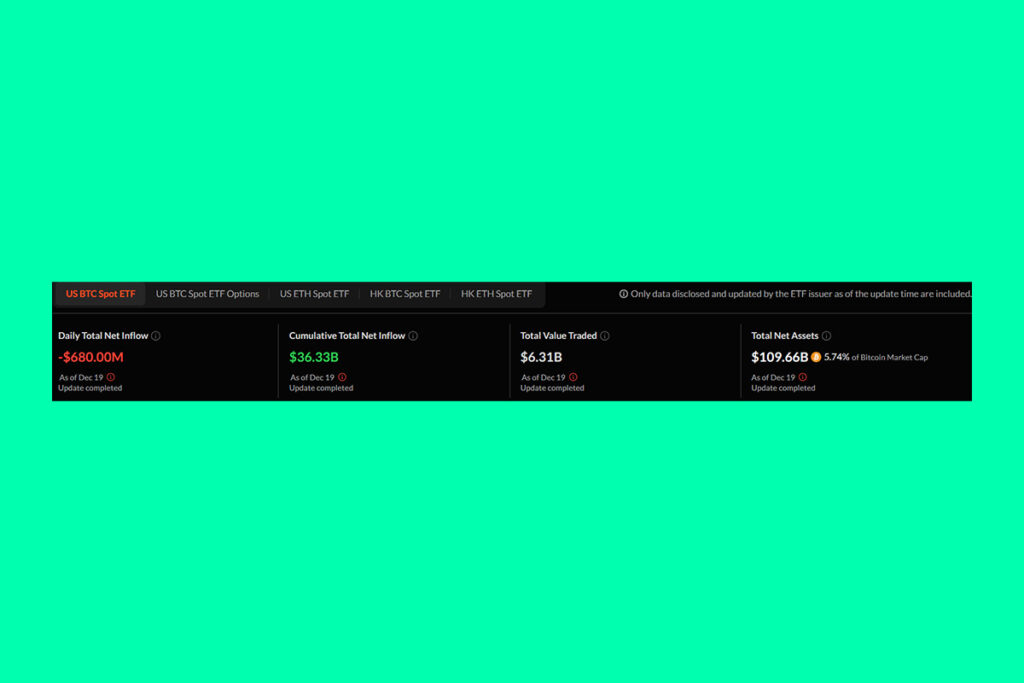

Bitcoin ETFs See Record $680M Single-Day Outflows, Led by Fidelity and Grayscale

On Thursday, $680 million came out of U.S. spot bitcoin exchange-traded funds, the biggest single-day outflow ever. This put a 15-day run of positive flows to an end. SoSoValue data shows that yesterday’s negative flows were topped by Fidelity’s FBTC, which saw outflows of $208.6 million. Grayscale’s Bitcoin Mini Trust recorded outflows of $188.6 million, while $108.4 million was recorded by Ark and 21Shares’ ARKB.

- $87.9 million left Grayscale’s GBTC fund.

- VanEck’s and Valkyrie’s ETFs also suffered withdrawals, and Bitwise’s BITB had outflows of $43.6 million.

- The biggest spot bitcoin ETF by net assets, BlackRock’s IBIT, showed no flows yesterday.

- Of the 12 ETFs, WisdomTree’s BTCW was the only one to show positive flows, with $2 million coming in.

The 12 spot bitcoin ETFs‘ trading volume increased from $5.9 million the day before to $6.3 billion on Thursday.

Bitcoin Plunges Below $100K After Fed Chair Powell’s Hawkish Remarks

Bitcoin fell below $100,000 on Thursday after Fed Chair Jerome Powell‘s harsh remarks. According to The Block’s pricing page, the biggest cryptocurrency in the world dropped 7.37% in the last day, to about $94,540 at the time of writing. When Ether changed hands at $3,218, it lost 12.74%.

The performance of the top 30 cryptocurrencies is gauged by the Block’s GMCI 30 index, which fell 6.3% over the previous day. In the meantime, an 18-day run of inflows ended Thursday with $60.5 million in withdrawals from spot Ethereum ETFs in the United States.

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment