Bitcoin Leverage Frenzy: High Leverage Could Trigger a Massive Sell-Off!

Investors have long been fascinated by the erratic price fluctuations of Bitcoin (BTC), but new evidence indicates that volatility may be increasing. Red flags are raised when leveraged trading positions increase, suggesting a possible market move. The potential of significant liquidations increases when traders take out loans to speculate on the future of Bitcoin. The direction of the price of Bitcoin may be greatly impacted by this growing storm of high-risk bets.

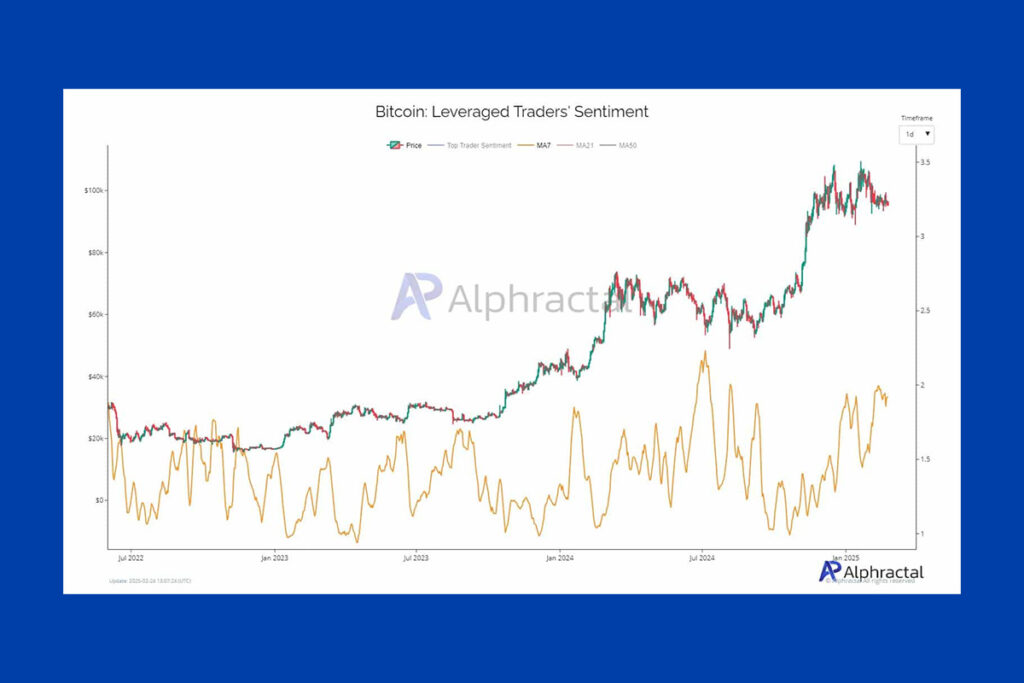

With the sentiment index currently hovering over 2.0, recent data from the sentiment charts of leveraged traders shows a dramatic rise in leveraged holdings. This number suggests that traders have a high amount of leverage exposure, which has been associated with increased volatility and large-scale liquidations. Prior to forced long liquidations, which resulted in sharp price drops, this statistic has frequently experienced surges.

Bitcoin Traders on Edge: Will High Leverage Trigger a Meltdown?

The recent spike in leverage and the current rebound in bitcoin support the trend of price swings driven by leverage. Seller exhaustion has occasionally caused local bottoms to be defined by previous sentiment peaks. Long squeezes are more likely, though, based on the current pattern. In an unsettled market, now is a crucial moment for traders, as Bitcoin may see significant declines if overly leveraged long holdings unwind.

Extreme sentiment readings and significant market reversals are clearly correlated, according to an analysis of leveraged trader sentiment for Bitcoin during the previous two years. Significant downturns have frequently been preceded by spikes in the sentiment index. This was evident when significant liquidations resulted from high leverage in the middle of 2023 and the end of 2024.

The sentiment spike in early 2024 coincided with the breakout rise in Bitcoin. Aggressive long squeezes were the result of comparable circumstances in previous cycles, nevertheless. The sentiment index is currently close to 2.0, a level that has historically led to either significant corrections or consolidation. Increased leverage may lead to liquidations, which would increase downside volatility if history repeats itself. This circumstance emphasizes how important it is to manage risks effectively.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment