Bitcoin ETF Inflows Surpass $1.8 Billion as Market Grows Stronger

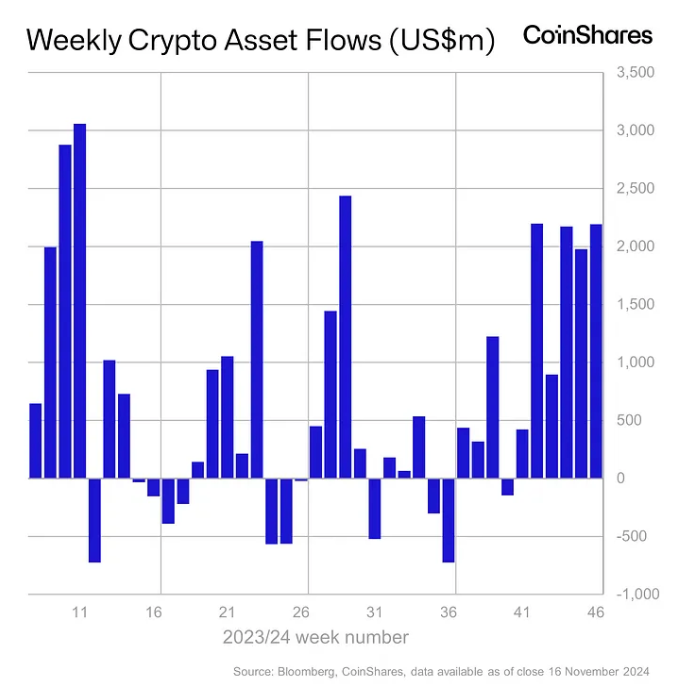

Bitcoin ETF – Global cryptocurrency funds, managed by major asset managers like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, have continued their upward trajectory, registering $2.19 billion in net inflows for the sixth consecutive week. This brings the total year-to-date inflows to a new record of $33.5 billion, according to data from CoinShares.

Record-Breaking Bitcoin Surge Boosts AUM

In addition to these impressive inflows, the price of Bitcoin (BTC) surged to new all-time highs above $93,000 on Wednesday, further propelling the assets under management (AUM) at these funds to a fresh peak of $138 billion. CoinShares Head of Research James Butterfill noted in a report on Monday that the current surge in activity is likely driven by a mix of looser monetary policy and the Republican Party’s recent success in the U.S. elections.

However, despite the strong inflows at the start of the week, the momentum slowed after Bitcoin hit its all-time high. According to Butterfill, there was a notable reversal, with $866 million in net outflows following the record price levels.

U.S.-Based Funds Lead the Way

As expected, U.S.-based funds continued to dominate, accounting for $2.21 billion of the weekly net inflows. Other regions also saw inflows, with Hong Kong, Australia, and Canada registering net inflows of $27 million, $18 million, and $13 million, respectively. Conversely, Sweden and Germany saw profit-taking, with net outflows of $58 million and $6.8 million, respectively.

Bitcoin ETFs and Ethereum Products Drive Growth

Bitcoin-based products remained the leader on the asset side, capturing $1.48 billion in net inflows globally for the week. However, the excitement surrounding Bitcoin’s all-time high prompted some investors to take a more cautious stance, adding $49 million to short-Bitcoin investment vehicles, according to Butterfill.

The U.S. spot Bitcoin ETFs experienced massive inflows, with $1.8 billion in net weekly inflows alone. While the total inflows for the week reached $2.4 billion by Wednesday, these were partially offset by $640.3 million in net outflows later in the week, as recorded by The Block.

Meanwhile, Ethereum (ETH)-based products have started to show signs of recovery, registering $646 million in net inflows for the week. This marked a 5% increase in assets under management (AUM) for Ethereum products. The uptick is likely due to a combination of factors, including the Beam Chain network upgrade proposal from Justin Drake and the recent U.S. elections, Butterfill stated.

Bitcoin’s Resilience Above $90,000

At the time of writing, Bitcoin is trading at $90,535, showing little movement over the past 24 hours but reflecting a 12% increase over the last week. Analysts suggest that Bitcoin’s consolidation above $90,000 is a bullish signal, as it has proven resilient even after a 40% rally since Donald Trump’s election.

BRN analyst Valentin Fournier commented earlier today that Bitcoin’s resilience amidst such strong price movement indicates ongoing accumulation. He added that technical indicators suggest there is potential for a breakout, with no immediate signs of reversal.

Leave a comment