Bitcoin Price- What Do Recent Indicators Mean?

Bitcoin Price– Bitcoin (BTC) is at risk of falling into a fresh bear market, with a collection of onchain metrics showing signs of a “bearish divergence,” according to recent reports. As the price of Bitcoin (BTC) struggles to recover toward its all-time highs, the Bitcoin Macro Index by Capriole Investments has raised alarms among analysts.

The Bitcoin Macro Index, created by Capriole in 2022, is a tool that uses machine learning to assess data from various metrics. Charles Edwards, the founder of Capriole, explained that the model analyzes onchain and macro-market data, excluding price data and traditional technical analysis.

Since late 2023, the Bitcoin Macro Index has been printing lower highs, while Bitcoin’s price has continued to show higher highs, which has resulted in a “bearish divergence.” This pattern is often seen in markets leading to potential downturns. When Edwards shared this update on social media, he referred to the development as “not great” and acknowledged the possibility that BTC/USD may have already reached its long-term peak.

Mixed Onchain Metrics Point to Short-Term Volatility

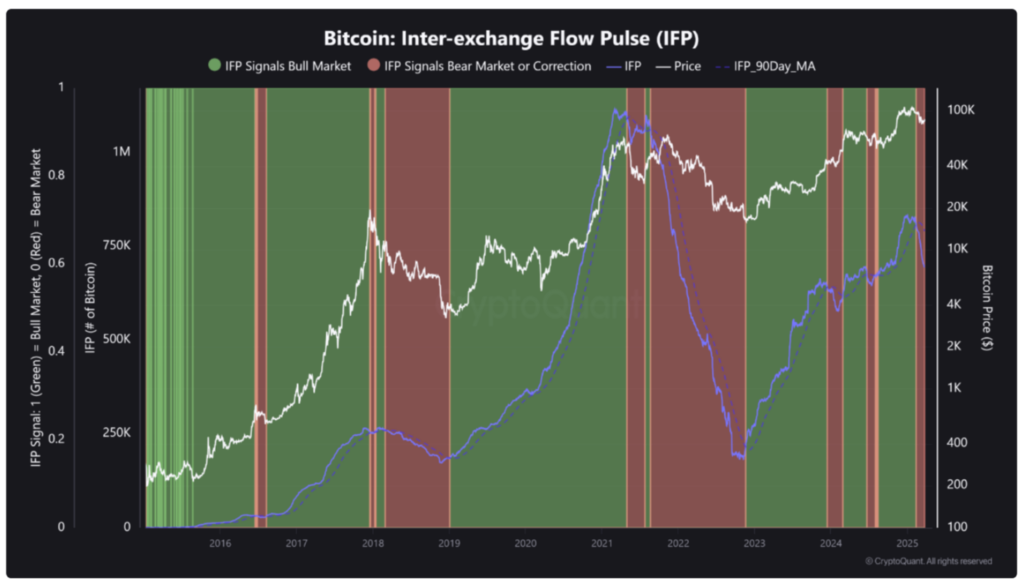

Onchain analytics platform CryptoQuant also referenced a series of metrics that suggest significant volatility for Bitcoin (BTC) in the short to mid-term. Key metrics such as the Market Value to Realized Value (MVRV), Net Unspent Profit/Loss (NUPL), and the Inter-Exchange Flow Pulse (IFP) have shown signs of weakness. In particular, the IFP metric, which turned bearish in February, needs to return above its 90-day moving average for a potential recovery.

While these signals indicate short-term turbulence, they do not suggest that Bitcoin (BTC) has reached an overheated or cycle-top level. Burak Kesmeci, an analyst at CryptoQuant, emphasized that these indicators do not point to a “cycle-top,” implying that Bitcoin may still have room for potential recovery if market conditions improve.

As BTC continues to show mixed signals, both investors and analysts are keeping a close watch on these metrics to gauge Bitcoin’s next move.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment