory urging Bitcoin holders to start selling aggressively once realized profits hit a key threshold. In a Quicktake blog post published on December 13, CryptoQuant emphasized the importance of monitoring the portion of Bitcoin supply in loss as a signal to begin selling.

Bitcoin Bull Markets and Profitability Signals

According to CryptoQuant, Bitcoin bull markets tend to end when a specific profitability threshold is crossed within the BTC supply. Historically, the last bull market, which reversed in late 2021, showed clear signs of supply profitability months before the market turned. In particular, Onchain Edge, a contributor to CryptoQuant, explained that when BTC supply loss percentage falls below 4%, it is time to dollar-cost average (DCA) out of Bitcoin and prepare for the next bear market lows.

Dollar-Cost Averaging (DCA) Strategy

The DCA strategy is a method where investors buy a fixed amount of Bitcoin at regular intervals, regardless of its price, to avoid the volatility that often accompanies the cryptocurrency market. CryptoQuant argues that, when the BTC supply loss drops below 4%, it signifies that many holders are in profit, signaling the peak of a bull run. As a result, selling Bitcoin via DCA can protect profits and reduce exposure to the inevitable pullbacks that follow a market peak.

An illustrative chart shared by CryptoQuant indicated that the current percentage of supply at a loss was still hovering around 8% as of December 12, suggesting that there is still room for further market upside before the selling signal is triggered.

Potential for Continued Bullish Trend

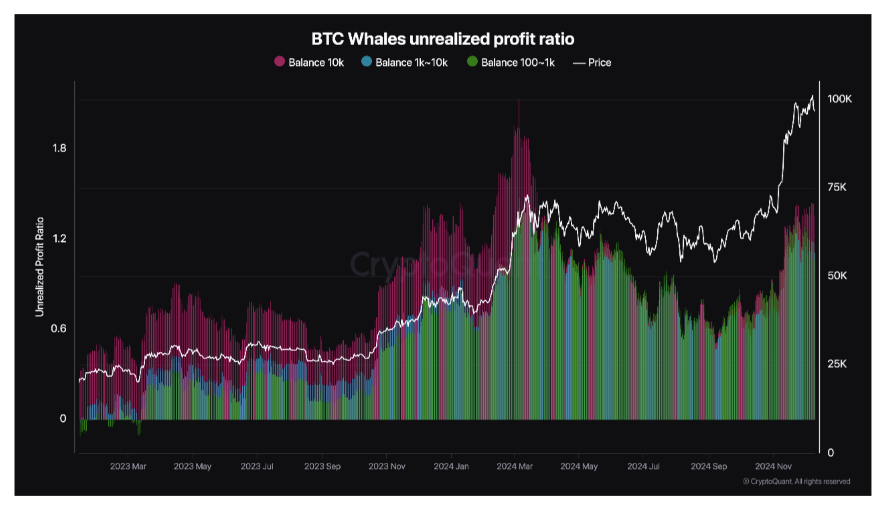

While some market participants are closely watching Bitcoin profitability levels, particularly the key price targets of $110,000 and $120,000, there are still signs that the bullish trend could persist in the medium term. In an analysis by fellow CryptoQuant contributor Darkfost, the unrealized profit ratio among Bitcoin whales was still relatively modest. As of now, this ratio sits at 1.2, compared to 2 back in March 2024, just before the market began to dip as whales started to take profits.

At the current price near $100,000, this indicates that Bitcoin still has potential for further bullish momentum before whales begin to take profits again. This suggests that for now, there may still be room for the trend to continue.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment