Bitcoin Price- Panic Selling Hits Bitcoin: 80,000 BTC Moved to Exchanges at a Loss

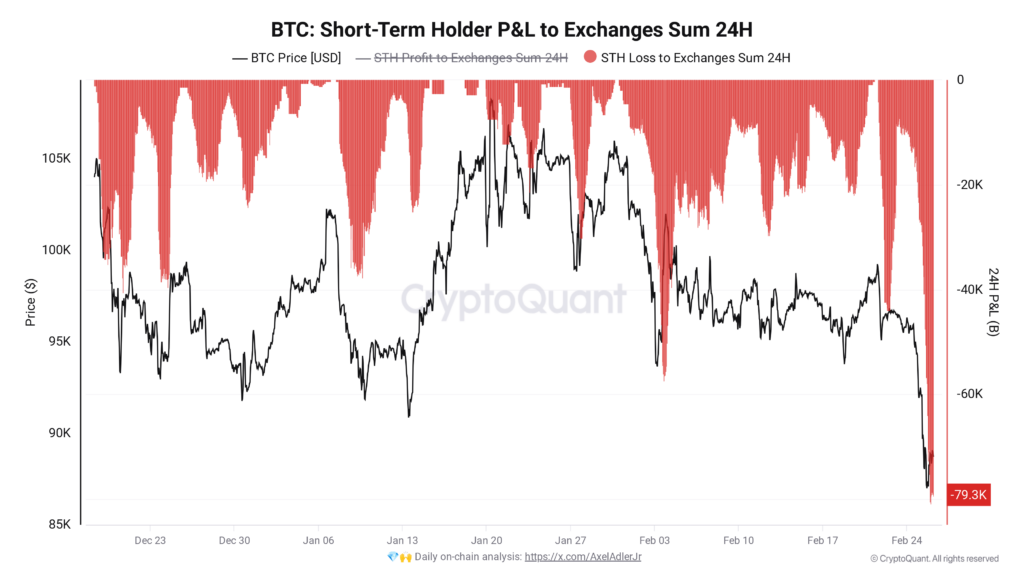

Bitcoin Price– Bitcoin’s value recently dropped to 15-week lows, sparking a significant sell-off by short-term holders. According to CryptoQuant, nearly 80,000 BTC was moved to exchanges at a loss, marking the largest Bitcoin sell-off of 2025.

Short-term holders (STHs), defined as entities holding Bitcoin for up to 155 days, appear to have panicked during the market downturn. On February 25, as Bitcoin’s price dropped to around $86,000, these holders sent a massive 79,300 BTC (worth approximately $7 billion) to exchange wallets within just 24 hours.

“This is the largest Bitcoin sell-off of 2025,” said Axel Adler Jr., a CryptoQuant analyst, adding that the market’s recent volatility triggered panic selling. The sharp decline in Bitcoin’s price, especially during these challenging market conditions, has led to heightened uncertainty among newer participants.

Long-Term Holders Show Confidence

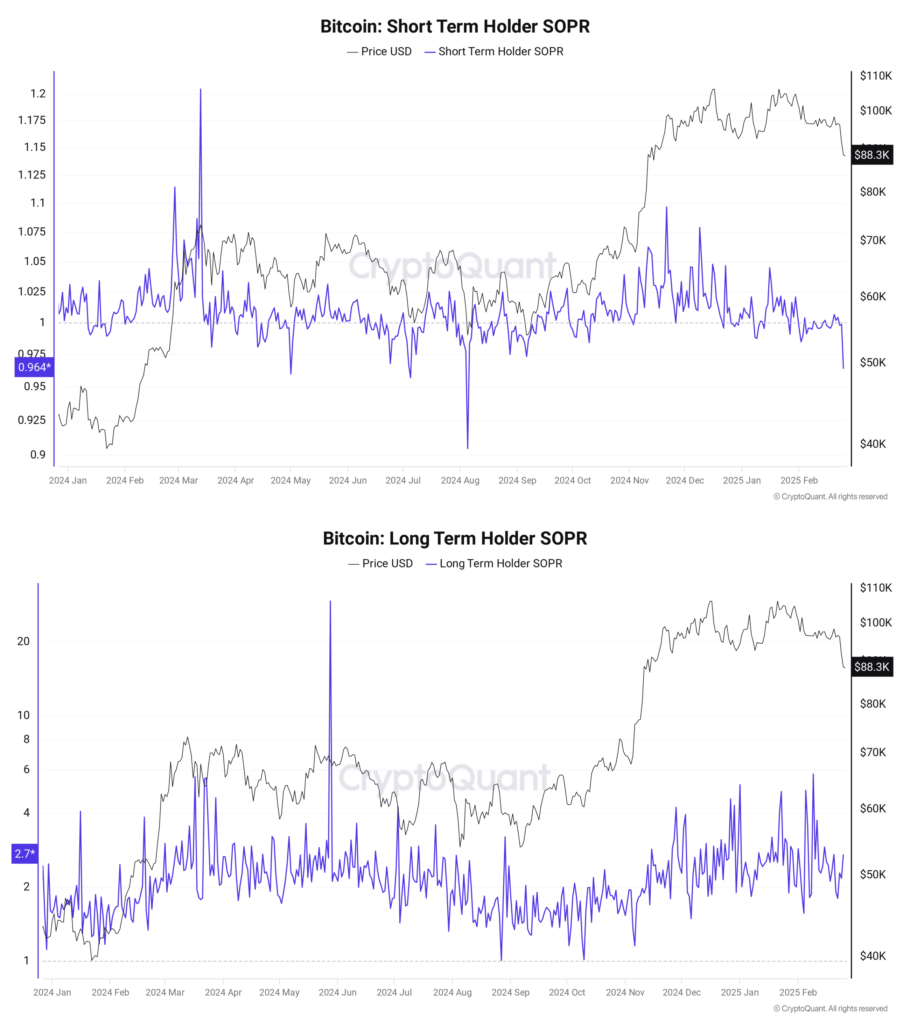

While short-term holders capitulated, long-term holders have remained largely unaffected by Bitcoin’s recent downturn. Avocado_onchain, another CryptoQuant contributor, highlighted that long-term holders have kept their positions intact, offering some support for the market amid the sell-off.

Bitcoin’s Breakeven Point at $90,000

James Check, creator of Checkonchain, mentioned that the $90,000 mark is a crucial support level for Bitcoin. “We’ve got this support level at around $90,000, but below it, there’s just not much,” Check said, suggesting that Bitcoin’s price could stabilize or bounce back if it reaches that point.

As the market faces uncertainty, digital asset lawyer Joe Carlasare warned against jumping to conclusions based on short-term volatility, stating that the current panic mirrors earlier periods of overconfidence and euphoric predictions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment