Despite Large $525M Options Expiry, Bybit Predicts Low Market Volatility for BTC and ETH

Despite significant options expirations on Friday, Bybit, the second-largest cryptocurrency exchange globally by trading volume, highlighted the low level of market volatility in their most recent Crypto Derivatives Analytics Report, which was published in partnership with Block Scholes. The realized volatility of ETH and BTC has gone up, but short-term options haven’t changed with it. This suggests that although BTC and ETH volumes have shown somewhat different patterns, the options market is not entirely responding to the changes in spot pricing.

The end-of-year options expiry for over $525 million in Bitcoin and Ethereum contracts expiring on December 27, 2024, appears to be one of the largest yet, but volatility forecasts have stayed low. The volatility structure of ETH shows an odd inversion, according to the research, but BTC has not responded similarly. A shift in funding rates, which can occasionally go negative when spot prices decline, also indicates a new stage of the market. Interestingly, ETH’s short-term options are showing more pronounced swings than BTC’s volatility structure, which has been less sensitive to shifts in spot prices.

Implied vs. Realized Volatility: Bitcoin and Ethereum’s Diverging Trends

Three times in the last month, the realized volatility of Bitcoin has exceeded the implied volatility, but each time it has stabilized. There is still a lot of open interest in Bitcoin options, which could lead to more volatility as the year draws to a close. The upcoming expiration of almost $360 million worth of Bitcoin options (both calls and puts) may have an impact on price movement.

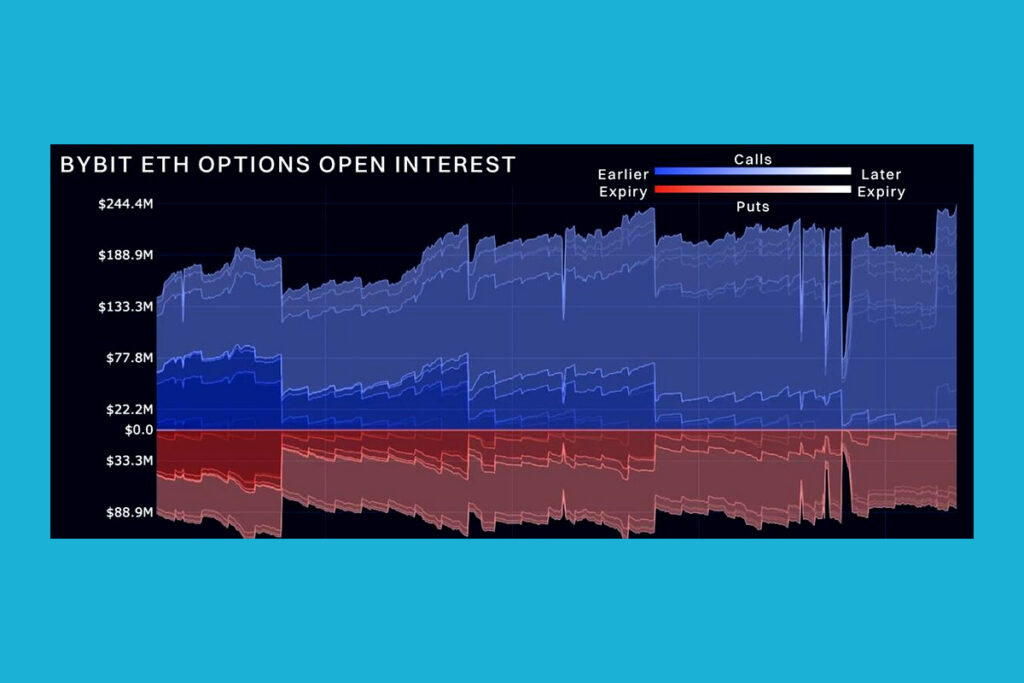

The volatility term structure of ETH has flattened, holding values akin to those observed over the previous month, despite a midweek inversion. Even if market movements and trading activity are stronger on the put side, calls outnumbered puts in open interest in ETH options during the last week of 2024.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment