Bitcoin Options Market Signals Cautious Sentiment Ahead of U.S. Spot ETF Decision

Crypto News – The trading landscape for Bitcoin (BTC) options is undergoing a notable shift, with call options now trading at significantly lower premiums compared to puts, a stark contrast to the market conditions observed in November. This change is largely attributed to anticipations around the impending launch of spot exchange-traded funds (ETFs) in the United States.

As the deadline set by the U.S. Securities and Exchange Commission (SEC) for the approval of spot ETFs draws closer on January 10th, the pricing trends in Bitcoin options markets are revealing a diminishing bullish sentiment among traders. Data from Amberdata highlights this trend, showing that call options expiring in one, two, and three months are currently trading at a mere 2% premium to puts, down from an 8% premium in early November. This gradual decline signals a more cautious and less bullish outlook on Bitcoin.

In options trading, calls represent the buyer’s right, though not obligation, to purchase the underlying asset at a predetermined price at a future date. A preference for call options typically indicates a bullish market sentiment, while a leaning towards put options suggests bearish expectations. The options skew is a metric that measures the relative demand for calls versus puts.

The current market behavior suggests that traders are adopting a ‘wait-and-see’ approach in anticipation of the SEC’s decision on ETFs. Some analysts speculate that the cryptocurrency, which has seen a 61% surge over three months fueled by ETF speculations, might experience a decline once these much-awaited financial products are introduced.

There’s also a noticeable shift in the bias for calls over longer durations, aligning with some unconventional analyses. These analyses propose that the inflows of billions of dollars into the ETFs are likely to occur gradually over time rather than instantly.

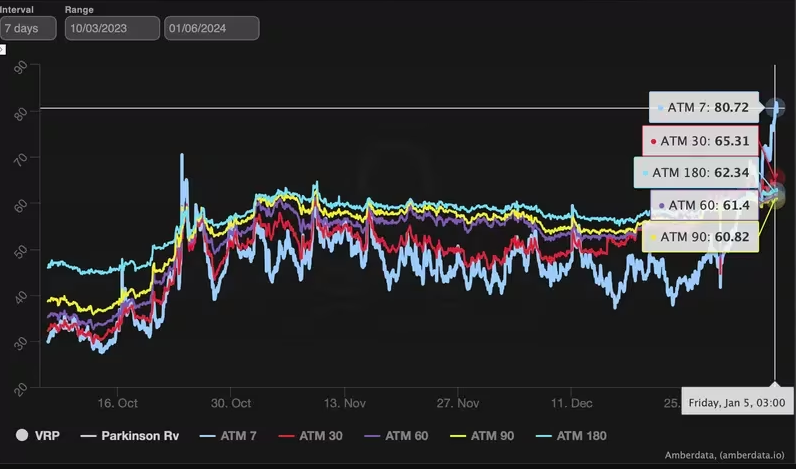

Regarding market dynamics, the one-week options at-the-money (ATM) implied volatility, an indicator of expected market volatility over the ensuing seven days, has nearly doubled on an annualized basis since December 29, surpassing the figures for longer-duration volatilities. This spike serves as a cautionary signal for traders, urging vigilance in the period leading up to and immediately following the January 10th deadline.

In contrast, the implied volatility measures for longer durations have only seen minor increases. This pattern suggests that traders anticipate the impact of ETF announcements to be temporary and limited in terms of influencing price volatility. Furthermore, some market analysts foresee that the introduction of ETFs might exert a stabilizing influence on Bitcoin’s price volatility over the long term.

Leave a comment