Bitcoin Faces Crucial Moment: Can Bulls Overcome $90K Resistance?

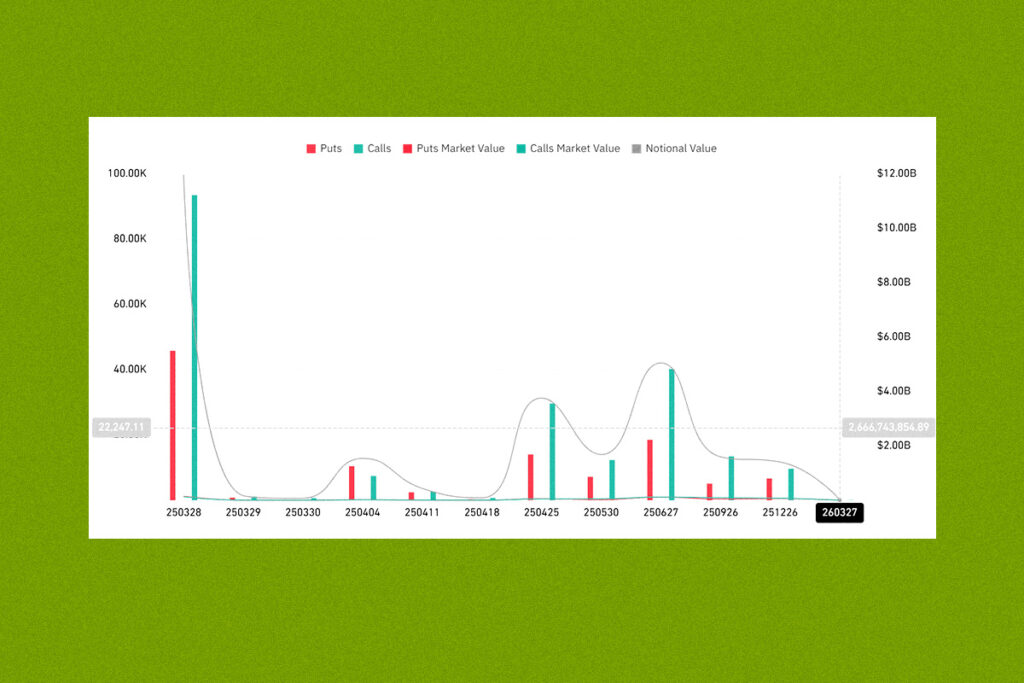

On March 28, a record-breaking $16.5 billion worth of Bitcoin options are scheduled to expire, leading to a great deal of speculation about the asset’s next significant move. The options market and technical indicators are flashing important indications that could influence Bitcoin’s short-term trajectory as traders prepare for this momentous occasion.

Massive open interest (OI) is present close to the $90K strike price, according to Coinglass data, with a noticeable bias toward call options. The $90K and $95K marks are interestingly where a lot of call options are concentrated, indicating that bulls are placing bets on a breakout over these resistance levels. However, there’s also a big put cluster close to the $80K–$82K zone. So, if traders hedge their holdings aggressively, a failure to rise above $90,000 might lead to downward pressure.

Bitcoin’s Liquidity Trap: Could Small Moves Trigger Big Liquidations?

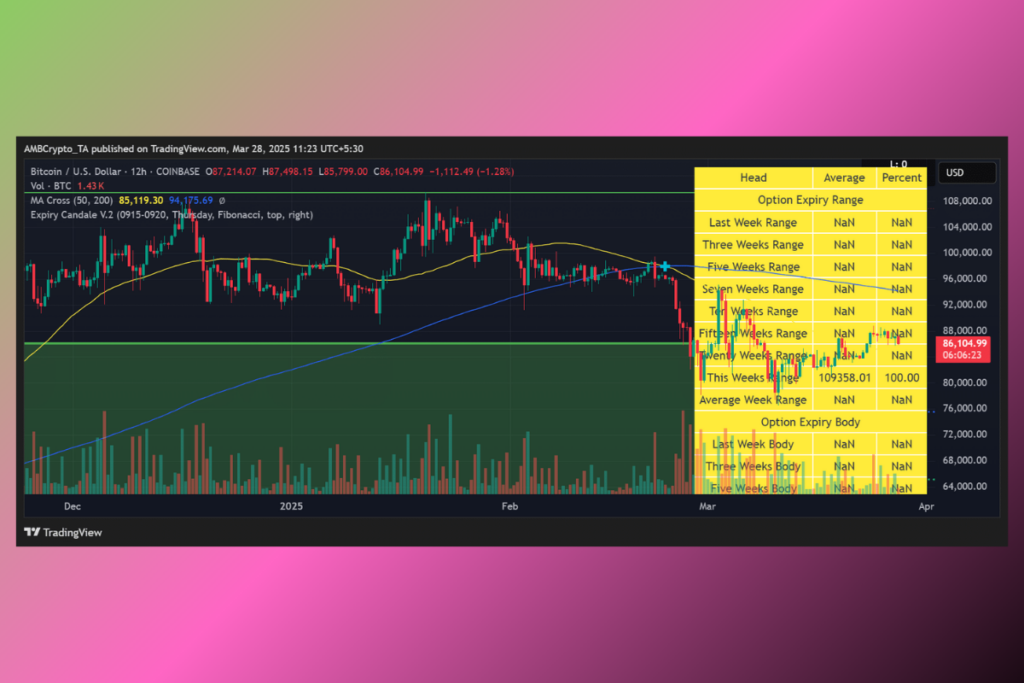

Despite momentum, Bitcoin’s technical setup suggests caution. Bitcoin struggled to sustain its upward pace as it traded around $86,100 on the 12-hour BTC/USD chart. The 200-day MA at $94,175 loomed overhead as a significant obstacle, while the 50-day MA at $85,119 served as short-term support.

The expiry candle indication, which places the current weekly expiry range at $109,358, significantly above the current price, adds to the anxiety. In the past, option expiration events have had the potential to cause volatility surges, but they frequently fall short of pushing Bitcoin above important psychological thresholds unless volume continues to rise.

Despite high OI, volume metrics point to declining participation, as evidenced by comparatively low trading activity. This discrepancy suggests that despite the stacked positions, real conviction is still low. In such a setting, even small price changes might lead to liquidations and inflated movements.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment