Bitcoin ETFs: Why Investors Are Pouring Billions into Bitcoin Trusts

Bitcoin ETF – In November 2024, United States investors poured an impressive $6.4 billion into spot Bitcoin exchange-traded funds (ETFs), marking a historic surge amid a 45% rally in Bitcoin’s price. This surge saw the cryptocurrency reach a new all-time high of nearly $99,000, sparking significant bullish sentiment within the market. The month-long bull run propelled Bitcoin’s price from $68,000 to $99,000, leading to massive ETF inflows and positioning Bitcoin (BTC) as one of the most attractive investment options.

BlackRock’s iShares Bitcoin Trust Dominates ETF Inflows

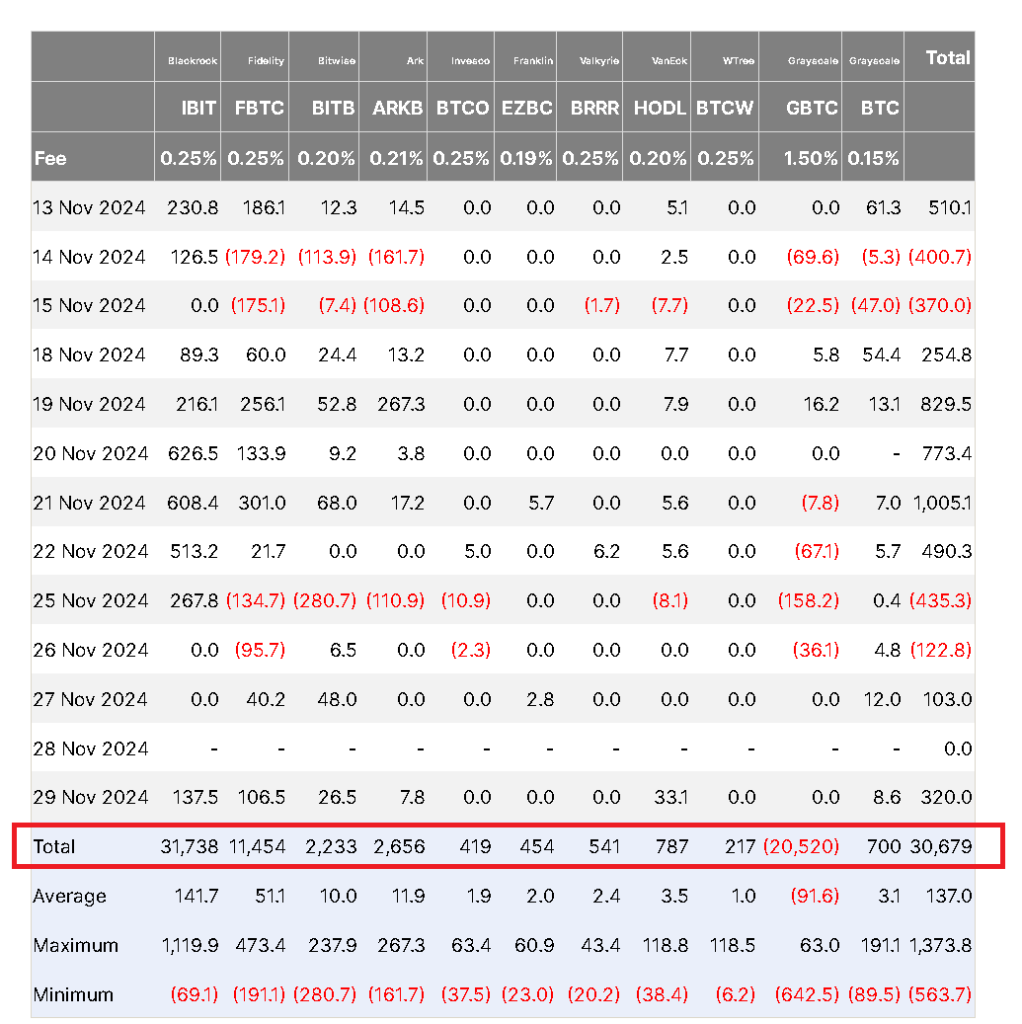

Among the various Bitcoin ETFs, BlackRock’s iShares Bitcoin Trust ETF led the pack, attracting a staggering $5.6 billion in investments during November. This accounted for nearly 87% of the total ETF inflows for the month, showcasing investor confidence in Bitcoin’s upward trajectory. BlackRock, a major player in institutional investments, has significantly boosted the legitimacy of Bitcoin ETFs as a mainstream investment vehicle.

Other key ETFs that captured investor attention included Fidelity’s Wise Origin Bitcoin Fund with $962 million, Grayscale’s Bitcoin Mini Trust ETF with $211.5 million, and the VanEck Bitcoin ETF, which brought in $71.2 million. These ETFs played crucial roles in pushing the total inflows into spot Bitcoin ETFs to $6.87 billion, even as some players faced outflows.

Outflows from Other Bitcoin Funds Amidst Bullish Trend

While the majority of Bitcoin ETFs saw massive inflows, a few notable funds experienced outflows in November. Grayscale Bitcoin Trust ETF recorded $364 million in outflows, followed by Bitwise Bitcoin ETF with $40.4 million and Valkyrie Bitcoin Fund at $6.8 million. Despite these withdrawals, the overall market sentiment remained overwhelmingly bullish, underscoring the dominance of Bitcoin in the cryptocurrency market.

Bitcoin Bull Run Fueling Investor Optimism

The 45% price surge in November has not only captured the attention of institutional investors but has also stoked widespread optimism among individual traders. The rally has been fueled by the growing belief that Bitcoin is entering a price discovery phase, with many traders and analysts predicting “insane long opportunities” in the coming months. The continuing institutional interest, coupled with high Bitcoin prices, signals that the bullish momentum could persist, further supporting Bitcoin’s role as a leading asset class.

The Crypto Fear & Greed Index, a widely-followed sentiment gauge for cryptocurrency markets, also mirrored the optimism. On November 22, the index hit a yearly high of 92, indicating extreme greed in the market. Despite a slight dip in December, the index continues to reflect strong bullish sentiment, suggesting that investors remain highly confident in Bitcoin’s future price potential.

Bitcoin’s Future Outlook: Price Discovery and Long Opportunities

As Bitcoin trades sideways around the $96,000 mark in early December, market participants are eagerly awaiting the next phase in its price journey. Analysts remain optimistic, with many expecting the cryptocurrency to continue its bullish momentum into the new year. Investors are particularly excited about the price discovery phase, where Bitcoin’s true value could be tested as it continues to set new price milestones.

For those looking to capitalize on this trend, long opportunities remain abundant, with Bitcoin positioned as an asset that continues to capture institutional and retail interest alike. The trend of institutional investments, like the BlackRock iShares Bitcoin Trust, is expected to continue, bolstering Bitcoin’s standing as a top-tier investment in the broader financial ecosystem.

Disclaimer: This website’s content is for informational purposes only and does not constitute financial advice, with all cryptocurrency purchases carrying inherent risks.

Leave a comment