Bitcoin Price – Upcoming Fed Rate Cut Expected to Impact Bitcoin and Crypto Markets

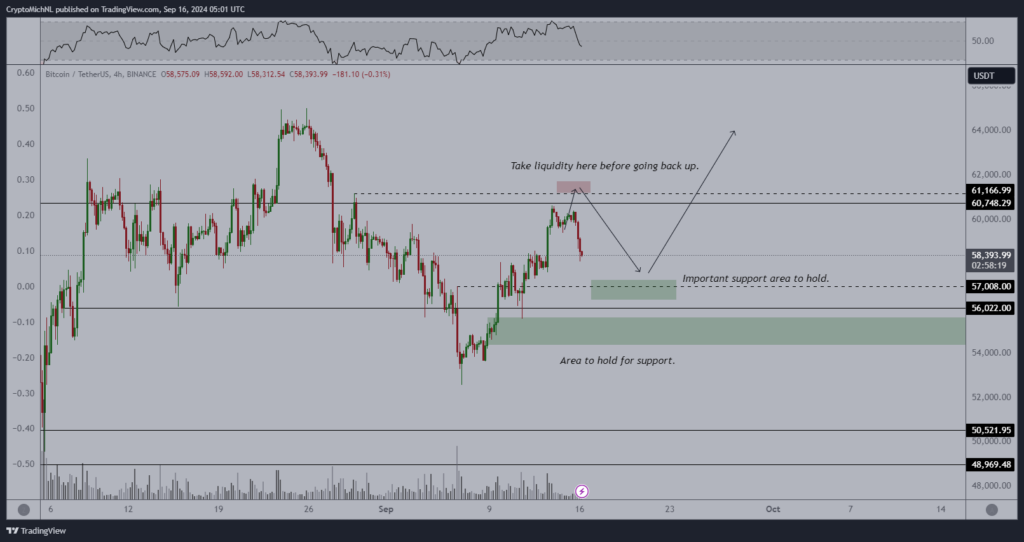

Bitcoin Price – Bitcoin (BTC) has recently encountered significant pressure, with its price falling to $58,530 as it starts a crucial macroeconomic week. The battle for the $60,000 support level continues, with bulls needing to reclaim this price point to improve the setup on both daily and weekly charts. As of now, BTC is circling the $59,000 mark, showing a 7.8% gain over the past week despite slipping into the weekly close.

Federal Reserve’s Rate Cut Decision Looms

This week, all eyes are on the United States Federal Reserve, which is poised to make its first interest rate cut in over four years. Traders are split on the scale of the cut, with the CME FedWatch Tool indicating a 50% chance of a 50 basis point cut and a 50% chance of a 25 basis point cut. The outcome of this meeting is expected to influence market conditions significantly, potentially creating a more favorable environment for equities, including Bitcoin.

Bitcoin Analysts Weigh In

Analysts are cautiously observing how BTC/USD may react to the Fed’s decision. Popular trader and analyst Mark Cullen expects a volatile week for Bitcoin, with a critical interest rate decision scheduled for September 18. Cullen and other analysts, such as Caleb Franzen from Cubic Analytics, suggest that Bitcoin could be retesting its 1-year average before potentially moving higher.

Resistance Levels and Technical Indicators

Bitcoin price indicators are facing crucial resistance tests as the cryptocurrency attempts to break the $60,000 mark. Key technical indicators, such as the Ichimoku cloud and the relative strength index (RSI), show that Bitcoin is at significant resistance levels. The daily chart appears moderately better, with the price above 50 on the RSI but still below the Ichimoku cloud. The weekly chart, however, indicates that BTC/USD remains stuck below important trend lines.

Fed Rate Cut Could Influence Bitcoin

The Federal Reserve’s anticipated rate cut is a major factor shaping this week’s market volatility. Historically, rate cuts have been associated with recessions, as they signal underlying economic concerns. However, some analysts, like Rickus, are preparing for a bullish reaction in Bitcoin prices, arguing that initial rate cuts can be bullish if market conditions support it.

Bitcoin Price Patterns and Historical Context

Bitcoin’s price behavior since late 2022 has shown a pattern of “uncanny” similarity to past cycles. Analyst Checkmate notes that BTC/USD is following a historical recovery pattern, which could suggest a positive trend in the coming months. This pattern aligns with the cryptocurrency’s previous recovery phases.

Ether Struggles as Bitcoin Dominance Soars

Amid Bitcoin’s performance, Ether (ETH) is experiencing challenges. The ETH/BTC pair has hit new multi-year lows, with Ether’s value compared to Bitcoin falling to 0.0387 on September 16. Bitcoin’s dominance in the crypto market has reached 58.07%, marking the highest level in three-and-a-half years. Crypto trader Michaël van de Poppe predicts that Bitcoin dominance may peak soon but expects both Bitcoin and altcoins to show signs of recovery.

Conclusion

As Bitcoin faces critical resistance levels and anticipates the Federal Reserve’s rate cut, the market’s reaction will be crucial for its short-term performance. With Bitcoin dominance at a high and Ether struggling, the coming weeks will be pivotal for both Bitcoin and the broader cryptocurrency market.

FAQ

Why has Bitcoin (BTC) recently struggled to maintain the $60,000 support level?

Bitcoin has faced difficulty maintaining the $60,000 support due to a combination of technical resistance and market uncertainty. The upcoming Federal Reserve meeting, where a potential interest rate cut is expected, has added volatility. Additionally, BTC price indicators suggest a need to reclaim this level to improve the setup on both daily and weekly charts.

What impact might the Federal Reserve’s decision on interest rates have on Bitcoin?

The Federal Reserve’s decision on interest rates could significantly impact Bitcoin. Lower interest rates generally create a more favorable environment for risk assets like Bitcoin by increasing market liquidity. However, there is concern that sharp rate cuts could signal deeper economic issues, which might also affect Bitcoin’s price and market sentiment.

Leave a comment