Bitcoin Faces Major Drop: Is $75,000 the Next Key Support Level Amid Trade War Fears?

Concerns about international trade are still putting pressure on investor sentiment, which might lead to a Bitcoin decline below the crucial $75,000 support level. According to data from Cointelegraph Markets Pro, the price of Bitcoin had dropped more than 6.5% on the last day, falling below a low of $78,197, last recorded on November 10, 2024. The present drop is ascribed by analysts to macroeconomic worries about a possible trade war between the US and China brought on by US President Donald Trump’s imposition of import tariffs. The primary cause of Bitcoin’s loss of the $80,000 support was these macroeconomic worries, according to Bitget Research principal analyst Ryan Lee.

Bitcoin’s drop below $80,000 amid investor fear from Trump’s tariffs and market unrest, points to a correction likely hitting $76,000-$78,000 this week, nearing $75,000 as a key support level based on historical patterns and trader sentiment.

Lee

How Likely Is a $70,000 Correction After Recent Price Declines?

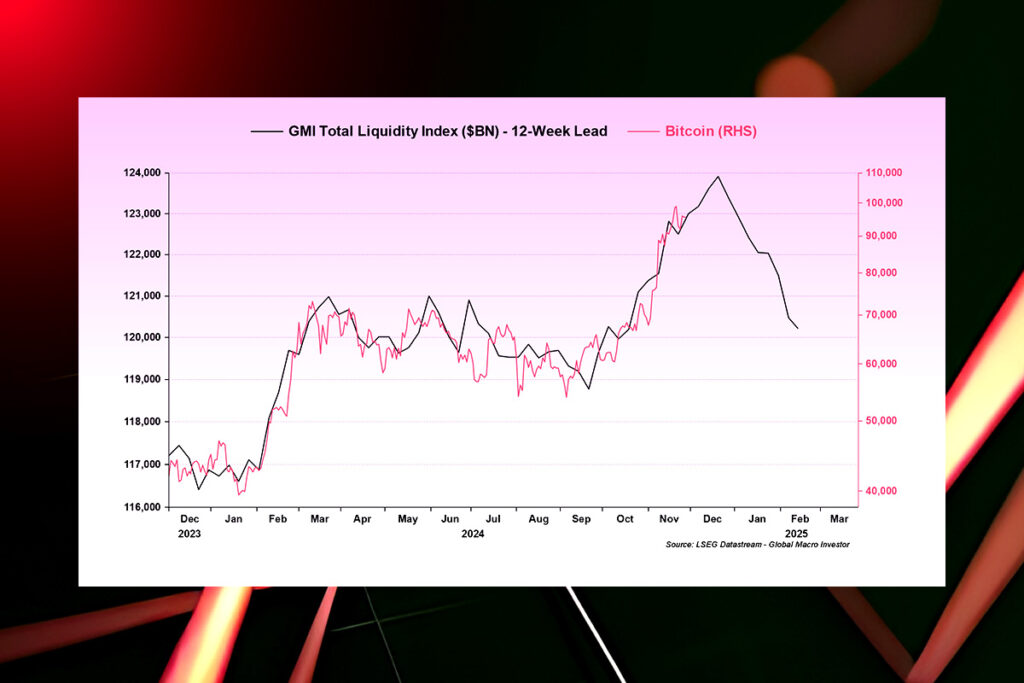

However, some analysts are worried that the world’s first cryptocurrency, Bitcoin, will return to $70,000 after its decline. The right-hand side (RHS) of Bitcoin, which represents the lowest price at which someone is prepared to sell the currency, may drop below $70,000 by the end of February after peaking close to $110,000 in January, according to its association with the global liquidity index.

It doesn’t appear plausible that Bitcoin will drop to $70,000 before the end of the week, despite the negative feeling among investors. A drop to $70,000 appears less probable in the absence of any new downside catalysts, according to Lee, given the ongoing dip in purchasing from big institutions like Michael Saylor’s Strategy.

A further plunge to $70,000 is possible but less probable by March 2 without a significant new shock. The $75,000 level aligns with technical support and stablecoin buffers, while $70,000 would need sustained panic or macro deterioration beyond current pressures.

Lee

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment