Bitcoin Price Could Surge to $250,000 in 2025: Experts Predict

Bitcoin Price– Bitcoin’s price might skyrocket to over $250,000 by the end of 2025, with analysts predicting a strong rally fueled by increasing fiat supply. This potential surge is tied to the U.S. Federal Reserve’s shift toward quantitative easing (QE), a policy where the central bank buys bonds to inject money into the economy, lowering interest rates and promoting spending during tough financial times.

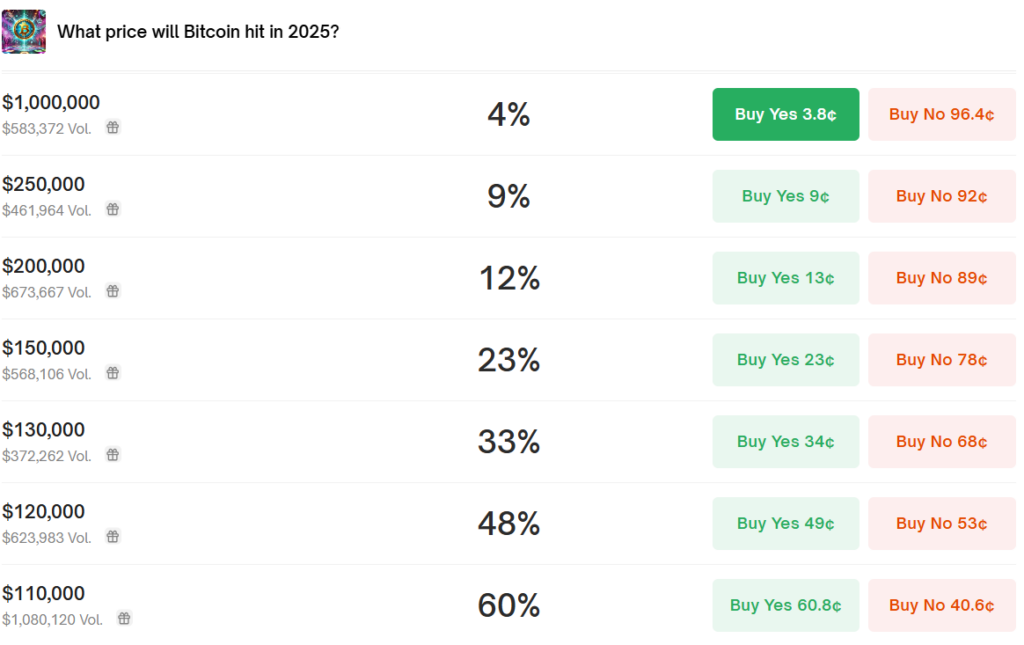

Arthur Hayes, co-founder of BitMEX, believes that Bitcoin’s value will continue to rise as the Fed pivots to QE. In a recent post, Hayes stated, “Bitcoin trades solely based on the market expectation for the future supply of fiat.” He added that Bitcoin hit a local low of $76,500 in March, signaling the start of an upward trend towards $250,000 by the year’s end. This prediction aligns with the Fed’s decision to reduce its Treasury runoff cap, which could trigger a surge in the cryptocurrency market.

Fed’s QE Strategy Could Push Bitcoin Beyond $132,000

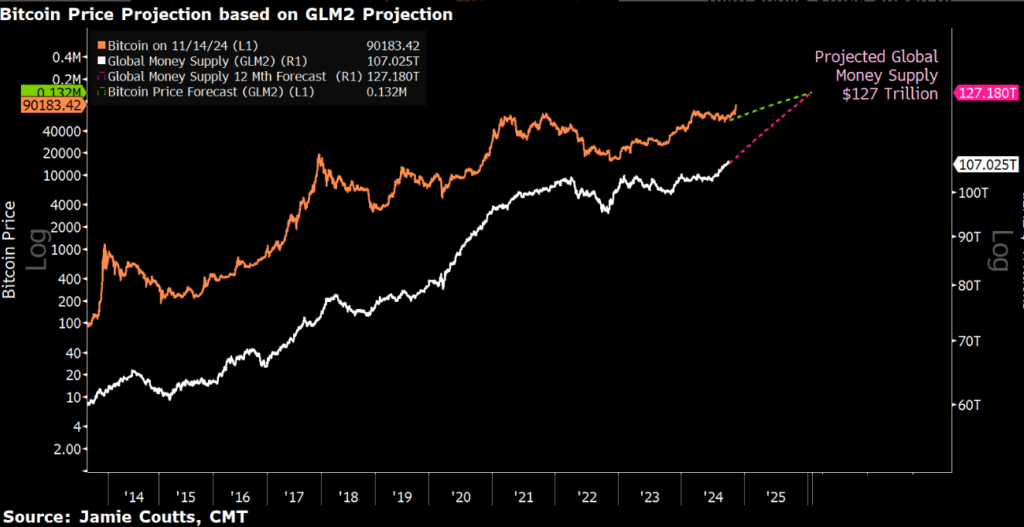

According to Jamie Coutts, chief crypto analyst at Real Vision, the growing money supply could push Bitcoin’s price above $132,000 before 2025 concludes. The shift from quantitative tightening (QT) to quantitative easing by the Fed is expected to flood the market with dollars, which in turn would benefit Bitcoin’s price.

Although Bitcoin faces short-term challenges due to global tariff concerns, especially with US President Donald Trump’s upcoming tariff announcement, long-term market sentiment remains positive. Hayes, who has been purchasing Bitcoin between $76,500 and $90,000, is confident that Bitcoin could still reach $250,000 by the end of the year. However, he notes that near-term momentum could be influenced by ongoing macroeconomic developments.

The outlook for Bitcoin in 2025 is bullish, as market dynamics, particularly the increasing fiat supply and potential QE policies, are expected to fuel significant price movements. As traders anticipate these changes, Bitcoin’s value could see substantial gains, with some forecasting a rise to $250,000 by the year-end.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment